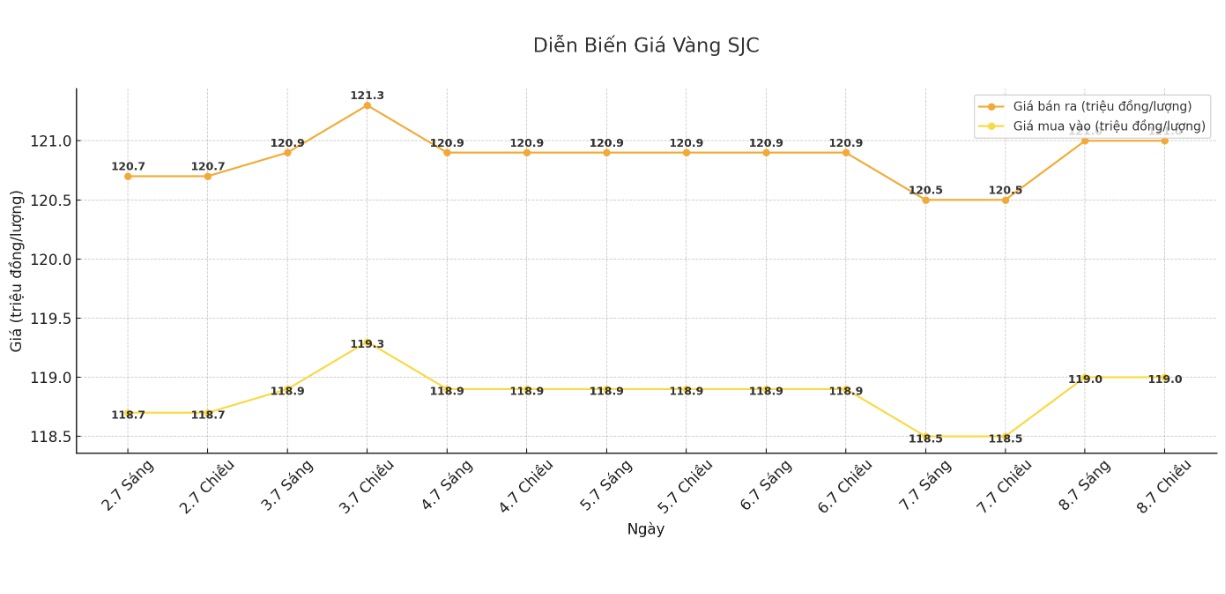

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out); increased by VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119-121 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy in - sell out); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

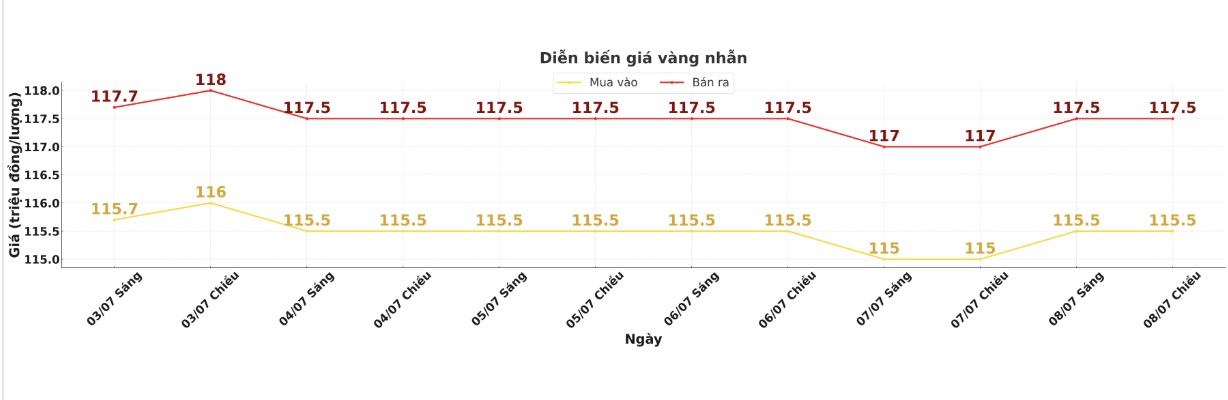

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at VND 115.5-117.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.3 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

