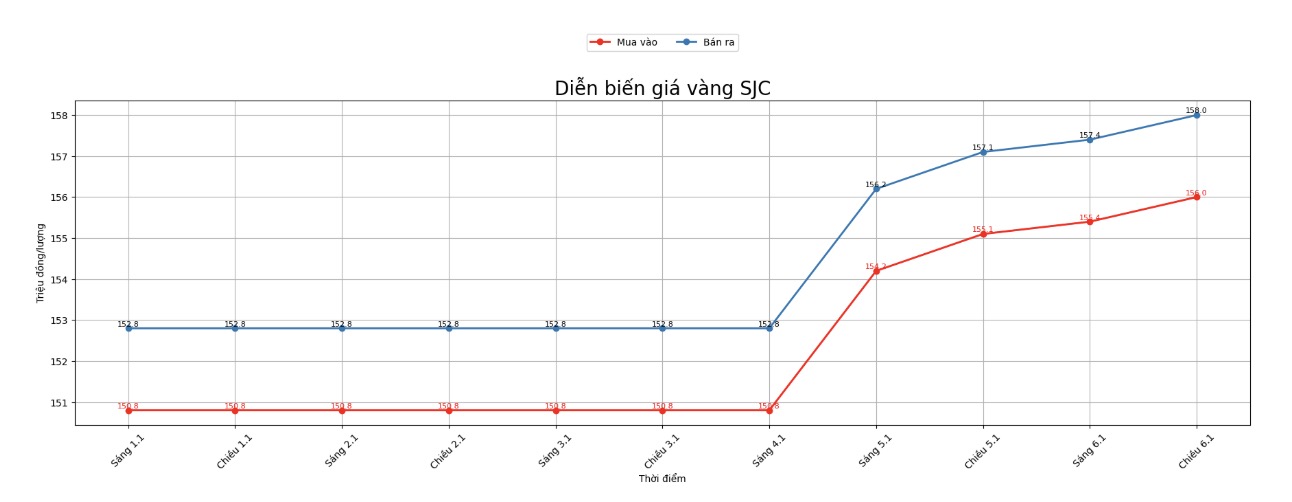

SJC gold bar price

As of 5:10 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 156-158 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 156-158 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 156-158 million VND/tael (buying - selling), an increase of 1.7 million VND/tael on the buying side and an increase of 1.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

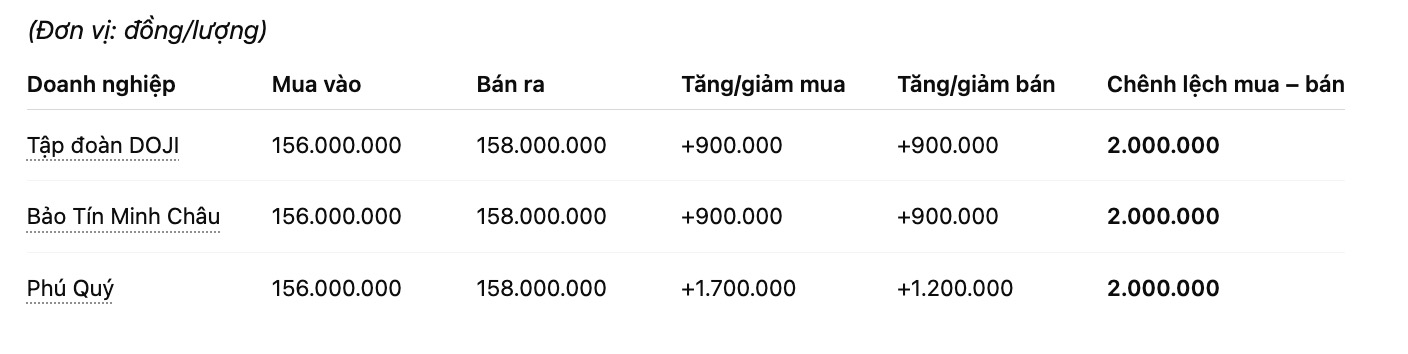

9999 gold ring price

As of 5:10 PM, DOJI Group listed the price of plain gold rings at 152.5-155.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153-156 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

