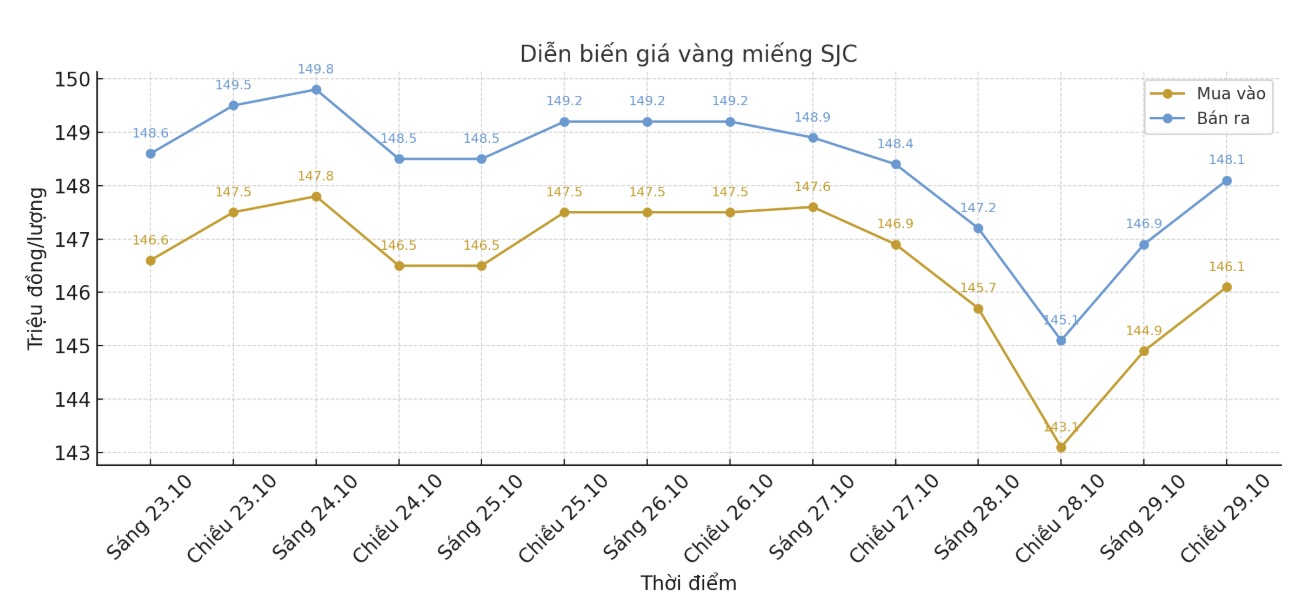

SJC gold bar price

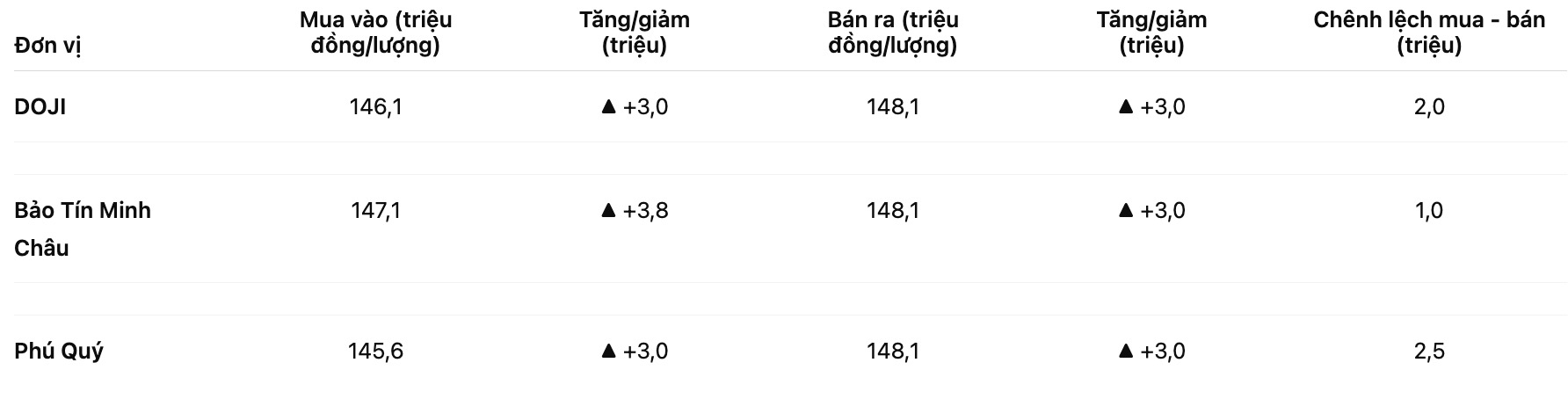

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 146.1-148.1 million VND/tael (buy in - sell out), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.1-148.1 million VND/tael (buy - sell), an increase of 3.8 million VND/tael for buying and an increase of 3 