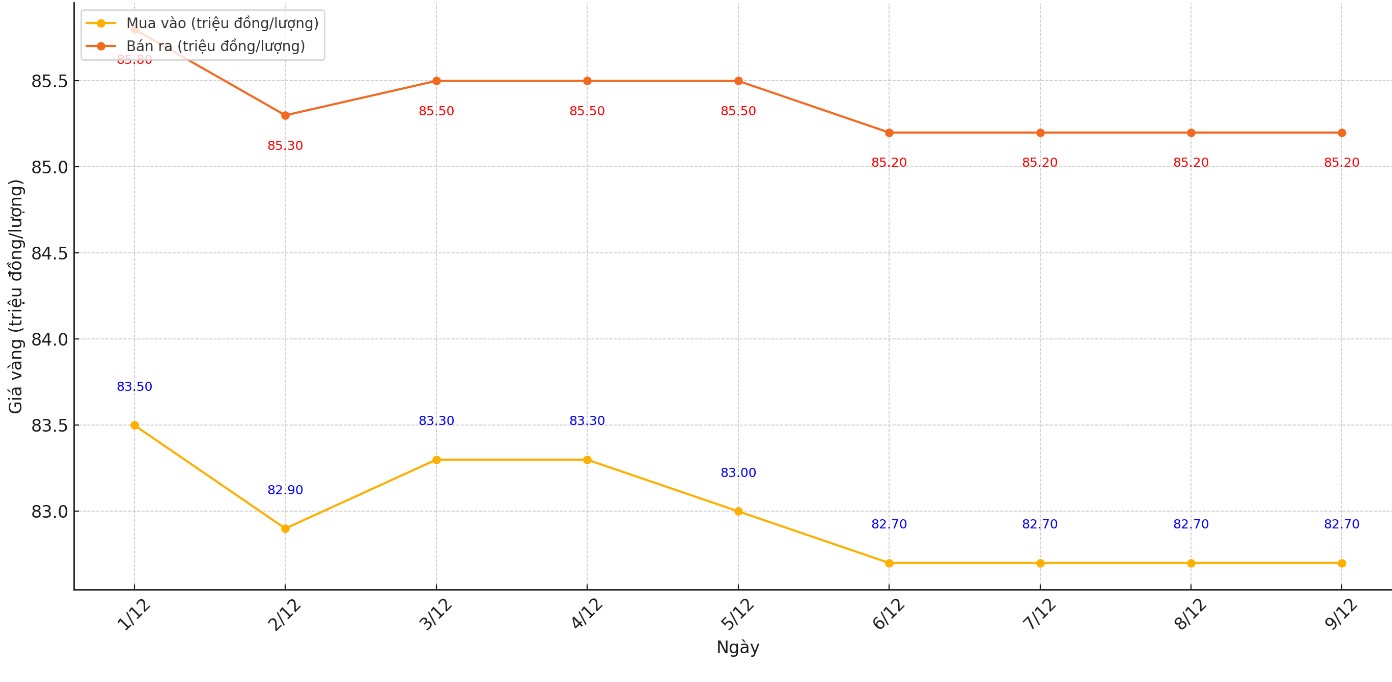

Update SJC gold price

As of 9:45 a.m., the price of SJC gold bars listed by DOJI Group was at 82.7-84.8 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.7-84.8 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.8 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