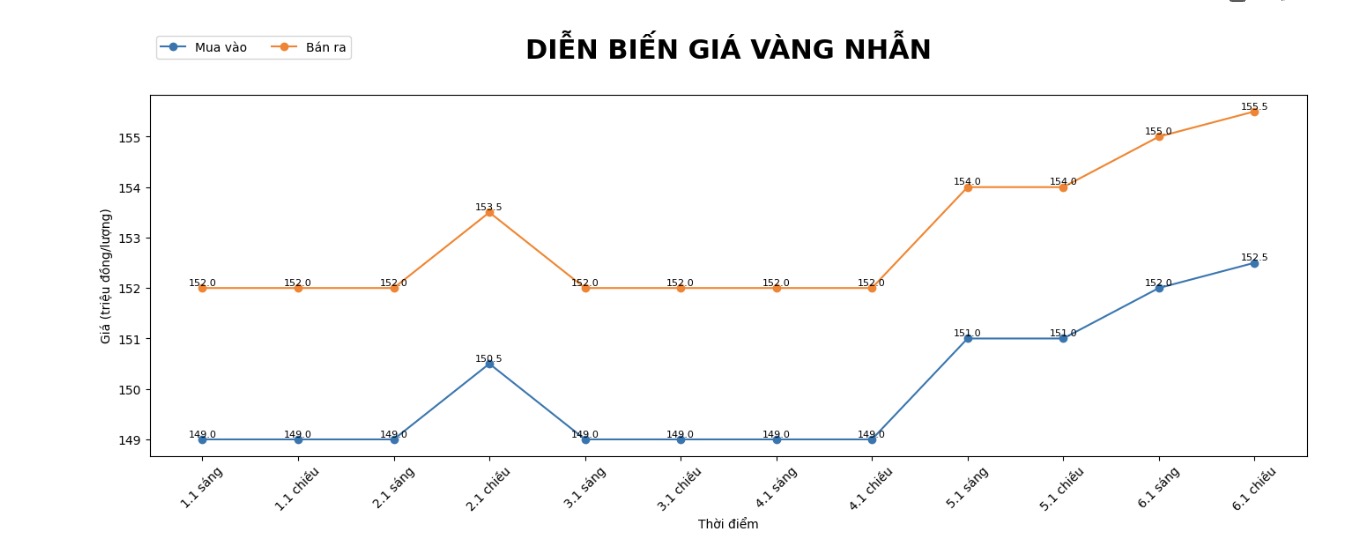

World gold price

World gold prices listed at 5:12 PM were at 4,448.8 USD/ounce USD/ounce, up 15.6 USD compared to the previous day.

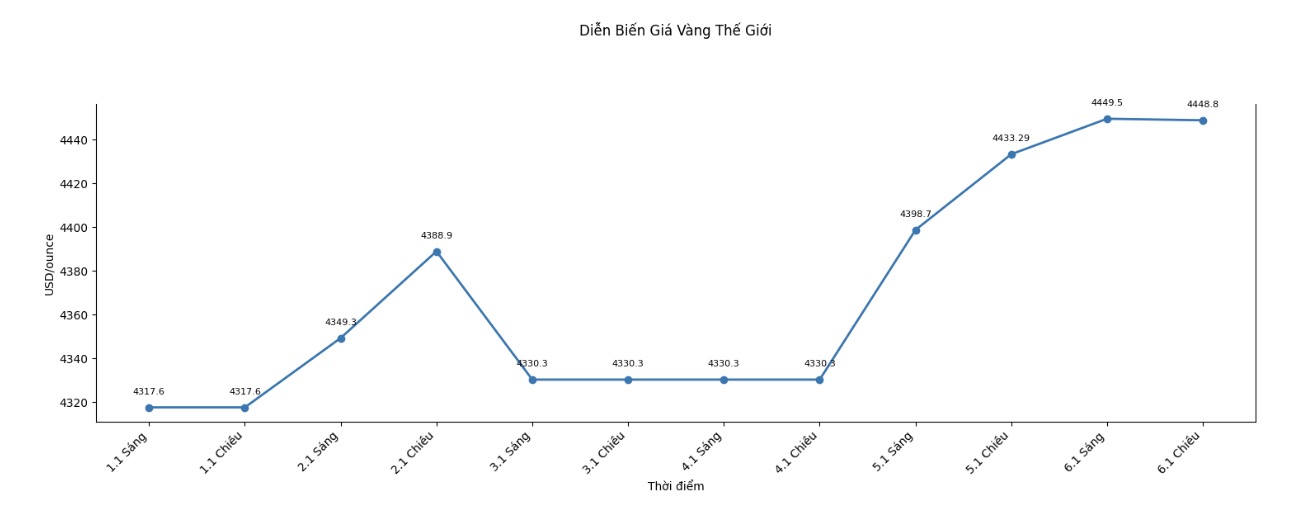

Gold price forecast

The vibrant developments of the gold market in recent sessions are attracting great attention from investors, especially in the context of domestic and world gold prices simultaneously rising. According to experts, the upward trend of the precious metal is still supported by many fundamental factors, but the increase range may no longer be too strong and the risk of short-term correction is something to consider.

On the international market, world gold prices have just surged, reaching their highest level in about a week. The main driving force comes from increased geopolitical tensions, especially after developments related to relations between the US and Venezuela. These new instabilities have pushed cash flow to safe haven assets, in which gold continues to be the top choice.

Mr. Zain Vawda - an analyst at MarketPulse of OANDA - said that geopolitical tensions not only increase investor defensive sentiment but also add a new layer of risk to the global financial market. According to him, this factor is likely to maintain demand for gold at a high level in the short term, especially when tough statements from the US make investors worried about the possibility of widespread instability.

In the medium and long term, many large organizations still maintain an optimistic view of the prospects of the precious metal. Mr. Aakash Doshi – Head of Gold Strategy at State Street Investment Management – said that the major trend of gold prices is still in the upward direction, although the pace may slow down compared to the recent breakthrough period. The basic scenario he put forward is that gold prices may fluctuate around the 4,500 – 4,600 USD/ounce range, with adjustments considered opportunities for re-accumulation.

Another important factor supporting the market is the increasingly large global debt scale, along with persistent inflation and loose fiscal policies in many major economies. In that context, gold is increasingly seen not only as a traditional safe haven but also as a hedging tool against currency devaluation risks.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...