Updated SJC gold price

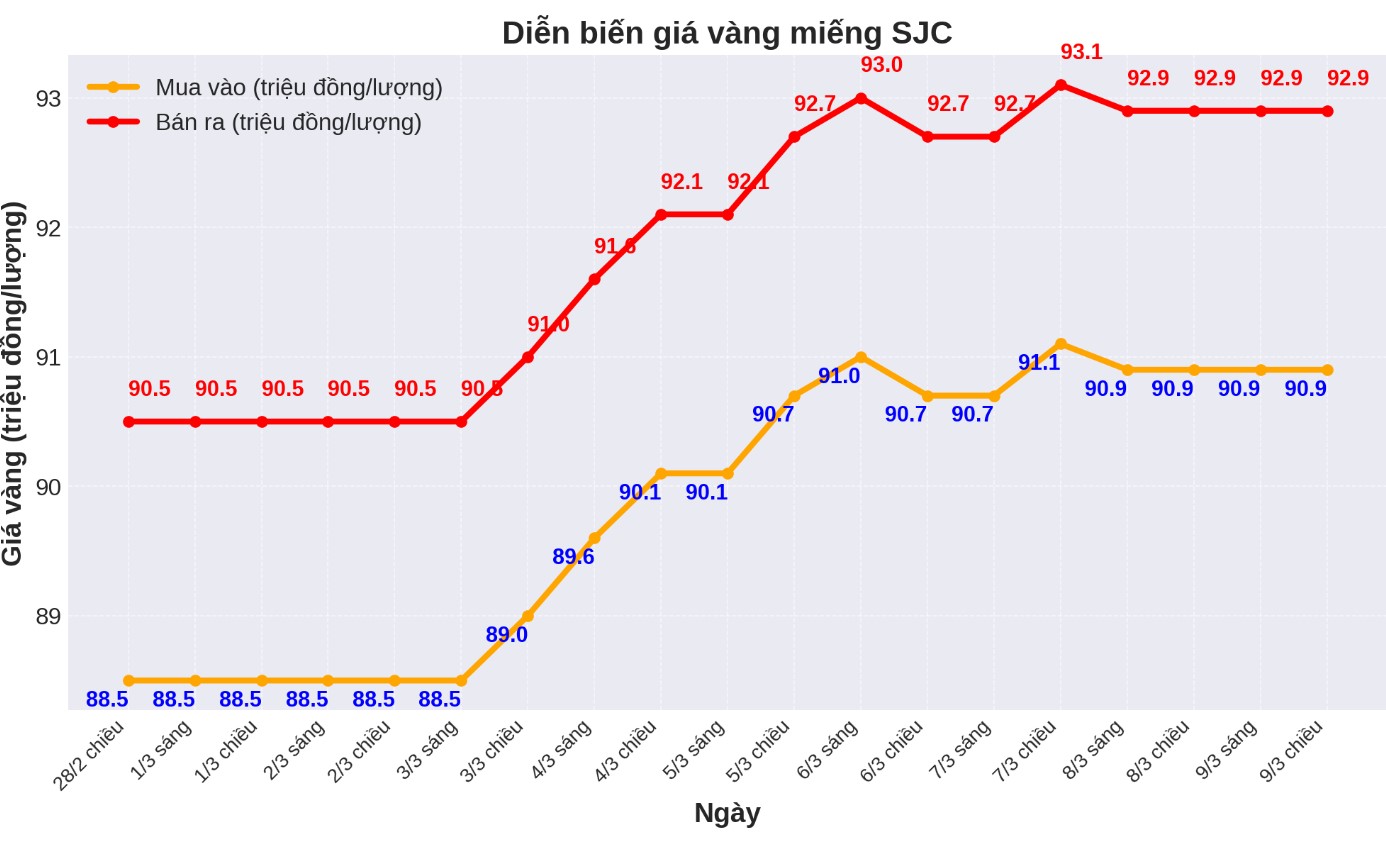

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 90.9-92.9 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at DOJI increased by 2.4 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 90.9-92.9 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 2.4 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company Group SJC is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of 2.3 and selling in today's session (9.3), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of 400,000 VND/tael.

