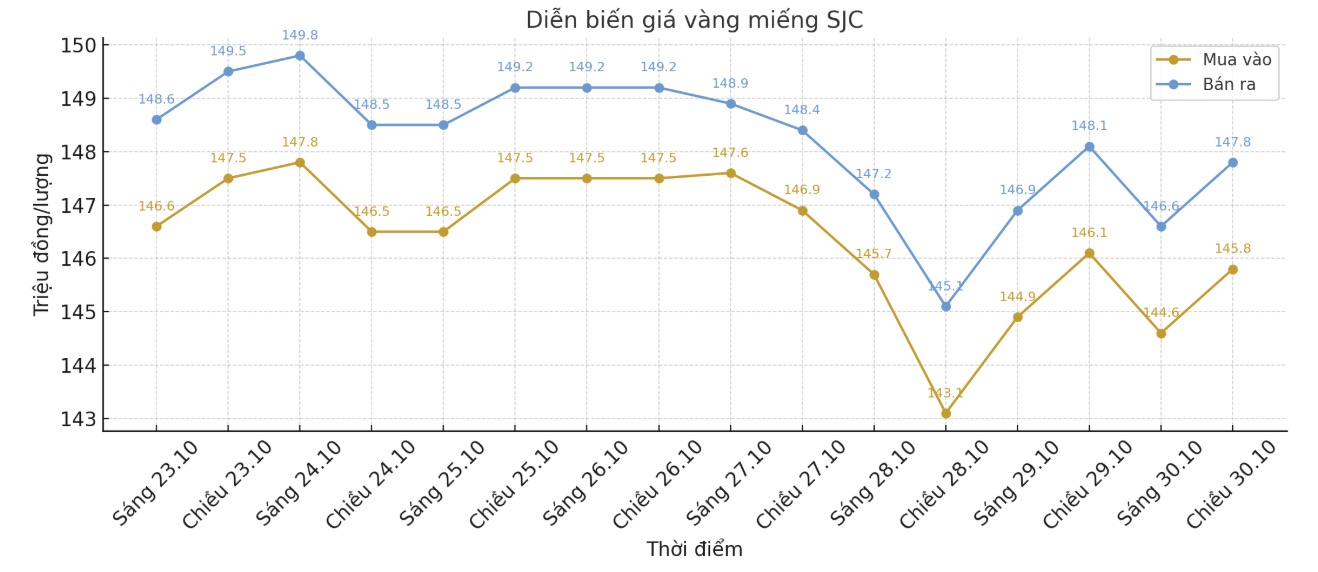

SJC gold bar price

As of 7:15 p.m., DOJI Group listed the price of SJC gold bars at 145.8-147.8 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.5-147.8 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.3-147.8 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

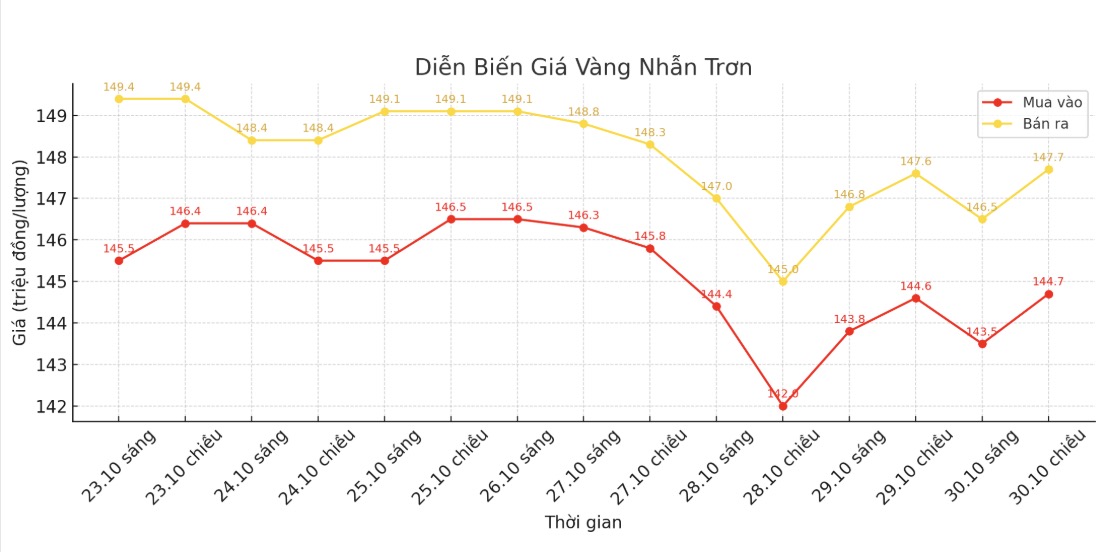

9999 gold ring price

As of 7:20 p.m., DOJI Group listed the price of gold rings at 144.7/47.7 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.9-148.9 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

