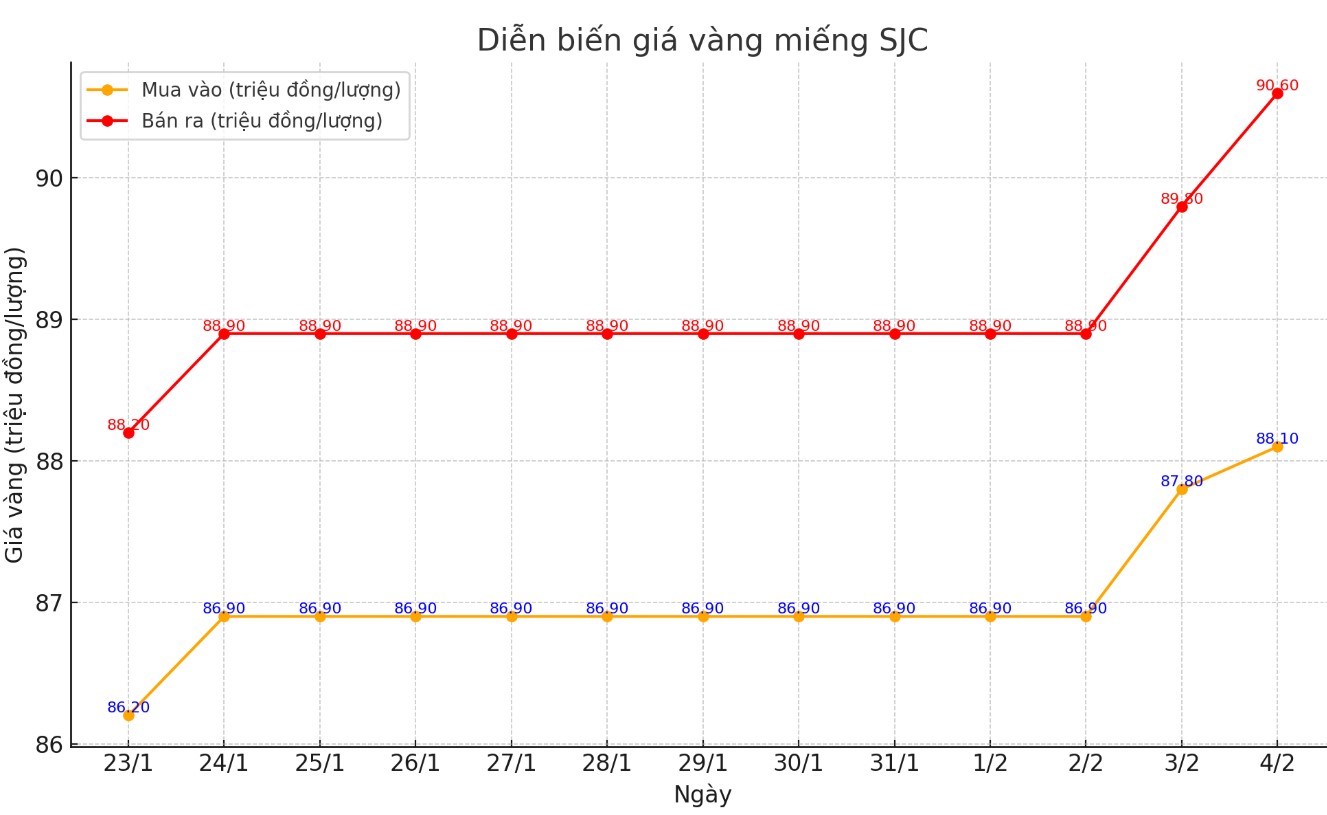

Update SJC gold price

As of 10:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND88.1-90.6 million/tael (buy - sell); an increase of VND800,000/tael for buying and an increase of VND1.3 million/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 88.1-90.6 million VND/tael (buy - sell); an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