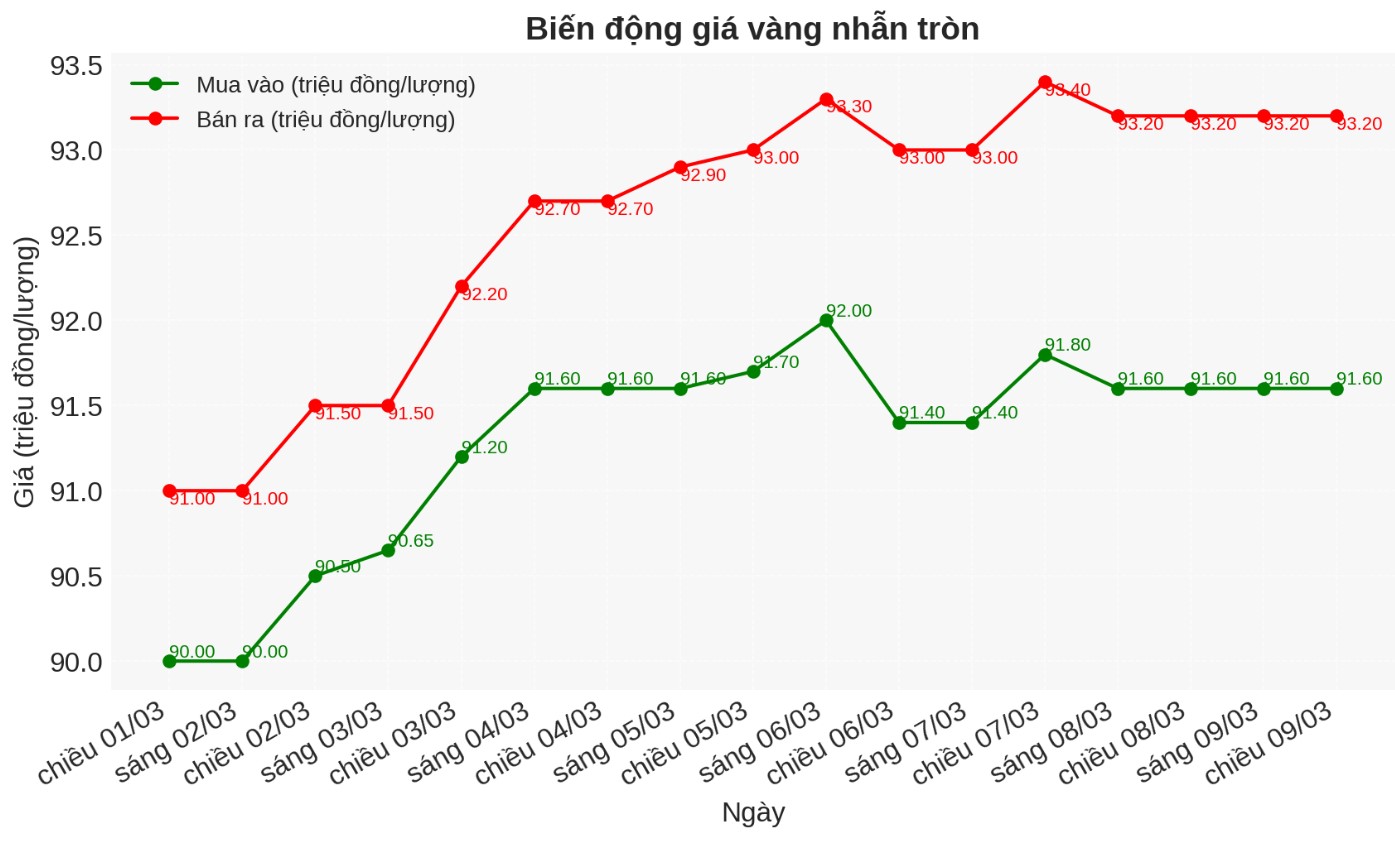

9999 round gold ring price

At the end of the trading session of the week, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 91.6-93.2 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for buying and an increase of 2.2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.7-93.3 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for buying and an increase of 2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

If buying gold rings in the session of 2.3 and selling in today's session (3.9), buyers at DOJI and Bao Tin Minh Chau will receive a profit of VND600,000 and VND400,000/tael, respectively.

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,909.5 USD/ounce, up 51.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices remained high at the end of the week in the context of the USD going down. Recorded at 5:00 p.m. on March 9, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.810 points (down 0.21%).

Gold prices ended the week above $2,900/ounce, up about 1.6% from last Friday. Some analysts believe that there needs to be a new factor to push prices above $3,000/ounce.

Gold prices could stagnate as we wait to see if the US enters a period of stagnant inflation. Financial expansion in Europe could affect investment flows, but I see no reason why gold prices cannot continue to rise.

Currently, many factors supporting prices have been reflected, so we need to wait and see the economic impact from current developments - Ole Hansen, head of commodity strategy at Saxo Bank commented.

Naeem Aslam - Investment Director at Zaye Capital Markets - commented that there is a 20-25% chance that the US will fall into recession this year due to persistent inflation and the US Federal Reserve (FED) may make policy mistakes.

Consumption psychology is weakening, the University of Michigan index fell 10% in February. In addition, Mr. Trump's tax policy could still disrupt the situation. In this context, gold prices have a chance to surpass $3,000/ounce, continue to increase by 28% in 2024 and be supported by strong demand from central banks, he said.

This week, market sentiment has changed significantly compared to last week, especially from the group of Wall Street experts. In the previous survey, only 21% of experts predicted gold prices would increase, while up to 64% thought prices would decrease.

However, this week, the experts' expectation of gold increasing has skyrocketed to 67%, while only 5% predicted a decrease - a significant change reflecting the reversal in analysts' assessment.

The group of individual investors (Main Street) also recorded a clear change. The proportion of investors who predict gold prices to increase has increased from 45% to 67%, while those who expect prices to decrease from 28% to 18%.

Important economic data next week

Tuesday: Number of US job positions (JOLTS).

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...