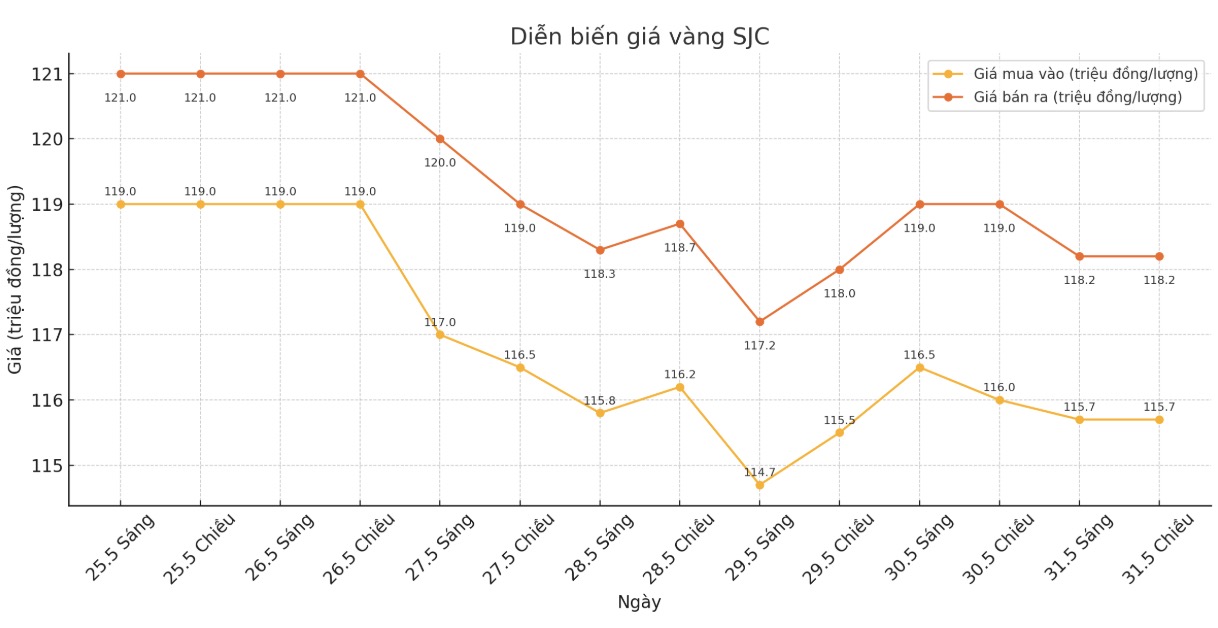

Updated SJC gold price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.7/18.2 million/tael (buy in - sell out), down VND 300,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-118.2 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-118.2 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND115-118.2 million/tael (buy - sell), down VND500,000/tael for buying and down VND300,000/tael for selling. The difference between buying and selling prices is at 3.2 million VND/tael.

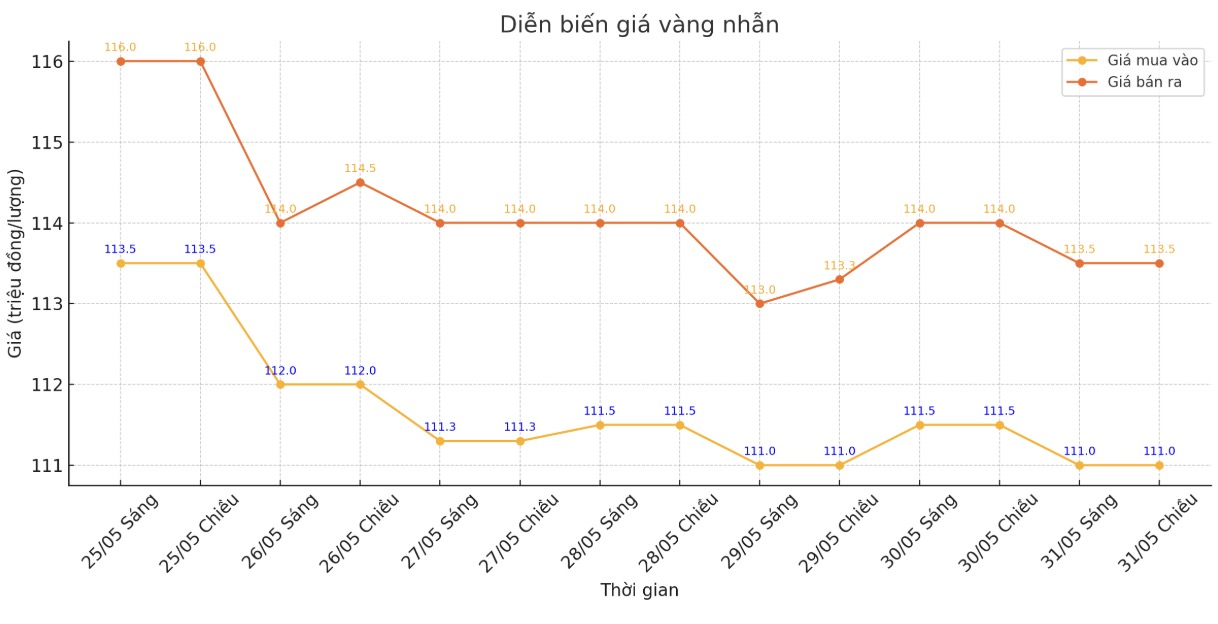

9999 round gold ring price

As of 5:15 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.5-113.5 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

