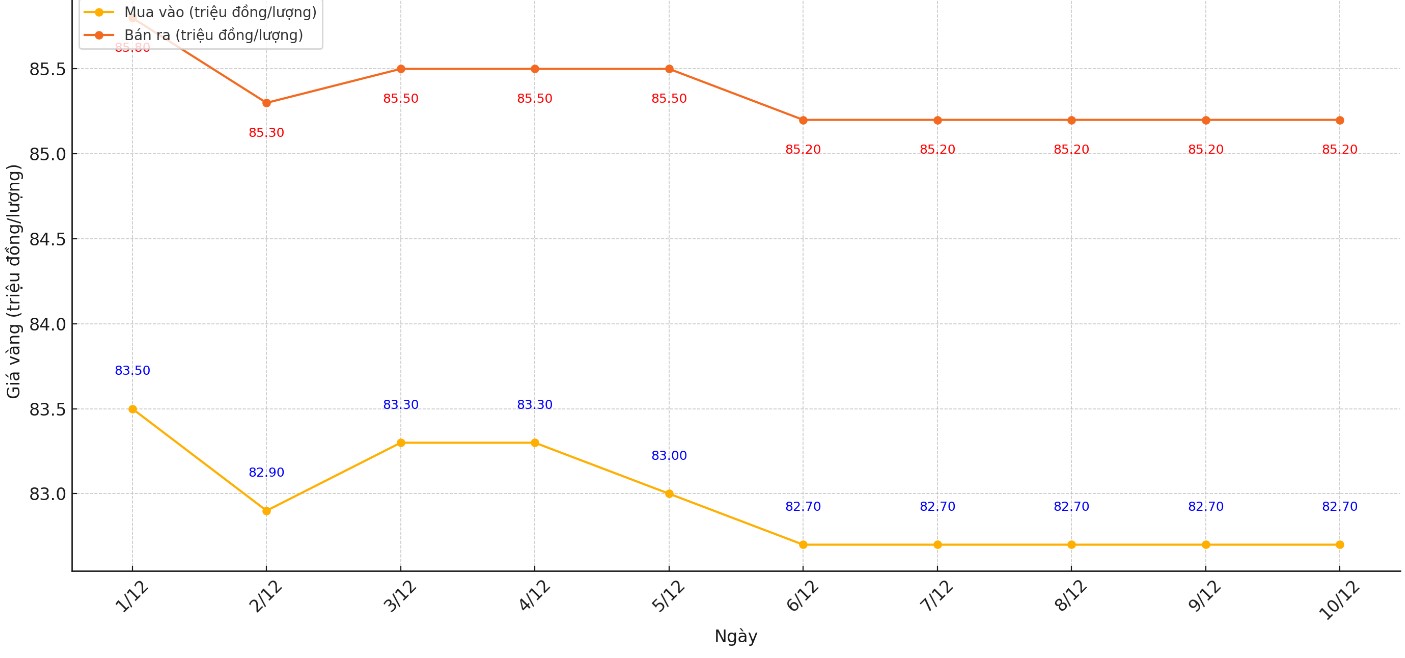

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars listed by DOJI Group was at 82.7-85.2 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.7-85.2 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-85.2 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