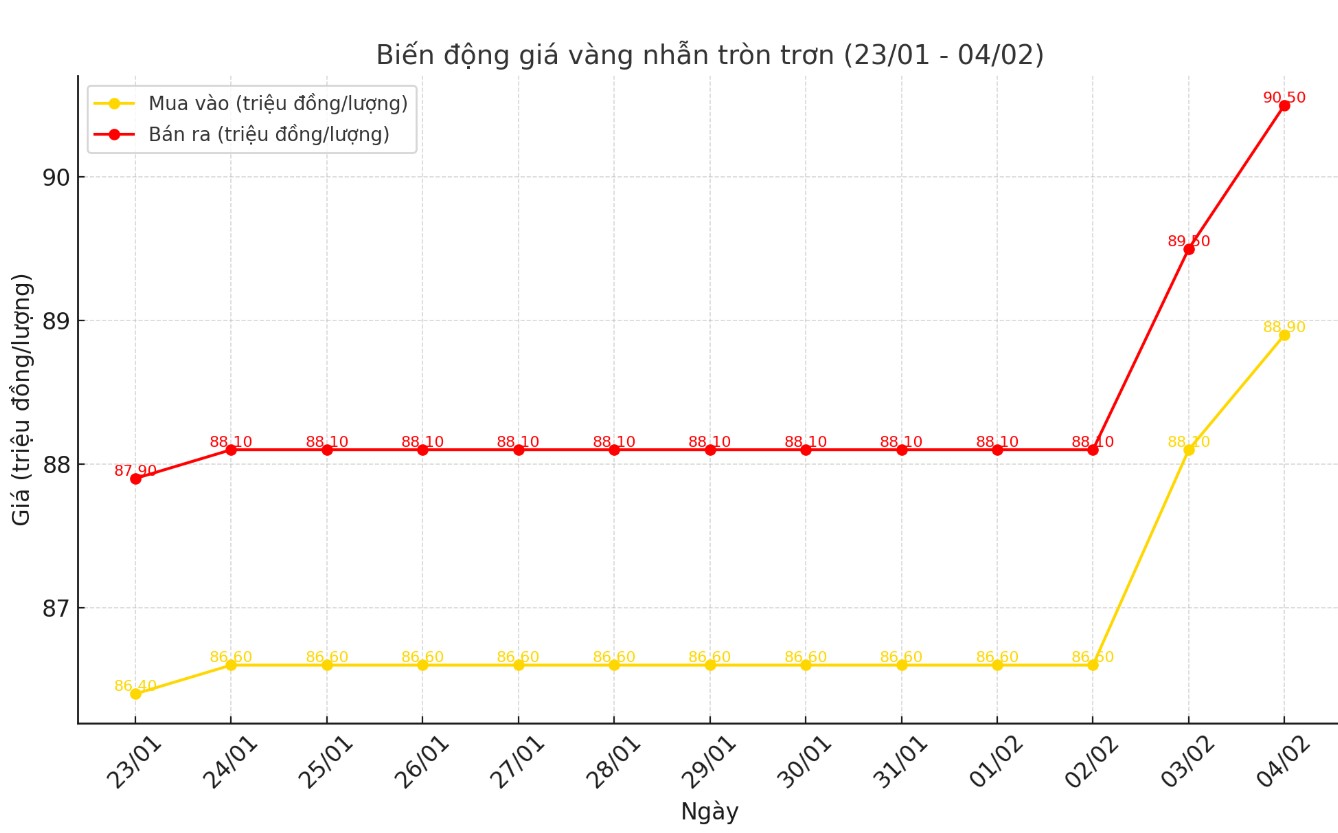

9999 round gold ring price

As of 9:10 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.9-90.5 million VND/tael (buy - sell); an increase of 1.3 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 88.5-90.55 million VND/tael (buy - sell), an increase of 1.4 million VND/tael for buying and 1.3 million VND/tael for selling compared to early this morning.

World gold price

As of 9:05 a.m., the world gold price listed on Kitco was at 2,823.8 USD/ounce, up 47.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased sharply despite the increase in the USD. Recorded at 9:05 a.m. on February 4, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.515 points (up 0.19%).

Gold prices traded near session highs after latest data showed the US manufacturing sector improved this month.

The Institute for Supply Management (ISM) announced on Monday that its manufacturing Purchasing Managers' Index (PMI) rose to 50.9 in January, after recording 49.3 in December. The figure was higher than analysts' forecasts, which were expecting only 49.8.

“U.S. manufacturing activity expanded in January after 26 consecutive months of decline,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee. “Demand clearly improved, while output expanded and input supplies remained favorable.”

Gold prices are posting healthy gains and approaching record highs, partly driven by safe-haven demand as markets become more uncertain as the US prepares to impose tariffs on major trading partners.

Many believe that tariffs can increase inflation and impact economic growth through higher costs, while tariffs create a stagflationary environment, said Phillip Streible, market strategist at Blue Line Futures.

Despite the headwind from the strength of the US dollar, world gold prices still increased due to safe-haven demand due to the uncertainty surrounding Donald Trump's tariffs, said David Meger, director of metals trading at High Ridge Futures.

The 25% tariffs that Donald Trump imposed on imports from Canada and Mexico, along with a 10% tariff on Chinese goods, have raised concerns about a trade war that could slow global growth and spur inflation. However, Donald Trump has announced a one-month pause on the tariffs on Mexico.

The market has yet to fully appreciate the extent of the trade war, said Bart Melek, commodity strategist at TD Securities. “We have not seen the full response from gold and if this trade war continues for a long time, it could lead to significant increases in gold prices in the future,” Melek added.

See more news related to gold prices HERE...