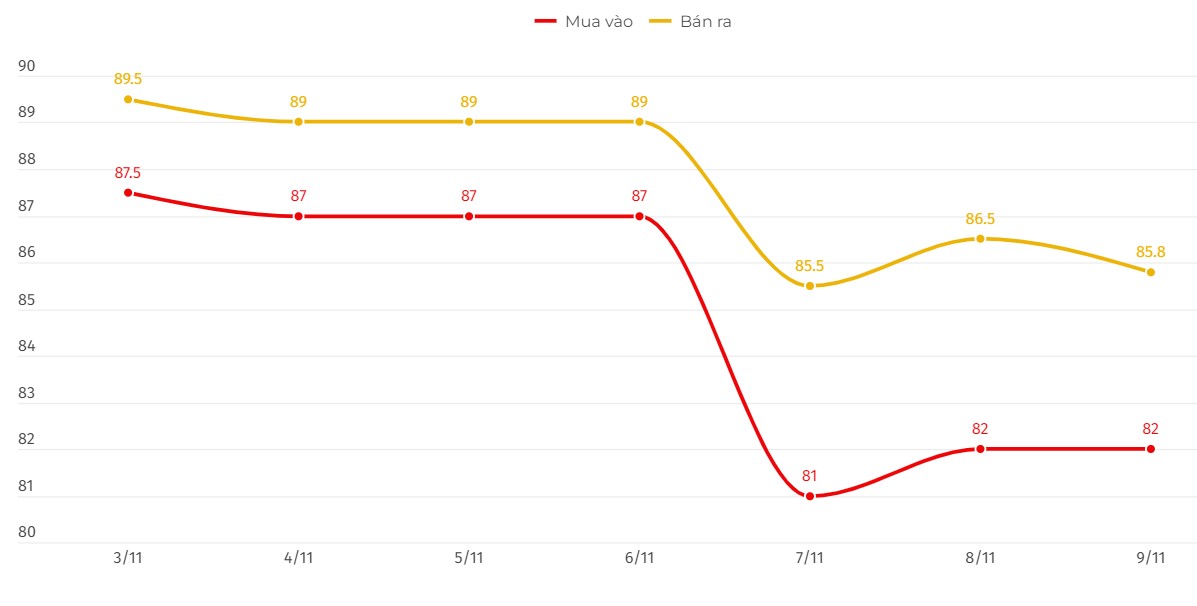

Update SJC gold price

As of 7:34 p.m., DOJI Group listed the price of SJC gold bars at 82-85.8 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at DOJI remained unchanged for buying and decreased by VND200,000/tael for selling. The difference between the buying and selling price of SJC gold at DOJI Group is at VND3.8 million/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82-85.8 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged for buying and decreased by VND200,000/tael for selling. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC was at VND3.8 million/tael.

Bao Tin Minh Chau listed SJC gold price at 82.3-85.8 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Bao Tin Minh Chau remained the same for buying and decreased by 200,000 VND/tael for selling.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

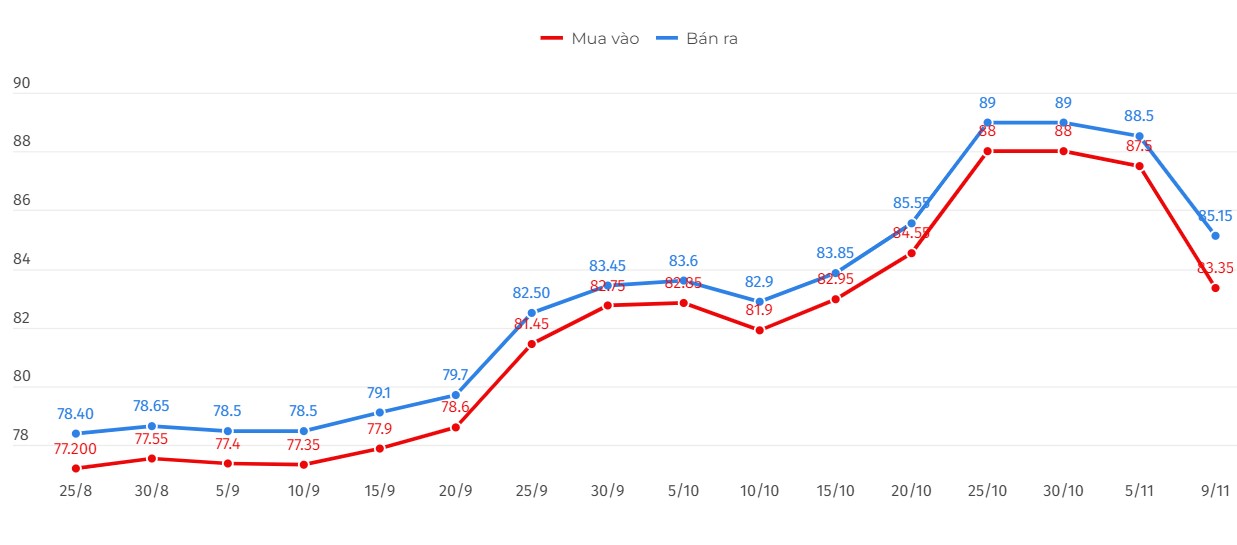

Price of round gold ring 9999

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.35-85.15 million VND/tael (buy - sell), keeping both selling prices unchanged compared to the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.32-85.12 million VND/tael (buy - sell); unchanged in both directions.

World gold price

As of 7:45 p.m., the world gold price listed on Kitco was at 2,684.4 USD/ounce, down 5.4 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices recover despite high USD index. Recorded at 6:00 p.m. on November 9, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.890 points (up 0.52%).

The recovery is being hampered by U.S. economic data, with the University of Michigan saying Friday that its preliminary survey of consumer sentiment rose to 73 in November.

This was a seven-month high and up from October's final reading of 70.5. The data was better than expected, as economists had predicted a smaller increase of just 71.

Gold is under some selling pressure after the release of US economic data.

However, Ryan McIntyre - an expert at Sprott - believes that in the long term, gold prices will increase thanks to supporting factors such as the devaluation of the USD and the unstable financial situation of many Western countries. Investors believe that under President Donald Trump, many economies will have to be very "cautious".

Tensions in the Middle East have not cooled down. Meanwhile, the World Gold Council said that global physical gold exchange-traded funds saw capital inflows in October, for the sixth consecutive month. Many forecasts say that gold will reach $3,000 an ounce in 2025.

Brian Lan, CEO of Singapore-based dealer GoldSilver Central, said that in the long term, gold prices will still rise. However, in the short term, if prices fall to $2,643 an ounce, the next support level will be $2,620-2,520 an ounce, he said.