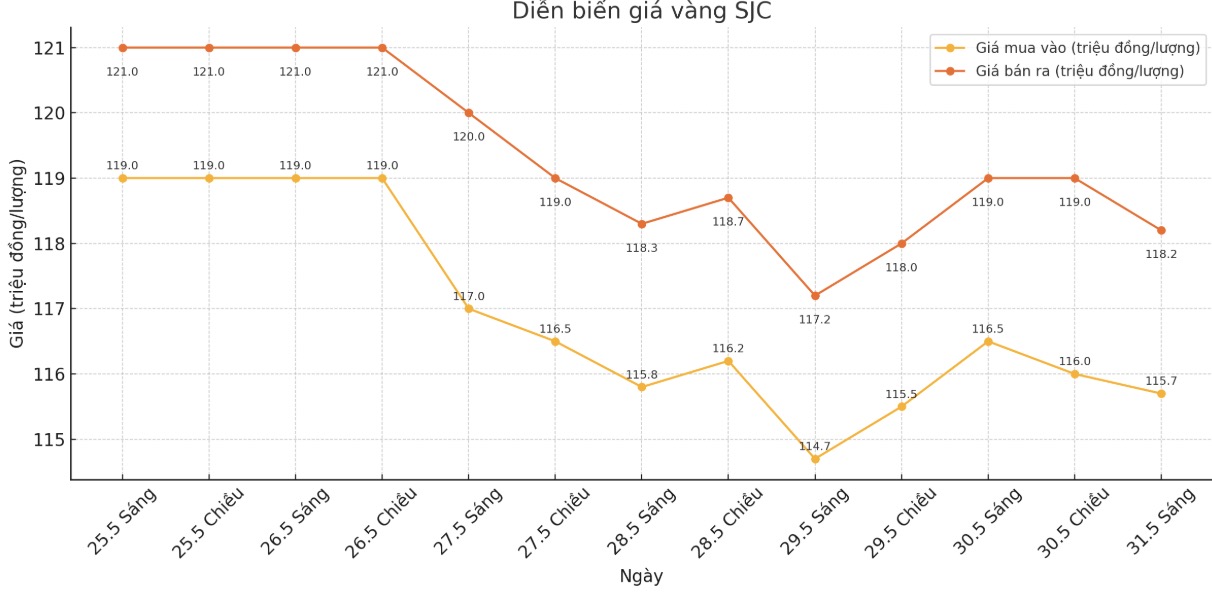

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.7/18.2 million/tael (buy in - sell out), down VND 800,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-118.2 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-118.2 million VND/tael (buy - sell), down 800,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 115-118.2 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 3.2 million VND/tael.

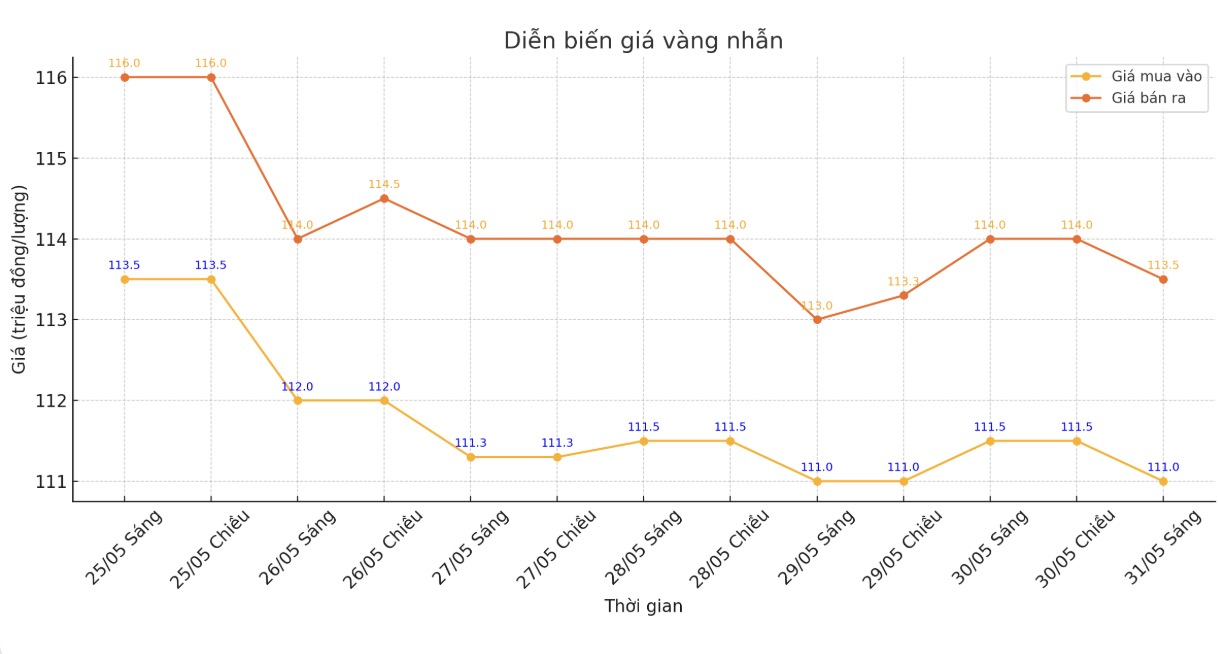

9999 round gold ring price

As of 9:15 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.7-113.7 million VND/tael (buy in - sell out), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