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.6-148.1 million VND/tael (buy - sell), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

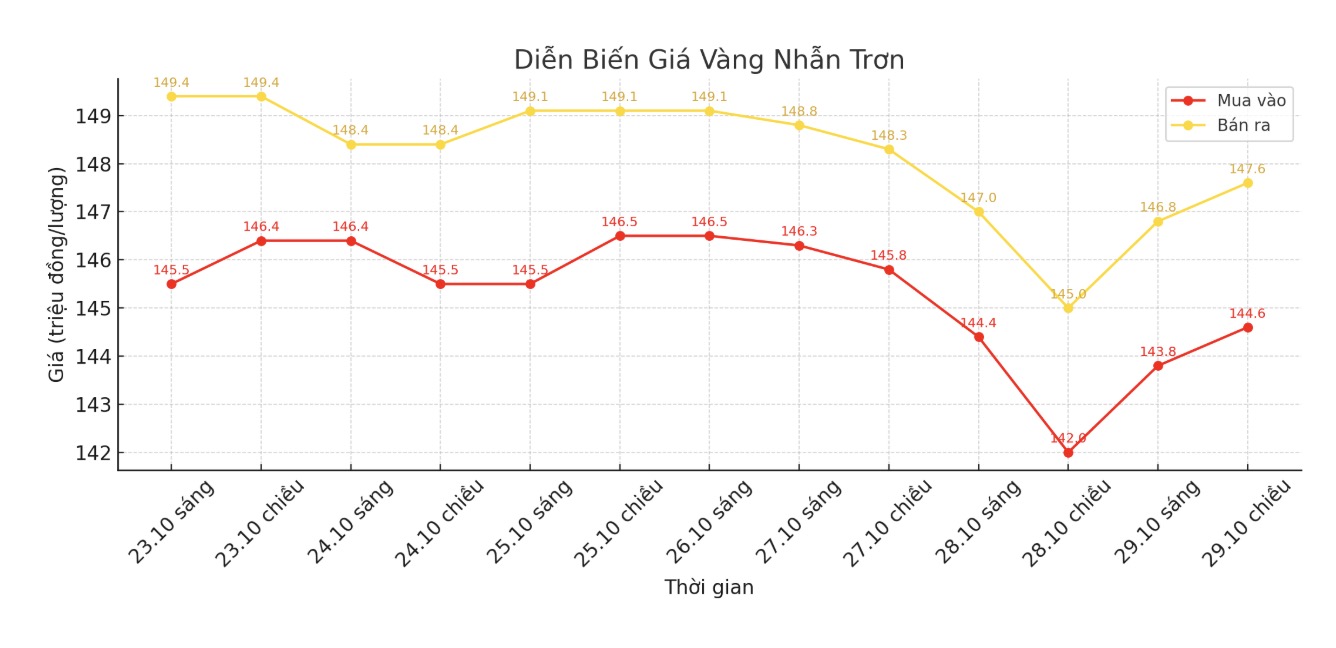

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 144.6-147.6 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.1-148.1 million VND/tael (buy - sell), an increase of 3.1 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