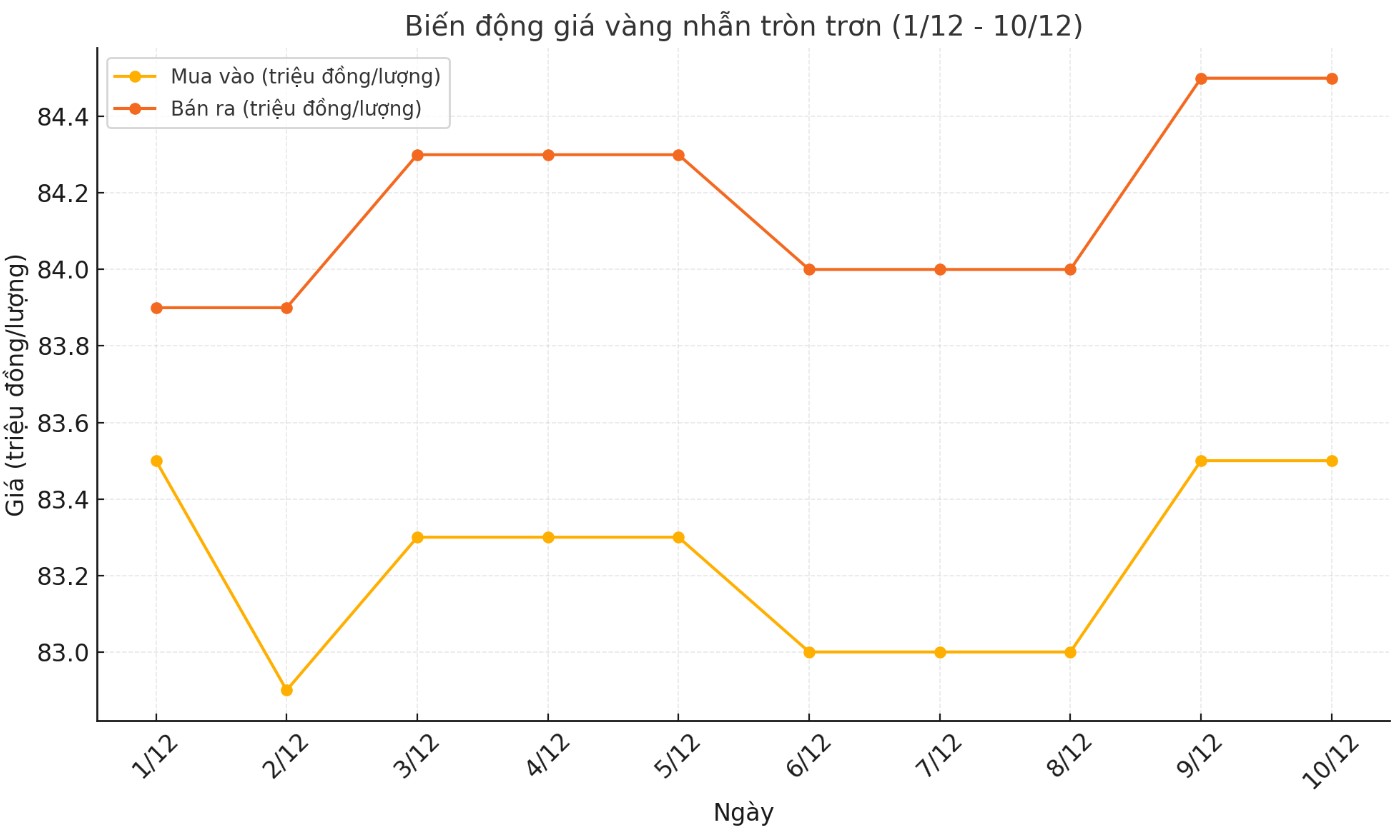

Price of round gold ring 9999

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.38-84.48 million VND/tael (buy - sell); increased 400,000 VND/tael for both buying and selling.

World gold price

As of 0:30 on December 10 (Vietnam time), the world gold price listed on Kitco was at 2,666.3 USD/ounce, up 33 USD/ounce compared to the opening of the previous trading session.

Gold Price Forecast

World gold prices fluctuated amid the increase in the USD index. Recorded at 0:30 on December 10, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 105.650 points (down 0.08%).

Gold prices rose sharply on news that the People's Bank of China (PBoC) resumed buying gold after a 6-month hiatus.

According to data from the People's Bank of China, the agency bought an additional 5 tons of gold in November, bringing its total official gold reserves to 2,269 tons, said Krishan Gopaul, senior analyst for the EMEA region at the World Gold Council.

China's comeback comes amid sharp corrections and major fluctuations in gold prices following Donald Trump's victory in the US presidential election.

Major outside markets today saw Nymex crude oil futures rise, trading around $68.25 a barrel. The yield on the 10-year US Treasury note is currently at 4.15%.

Markets are awaiting key U.S. inflation data and interest rate decisions from other central banks. Wednesday sees the Bank of Canada rate decision and U.S. CPI data. Thursday sees interest rate decisions from the European Central Bank and the Swiss National Bank, along with U.S. PPI data.

Experts say the gold market will continue to fluctuate within a narrow range until there are clearer signals from economic data and policies of the US Federal Reserve (FED).

See more news related to gold prices HERE...