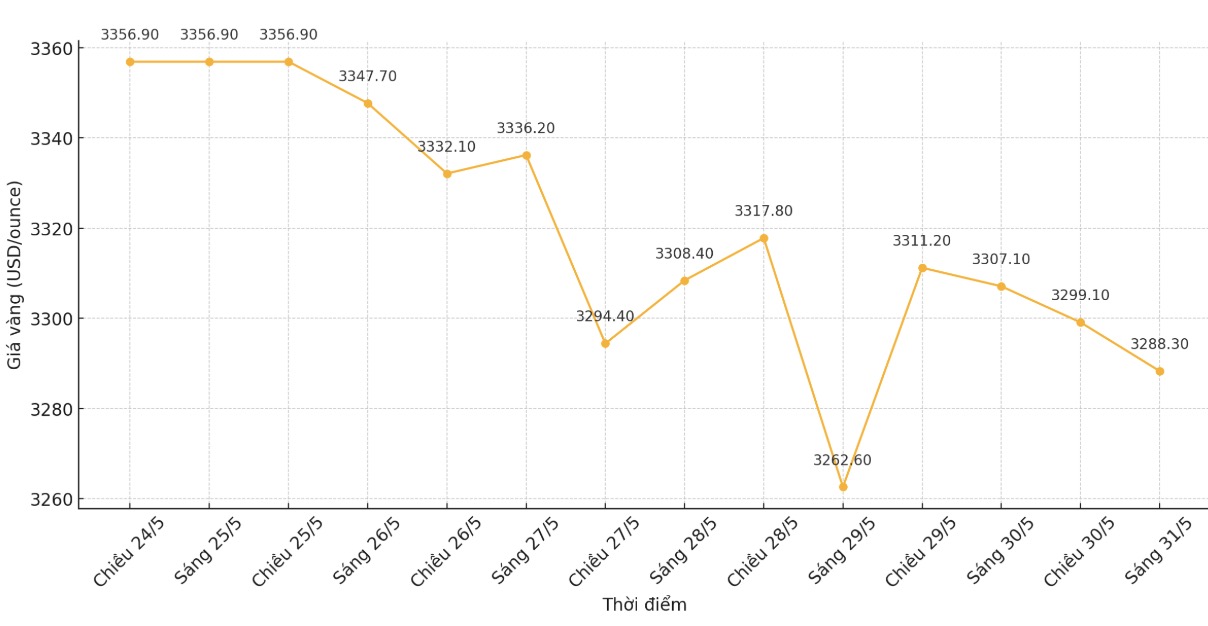

World gold price

At 9:17 a.m., the world gold price was listed on Kitco around 3,262.6 USD/ounce.

Gold price forecast

Tensions surrounding tariff policies between the US and its partners, especially China, have caused gold prices to fluctuate strongly over the past month. However, demand for gold has weakened as concerns about a full-scale trade war have eased.

The market is currently monitoring developments around whether US President Donald Trump's tax policies will be supported by the court. The Federal Court of Appeals in the Washington area recently postponed the execution of a judgment to block taxes from subordinates.

Previously, on May 28, the International Trade Court (CIT) in Manhattan rejected most of the import tariffs imposed by Donald Trump, citing him as having exceeded his authority when citing the Emergency Economic Rights Act (IEEPA).

In another development, a report from Fidelity (one of the world's largest financial asset and services management groups, headquartered in the US) said that although economic concerns have helped gold prices set new records and long-term supporting factors still exist, the recent strong increase in gold requires investors to be cautious.

The latest period of gold Son started in the fall of 2022, when trading prices were around 1,670 USD/ounce. Since then, gold prices have nearly doubled, the report said.

Although demand has increased widely during this price increase, the purchase of gold by central banks outside the Organization for Economic Cooperation and Development (OECD) is a notable factor.

There has been a shift away from the US dollar by some central banks, causing gold purchases to exceed 1,000 tons per year in the period of 2022 - 2024. For example, the central bank that bought the most gold in 2024 was Poland with 90 tons. I think ASEAN countries will continue to increase gold purchases," said Boris Shepov, co-chair of Fidelity Select Gold Portfolio (FSAGX).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...