After the Chairman of the US Federal Reserve (FED) cut interest rates by another 25 basis points in a move predicted by investors, Mr. Powell emphasized at the beginning of the press conference that continuing to cut interest rates before the end of this year is still a long way off.

In the Committees discussions at this meeting, there were mixed opinions on how to act in December. The additional interest rate cut at the December meeting is not a given. Absolutely not. The current policy does not follow a prescribed roadmap," Mr. Powell said.

Before Mr. Powell's speech, the market had priced in a nearly 90% chance that the Fed would continue to cut interest rates in December. However, according to CME's FedWatch tool, investors now see only a 60% chance of another policy easing.

The gold market reacted cautiously to Powell's comments, despite losing some of its previous upward momentum after the Fed announced a policy statement that was assessed as "uncoordinated".

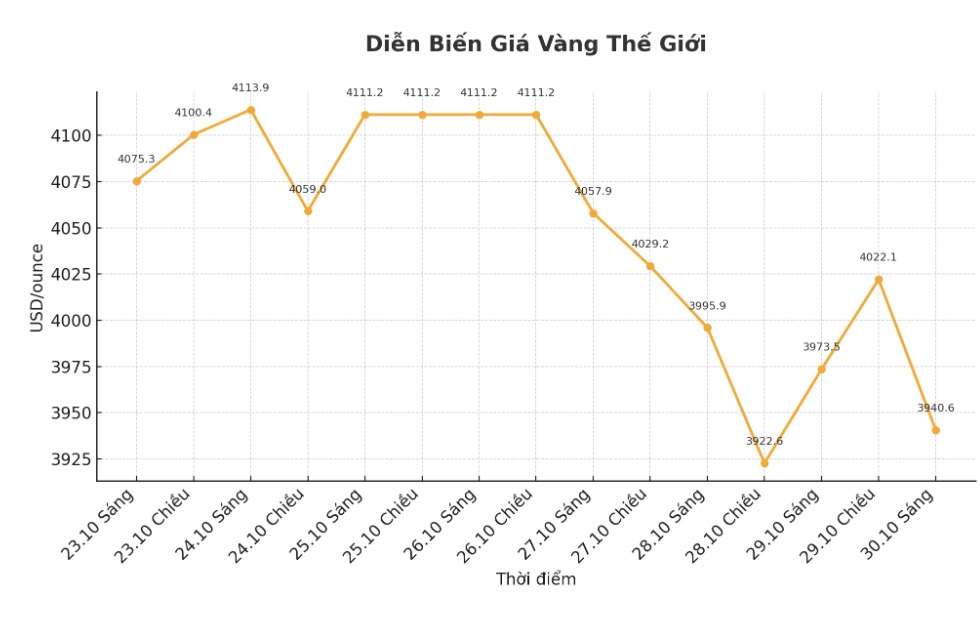

Spot gold is currently trading at $3,941.25 an ounce, down 0.25% on the day. Before Mr. Powell spoke, prices had increased by about 1%.

Mr. Powell said after cutting interest rates in the last two meetings. In the context of limited economic data due to the US government's temporary closure of the FED, it may be necessary to slow down the pace of policy easing.

If you are driving in the fog, what will you do? You will move more slowly. The data will come back, but at this time we may need to be more cautious when acting" - Mr. vi von.

Powell also noted that there is no completely safe path for monetary policy, as the Fed has to balance the two goals of jobs and inflation.

Although Powell has shown a more cautious stance, many experts still expect the Fed to continue cutting interest rates in the coming time to support the weakening labor market.

Commodity analysts say that a decrease in real interest rates while inflation remains high will benefit gold, as this reduces the opportunity cost of holding non-yielding assets such as gold.

See more news related to gold prices HERE...