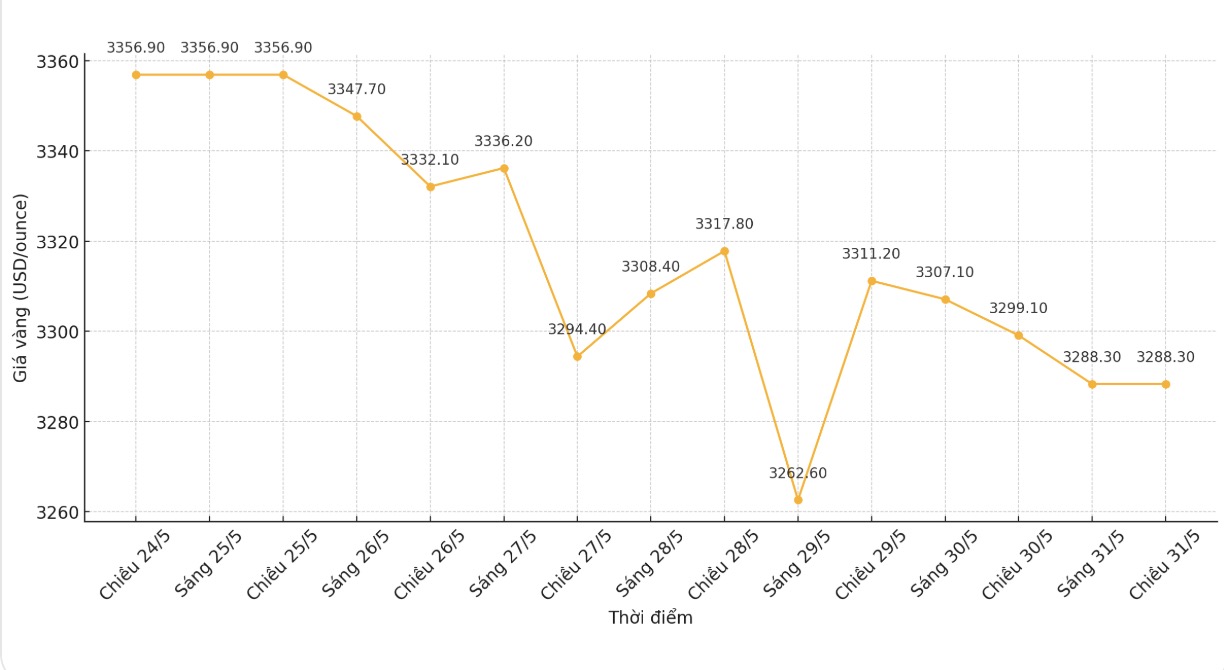

World gold price

At 5:17 p.m., the world gold price listed on Kitco was around 3,288.3 USD/ounce, down 10.8 USD.

Gold price forecast

Gold prices fell due to pressure from the recovery of the USD. The US Dollar Index is rising, making gold more expensive for holders of other currencies.

According to David Meger - Director of Metals Trading at High Ridge Futures - at this time, gold prices are falling compared to the recent high and are in the consolidation phase. Gold prices are under slight pressure as we see a slight decrease in demand for safe-haven assets, but it looks like President Donald Trump will react strongly and that will eventually help gold prices, Meger said.

Mr. Kelvin Wong - senior analyst at Oanda Asia Pacific - said that gold prices have failed to surpass the important short-term resistance level of $3,328/ounce twice. In addition, the waiting mentality for US macroeconomic data shows investors' caution.

Any sign of rising inflation could prompt the Federal Reserve to maintain a tight monetary policy, putting pressure on gold prices - which are often sensitive to interest rates.

According to JPMorgan, gold is considered a more cautious choice for investors who prefer safety. In their mid-year outlook report, JPMorgan analysts said gold could be positioned to provide some protections against rising geopolitical risks and a weakening of the US dollar.

David Einhorn - founder of Greenlight Capital protection fund - commented that the USD is losing its popularity as a world reserve currency. The US budget deficit is likely to worsen, hampering economic growth. In this environment, he said he prioritizes European stock markets.

We are buying gold. The budget situation is a serious problem and I believe in European stocks, he affirmed.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...