World gold prices fell in the trading session early this morning (Vietnam time), after the market reacted to Fed Chairman Jerome Powell's statement on monetary policy orientation, even though the US Central Bank has just cut the basic interest rate by 0.25%, as previously forecast.

The Fed has cut its key interest rate overnight to a target range of 3.75%-4.00%, marking the second easing of the year.

At his press conference after the decision, Mr. Powell gave a cautious warning about the policy outlook: In this Committee discussion, there were mixed opinions on how to continue in December. Another interest rate cut in December is not a sure thing. The policy does not follow a prescribed roadmap, he said.

According to Peter Grant - Vice President and senior metals strategist at Zaner Metals: "Gold prices reacted appropriately as Powell tried to reduce expectations for the next cut. The FED interest rate futures market is adjusting its forecast, which is beneficial for the USD and disadvantageous for gold."

The US dollar index continues to rise, making gold - priced in greenback - more expensive for overseas buyers.

Gold, which is not profitable, often benefits from a low interest rate environment and periods of economic instability. However, according to independent metals trader Tai Wong, "the possibility of a December interest rate cut is questioned, which will slow down the recovery of the precious metal".

On trade, US President Donald Trump announced that he had reached a deal with South Korea and expressed optimism about the possibility of reaching a similar deal with Chinese President Xi Jinping, before the meeting on Thursday.

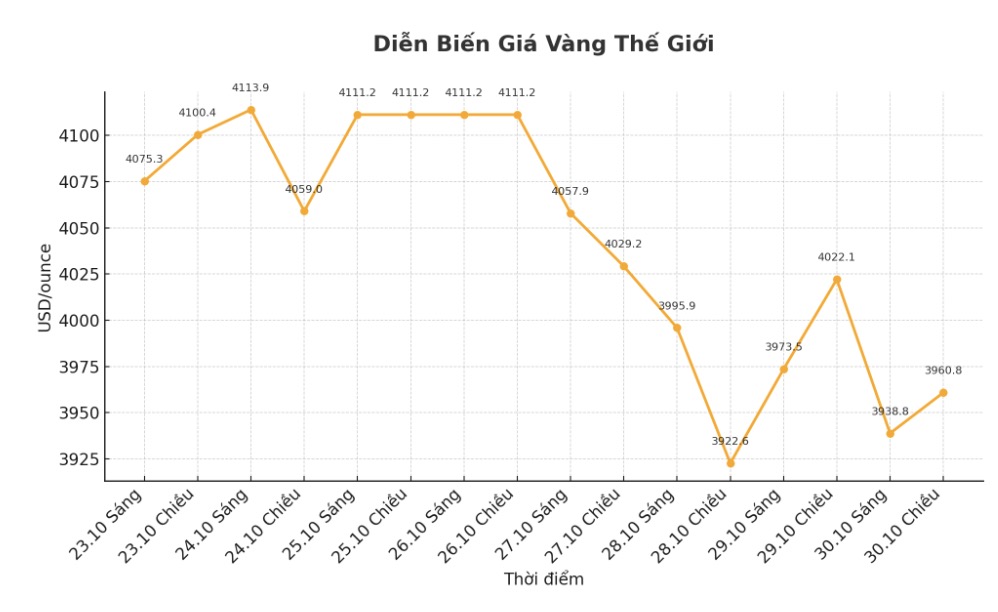

Since the beginning of the year, gold prices have increased 51% and reached a record of 4,381.21 USD/ounce on October 20, but have decreased by more than 3% this week, partly due to cooling trade tensions.

For other precious metals, spot silver rose 1.7% to $47.82/ounce; platinum rose 0.6% to $1,595.81/ounce; while gold rose 1.9% to $1,420.05/ounce.

See more news related to gold prices HERE...