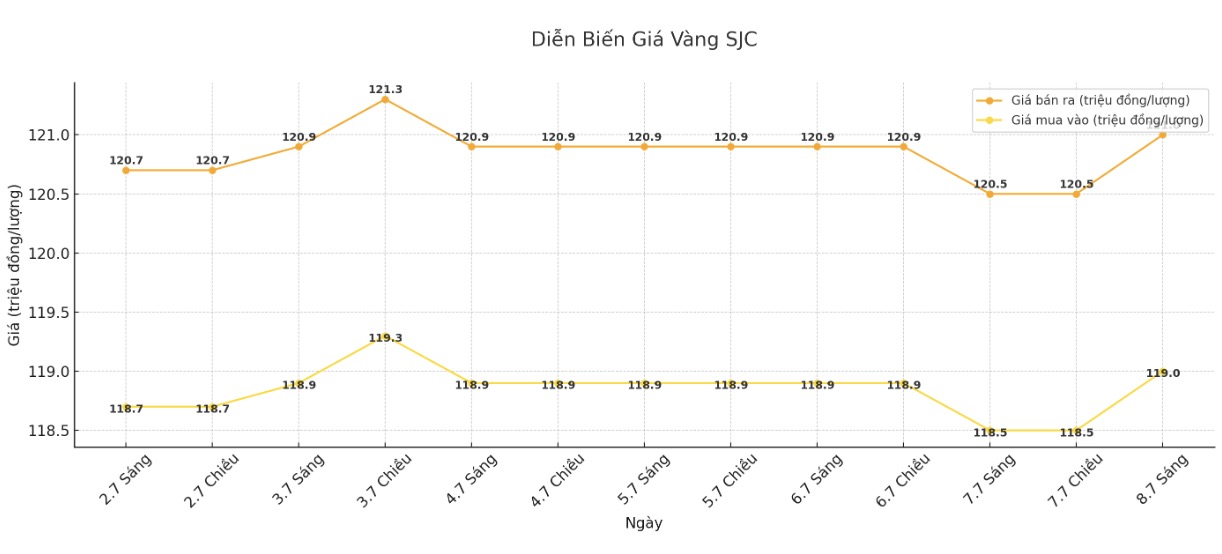

Updated SJC gold price

As of 9:20 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

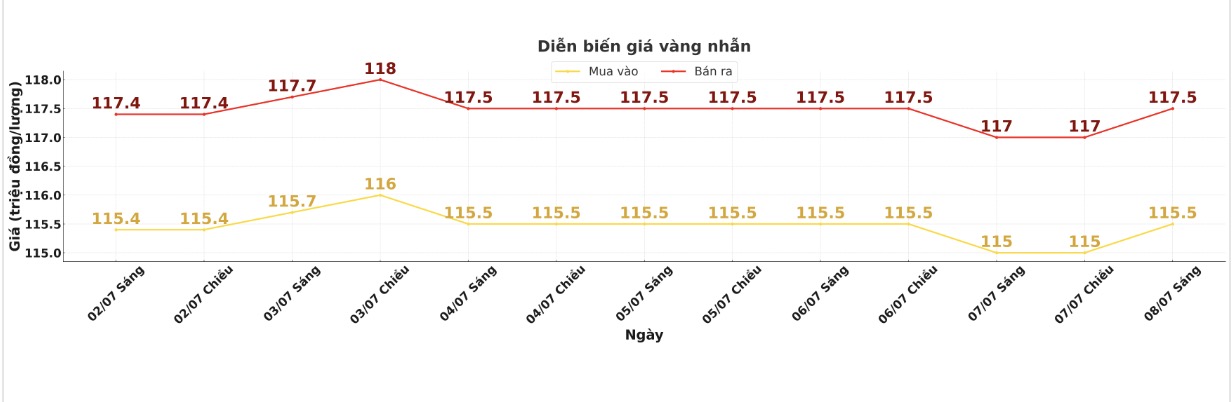

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

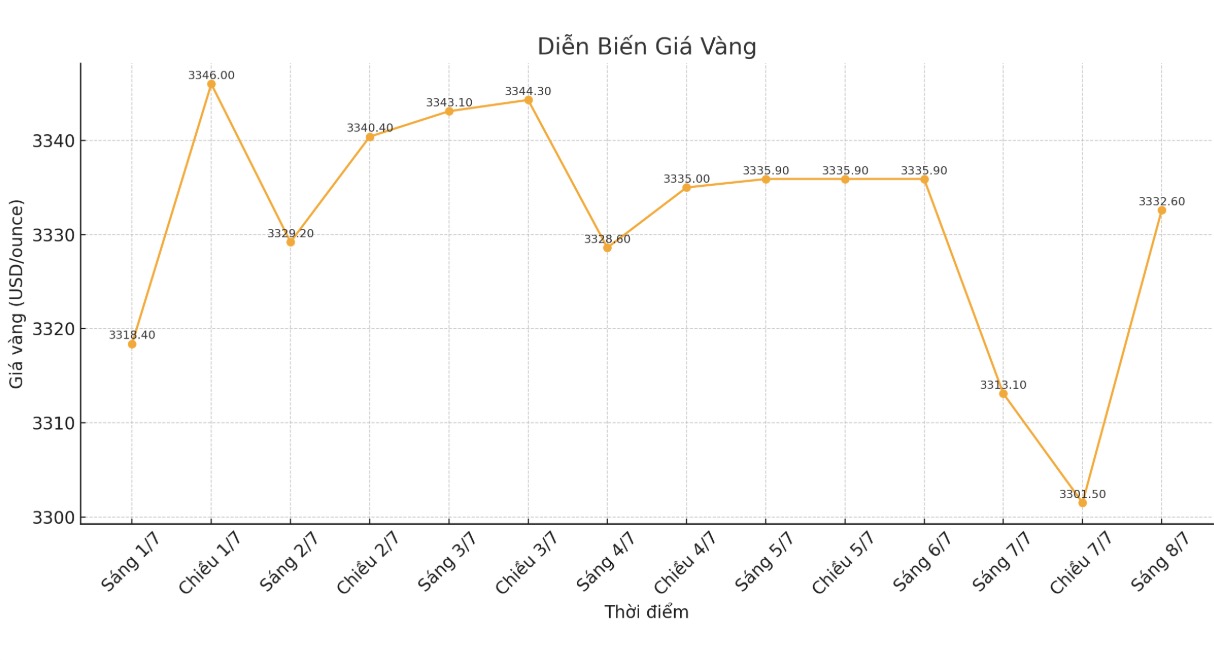

World gold price

At 9:20 a.m., the world gold price was listed around 3,332.6 USD/ounce, up 19.5 USD/ounce compared to 1 day ago.

Gold price forecast

The bearish trend of gold is being reversed due to the wave of buying as prices fall. Early this morning (July 8 - Vietnam time), the precious metal on the world market almost regained its previous decrease.

The Asian and European stock markets fluctuated in different directions overnight. US stock indexes are heading for a weaker opening session today in New York.

The development comes as US Treasury Secretary Bessent said the deadline for US real trade talks with partners could be postponed from July 9 to August 1. White House officials say some trade deals could be reached this week.

In another development, the BRICS (Russia, China, India, Brazil and South Africa) summit will begin this week, hosted by Brazil in Rio. President Donald Trump warned that countries associated with the BRICS group may face additional tariffs.

Technically, speculators who sell gold in August still have a short-term advantage. The next upside target for buyers is to close above $3,400/ounce. The nearest downside target for the seller is to pull prices below the support level of $3,200/ounce.

The first resistance level was the overnight peak of $3,355 an ounce, followed by last week's peak of $3,376.9/ounce. First support was at the bottom of overnight at $3,304.4 an ounce, followed by $3,300 an ounce.

Jim Wyckoff - senior analyst at a precious metals website is currently in a "riesome and bumpy" state, reflecting the lack of strong enough factors to push prices above the current trading range.

The chart is still showing an uptrend, but buyers need new momentum to push prices out of the recent trading range, Wyckoff stressed.

According to him, although the potential for price increases still exists, gold investors need to closely monitor macroeconomic and geopolitical information that can create a breakthrough, disrupt the consolidation phase and shape a new price trend for this precious metal.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...