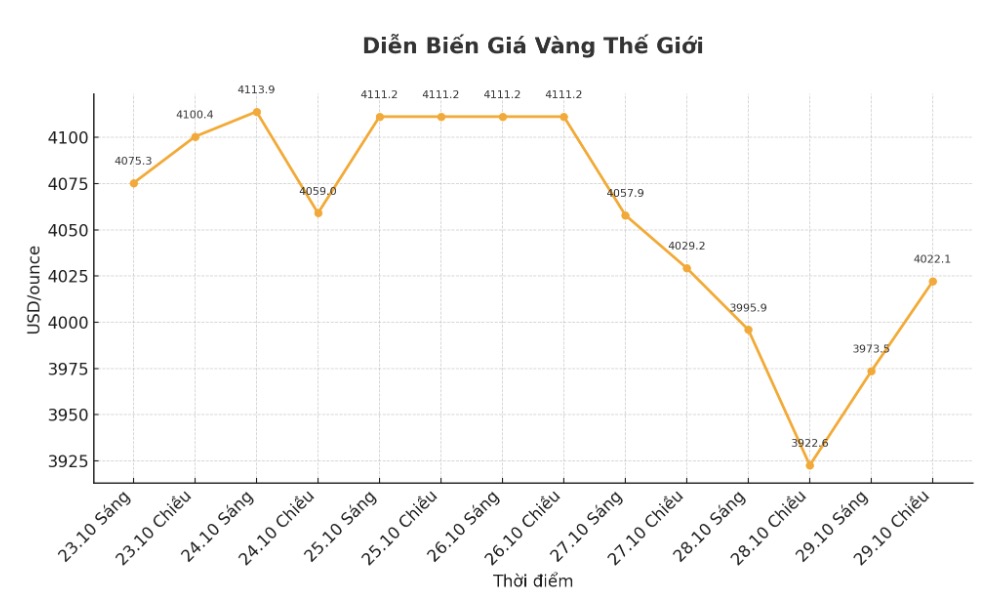

World gold price

The world gold price was listed at 6:00 p.m. at 4,022.1 USD/ounce, up 99.5 USD compared to a day ago.

Gold price forecast

Gold prices have recently been under pressure, as expectations of progress in US-China trade negotiations have weakened the safe-haven attractiveness of the precious metal, while investors have turned their attention to the interest rate decision of the US Federal Reserve (FED) this week.

Mr. Jim Wyckoff - senior analyst at Kitco Metals - commented: "US-China trade tensions have cooled down significantly, with the possibility of the two sides reaching an agreement this week after the conference between Chinese President Xi Jinping and US President Donald Trump. This development has a negative impact on demand for safe-haven metals such as gold".

Over the weekend, top US and Chinese economic officials have finalized the framework for a potential deal, which is expected to be considered by Chinese and US leaders at a meeting on Thursday.

Expectations of a reliever of trade tensions have fueled optimism in global markets, as Wall Street's key indicators simultaneously opened at record levels in the third session.

However, gold prices quickly recovered this afternoon as investors watched the results of the Fed's two-day policy meeting. The Open Market Committee, the Fed's policy-making agency, has just ended the first day of the October policy meeting. In the context of the FED in the process of transitioning from tightening policies to monetary easing to support the US labor market, this meeting is receiving great attention.

According to Reuters, the US government's closure has blocked the flow of important economic data at a time when policymakers and investors are concerned about the health of the labor market, inflation, consumer spending and corporate investment. However, much of the data from private sources will continue to be released, although the figures also rely on reports from government agencies before the closure.

The outlook for this safe haven metal is still uncertain, as some analysts expect gold prices to continue to remain high, while others remain reserved.

At the annual meeting of the London Gold Market Association (LBMA), experts predicted that gold prices could reach 4,980 USD/ounce in the next 12 months.

In contrast, two major financial institutions Citi and Capital Economics adjusted their gold price forecasts down on Monday.

Bank of America said in a report: "The market has fallen into an overbought state and that eventually led to an adjustment this week."

The bank also noted that gold prices are approaching their downward trend forecast - around $3,800/ounce in the fourth quarter of this year.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...