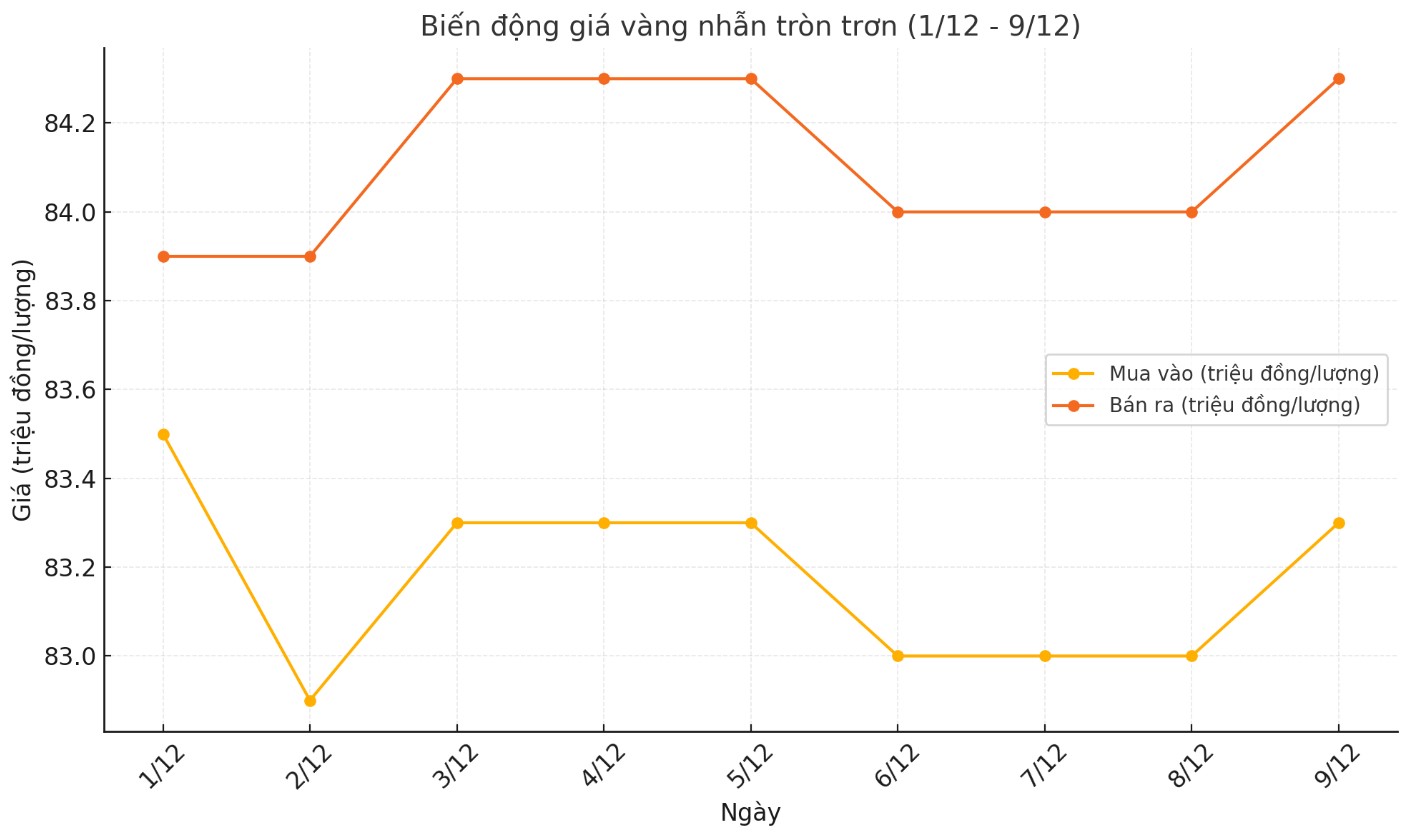

Price of round gold ring 9999

As of 9:45 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.18-84.28 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

World gold price

As of 10:05, the world gold price listed on Kitco was at 2,642.2 USD/ounce, up 8.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased slightly in the context of the USD trending down. Recorded at 10:10 on December 9, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 105,730 points.

Experts say the gold market will continue to fluctuate within a narrow range until there are clearer signals from economic data and policies of the US Federal Reserve (FED).

The latest Kitco News survey shows that experts continue to be divided, while individual investors are optimistic about gold prices this week.

Five experts (42%) predict gold prices will rise this week. Another five experts (also 42%) predict gold prices will continue to move sideways. The remaining two experts (17%) predict the price of this precious metal will fall.

Meanwhile, there were 116 votes in Kitco's online poll, with Main Street investors again turning bullish on gold after its solid performance this week.

“I expect gold to rise as long as $2,600 an ounce holds. Three G10 central banks will cut interest rates, and the market is expecting two (the Bank of Canada and the Swiss National Bank) to cut by 25 basis points,” said Marc Chandler, managing director at Bannockburn Global Forex.

“The downtrend line from the late October record high will be near $2,680 an ounce on Monday and drop to around $2,660 an ounce by the end of next week,” he added.

Meanwhile, Christopher Vecchio, head of futures and FX strategy at Tastylive.com, is less bullish on gold in the short term, noting that risks remain due to profit-taking after a very strong year for the precious metal.

This week, markets will focus on important US inflation data and interest rate decisions from other central banks:

Monday: Reserve Bank of Australia monetary policy announcement.

Wednesday: Bank of Canada interest rate decision and US CPI data.

Thursday: Interest rate decisions from the European Central Bank and Swiss National Bank, plus US PPI data.

See more news related to gold prices HERE...