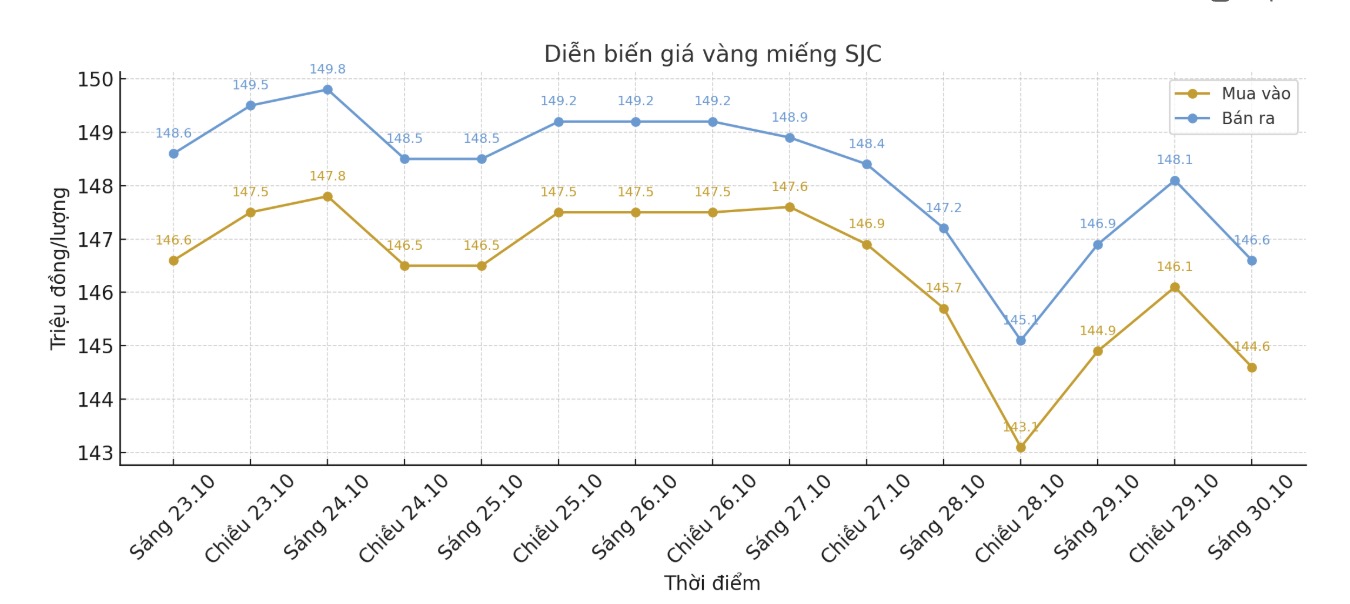

Updated SJC gold price

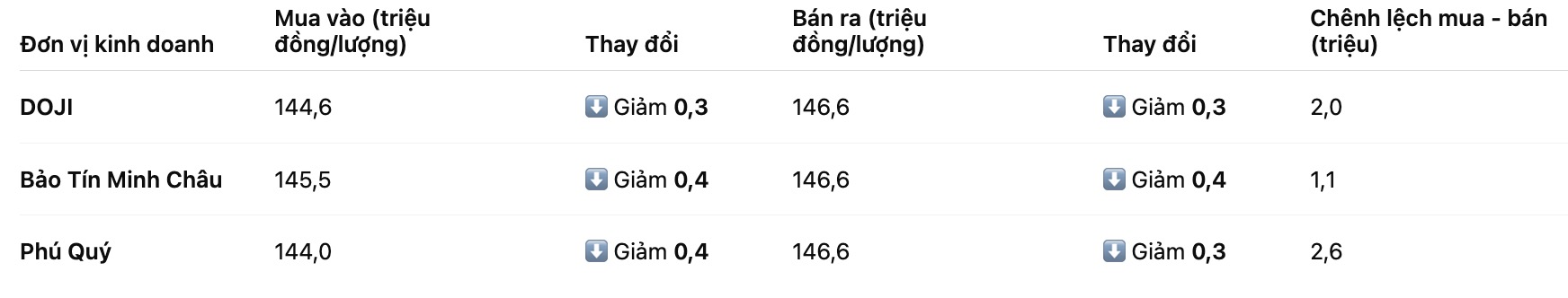

As of 9:40 a.m., DOJI Group listed the price of SJC gold bars at VND144.6-146.6 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 145.5-146.6 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 1.1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 144-146.6 million VND/tael (buy - sell), down 400,000 VND/tael for buying and 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