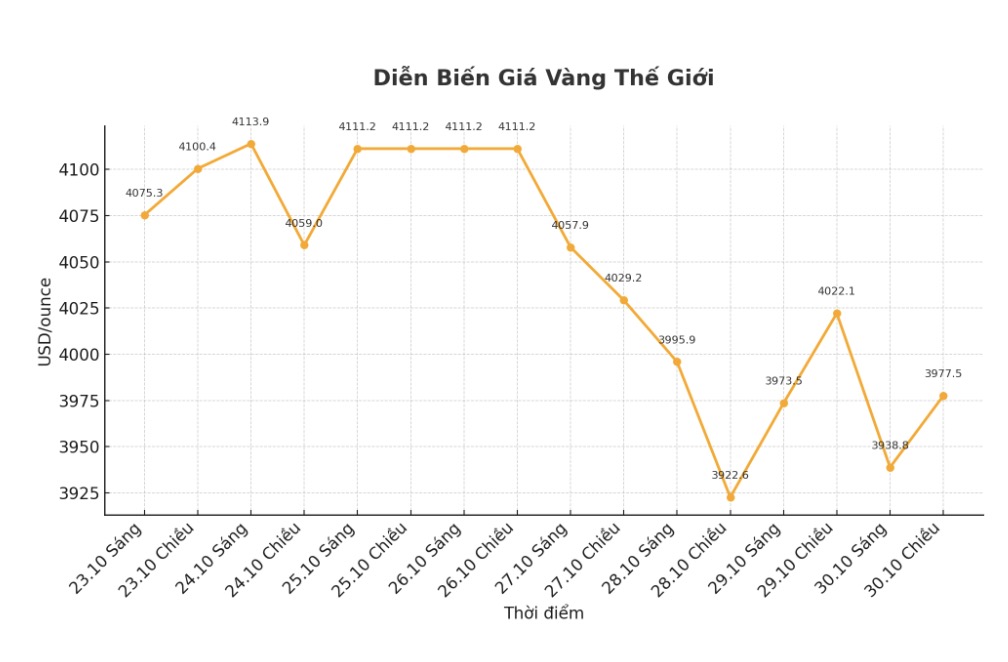

World gold price

The world gold price was listed at 6:00 p.m. at 3,977.5 USD/ounce, down 44.6 USD compared to a day ago.

Gold price forecast

Despite the US Federal Reserve's (FED) interest rate cut, gold prices today still decreased. This is a confusing development, because gold often increases in price when interest rates fall.

World gold prices fell in the trading session early this morning (Vietnam time), after the market reacted to Fed Chairman Jerome Powell's statement on monetary policy orientation, even though the US Central Bank has just cut the basic interest rate by 0.25%, as previously forecast.

The Fed has cut its key interest rate overnight to a target range of 3.75%-4.00%, marking the second easing of the year.

At his press conference after the decision, Mr. Powell gave a cautious warning about the policy outlook: In this Committee discussion, there were mixed opinions on how to continue in December. Another interest rate cut in December is not a sure thing. The policy does not follow a prescribed roadmap, he said.

The World Gold Council (WGC) said that global gold demand in the third quarter of 2025 increased by 3% compared to the same period last year, reaching 1,313 tons - the highest level ever recorded - thanks to strong investment demand.

Spot gold prices have increased by 50% since the beginning of the year, reaching a record $4,381/ounce on October 20. The increase was driven by safe-haven demand amid geopolitical tensions, uncertainty over US tariffs, and recent recent buying for the fear of missing (FOMO) mentality.

Ms. Louise Street - senior market analyst at WGC - commented: "The outlook for gold remains positive, as the USD weakens, expectations of lower interest rates and the risk of inflation can continue to boost investment demand.

Our studies show that the market has not yet reached the saturated point."

Demand for gold bars and coins in the third quarter increased by 17%, mainly from India and China, while capital flows into physical gold ETFs skyrocketed by 134%, according to the WGC - the representative organization for global gold mining companies.

These segments have offset the sharp decline in demand for gold jewelry - the sector that accounts for the largest proportion of physical gold demand - down 23% to 419.2 tons due to high prices, making global consumers more cautious about spending.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...