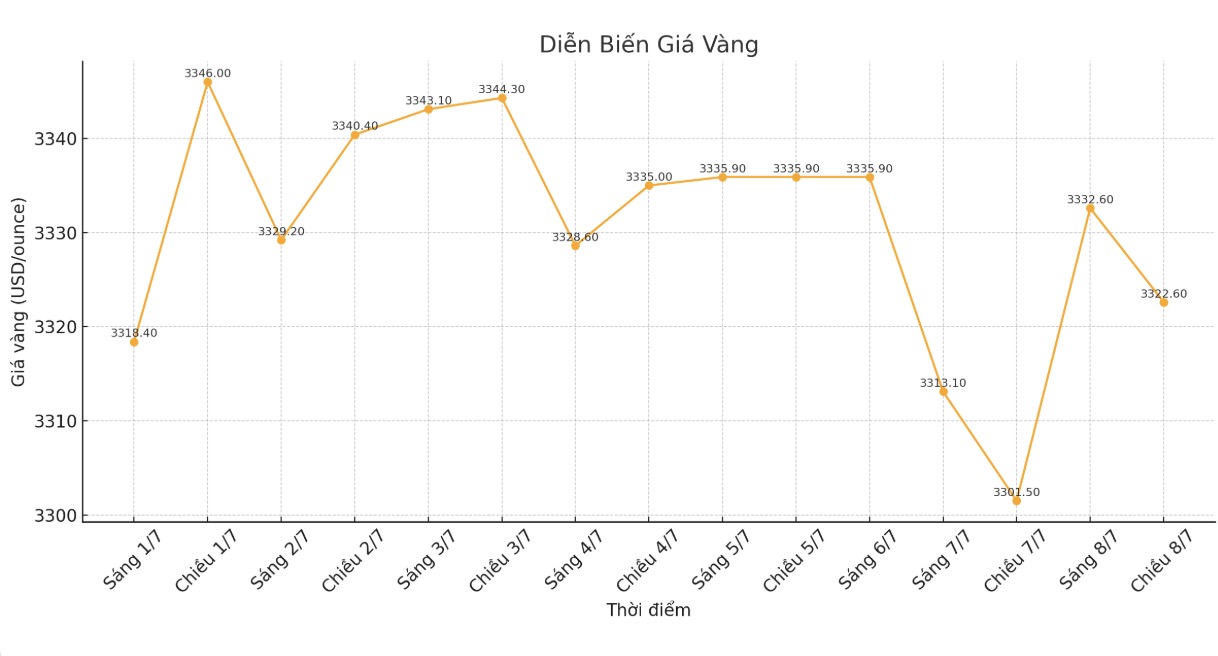

World gold price

The world gold price was listed at 5:20 p.m. at 3,322.6 USD/ounce, up 21.1 USD/ounce compared to 1 day ago.

Gold price forecast

Traders dont seem to be too confused by US President Donald Trumps tax letter, said Tim Waterer, chief market analyst at KCM Trade. With safe-haven demand largely controlled at the moment, gold is still waiting for an opportunity, waiting for a breakthrough.

Mr. Waterer also added that higher bond yields and the resilience of the Asian market in the face of tariff developments are limiting the immediate upside potential of gold.

The yield on the benchmark 10-year US Treasury note has hovered near a two-week high. Higher yields increase the opportunity cost of holding non-yielding gold.

Commenting on the gold price trend, market participants are still worried and are looking forward to signs of the US Federal Reserve's attitude towards tightening currencies, which could shape the future of gold prices.

Minutes of the FED's June meeting - scheduled to be released on Wednesday will provide more information on the central bank's policy outlook.

As the US dollar strengthens, it is also a difficult time for gold. But if the tariff war accelerates, gold will increase in price, especially as concerns about inflation and trade wars increase.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...