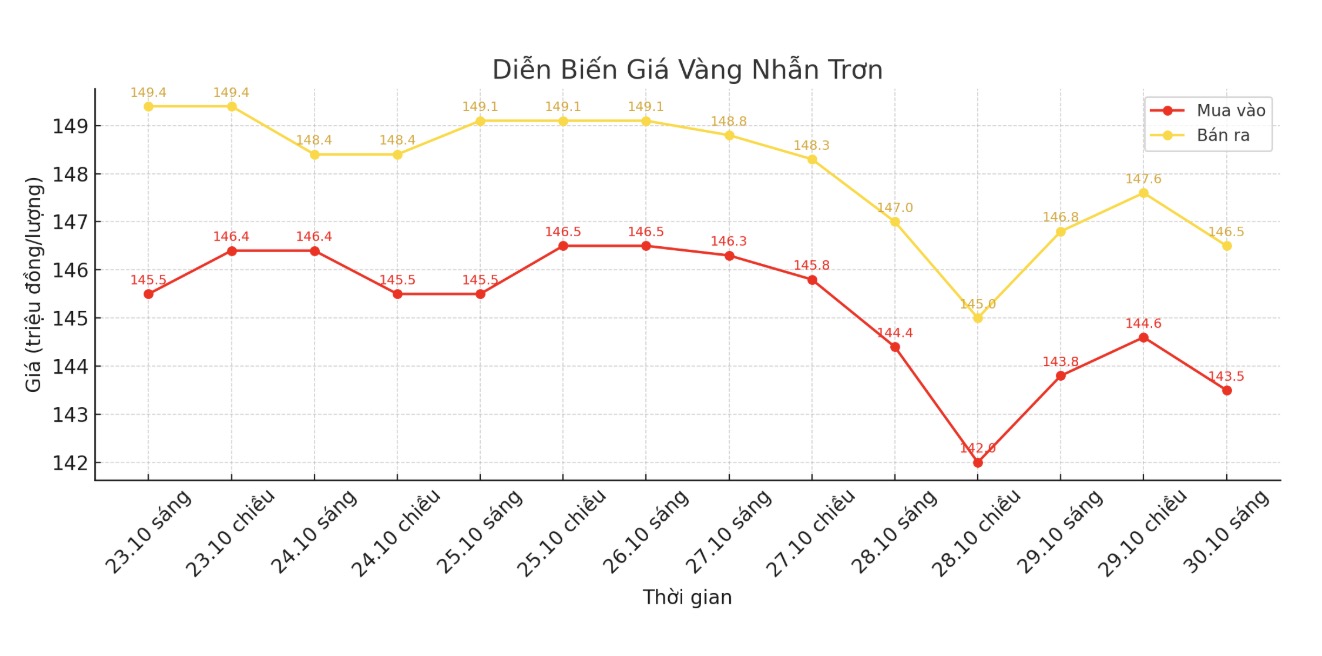

9999 round gold ring price

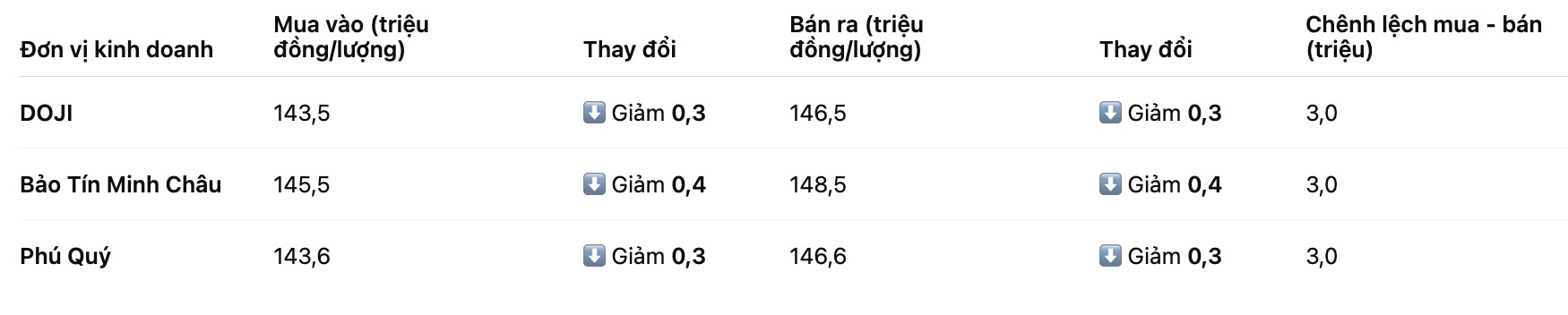

As of 9:40 a.m., DOJI Group listed the price of gold rings at 143.5-146.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.5-148.5 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 143.6-146.6 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

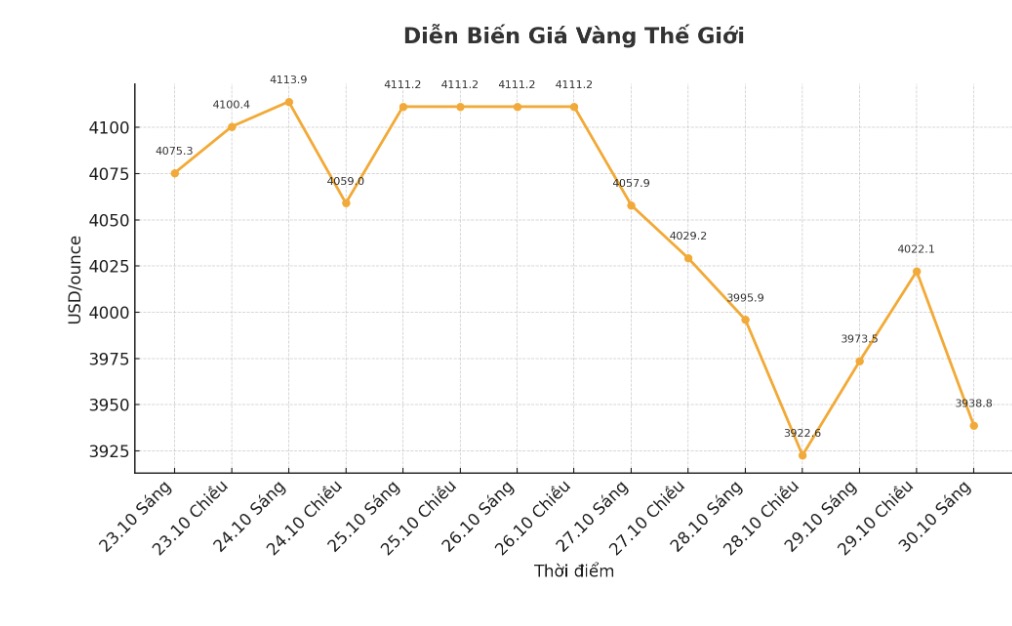

World gold price

At 9:40 a.m., the world gold price was listed around 3,938.8 USD/ounce, down 34.7 USD.

Gold price forecast

World gold prices fell as Federal Reserve Chairman Jerome Powell took a "cold drink" in expectation of a rate cut in December.

After the Fed cut interest rates by another 25 basis points in a move predicted by investors, Mr. Powell emphasized at the beginning of the press conference that continuing to cut interest rates before the end of this year is still a long way off.

In the latest research report, Bernard Dahdah - Precious metals analyst of Natixis has given three scenarios for gold's potential decline. The report comes as spot gold is at $3,996.6 an ounce.

He said the last straw of gold prices was right above production costs, around $2,000 an ounce, well above the average maintenance cost of the mining sector about $1,600 an ounce.

In the second scenario, Dahdah believes that high gold prices could weaken central bank demand, while boosting capital outflows from gold ETFs - currently less than 2% away from a historical peak. In this case, gold prices could fall to $2,800/ounce.

In the third scenario, if investment demand does not change much but central bank buying power slows down, the market can check the support zone around 3,450 USD/ounce.

However, Dahdah believes these scenarios are unlikely, as the gold market has changed significantly in recent years.

I think if gold prices fall below $3,400/ounce, Chinese investors will take a strong buy. We will also see a significant recovery in jewelry demand, he said in the interview.

Despite the downside risk, Dahdah believes the base scenario is that gold prices will move sideways around the current level until 2026. He forecasts an average of $3,800/ounce next year.

He said he did not see enough momentum for gold to continuously break out to over $4,000/ounce.

Technically, the December gold contract chart shows that the bulls still maintain a slight advantage. However, the recent strong sell-off has caused significant damage to the overall technical structure, showing the possibility of setting a short-term peak in the market.

The next upside target for buyers is to close above a solid resistance level at $4,100/ounce. On the contrary, the target for the sellers is to push the price below the strong support zone at 3,800 USD/ounce.

The first resistance level was at $4,050/ounce, followed by $4,100/ounce; first support was at $4,000, then to an overnight low of $3,930/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...