Update SJC gold price

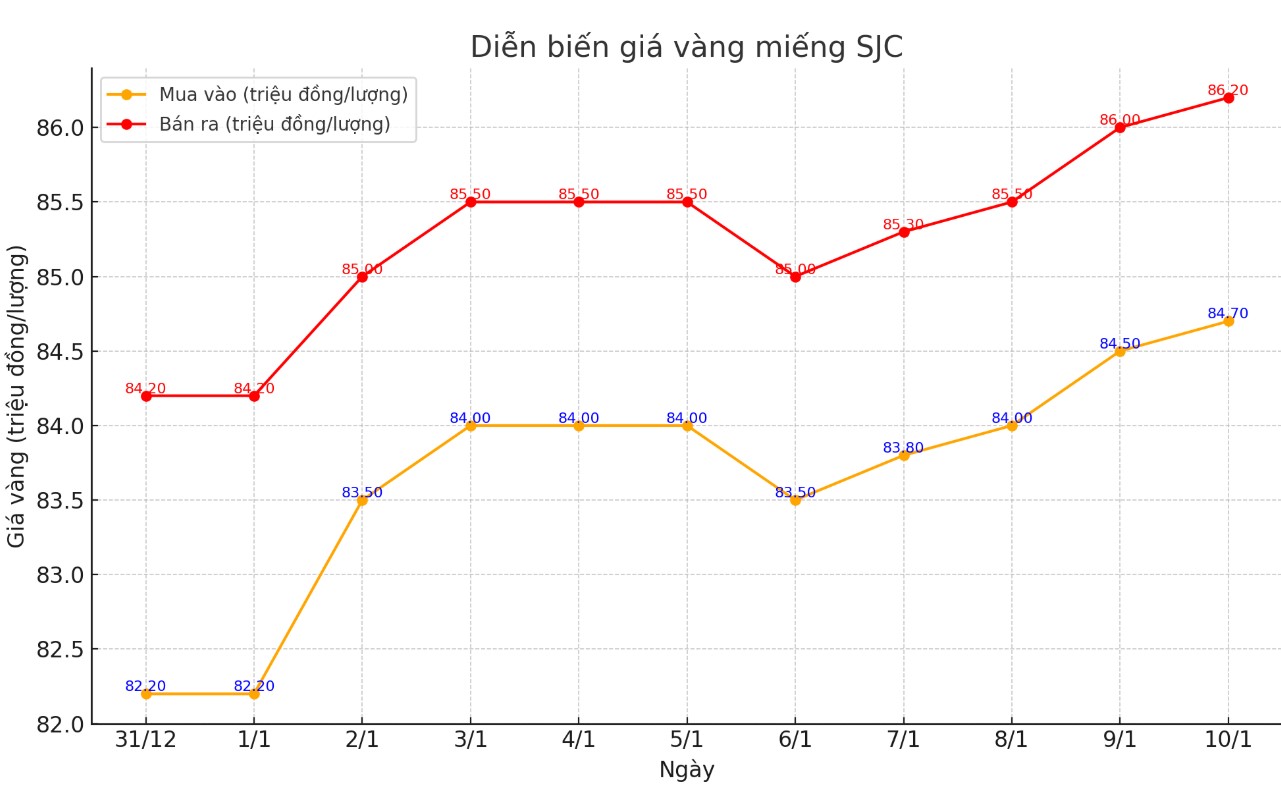

As of 7:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.7-86.2 million/tael (buy - sell); an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.7-86.2 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.2 million VND/tael (buy - sell); increased by 100,000 VND/tael for buying and increased by 200,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

Price of round gold ring 9999

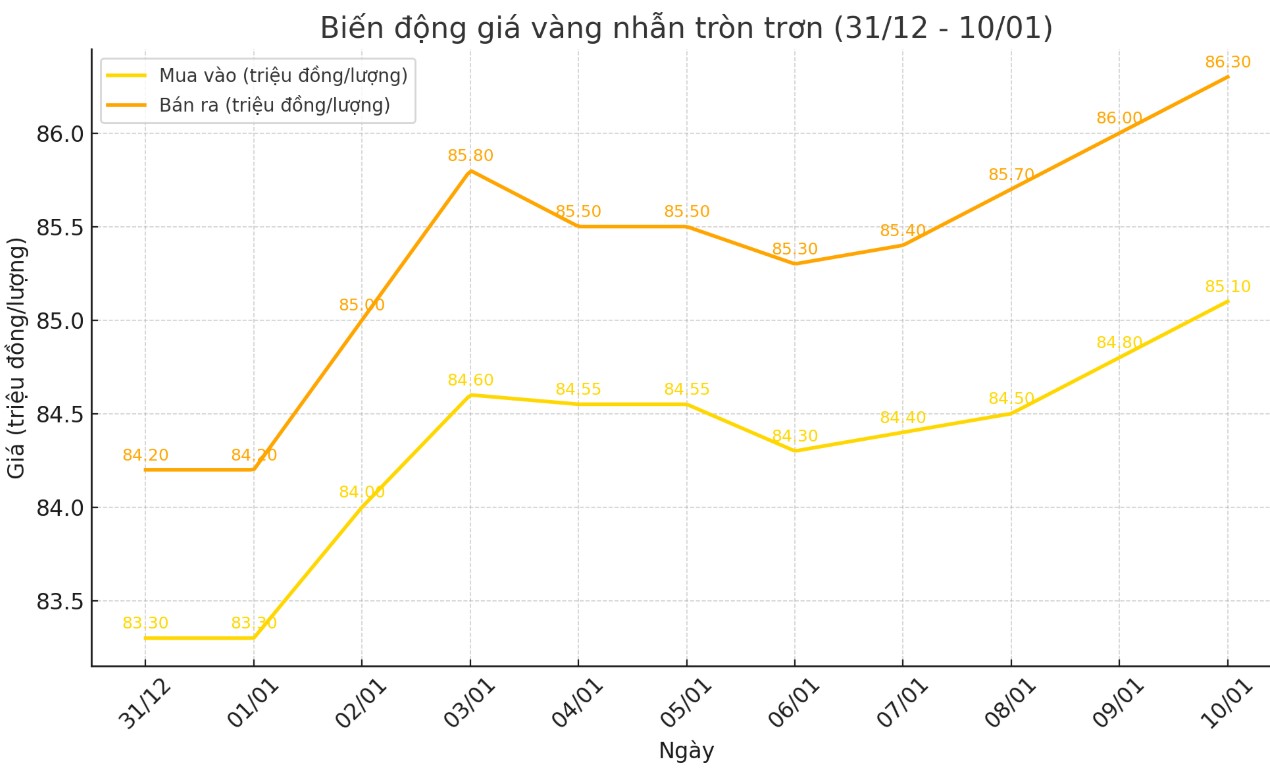

As of 7:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.1-86.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.1-86.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 7:25 p.m., the world gold price listed on Kitco was at 2,678.3 USD/ounce, up 11.9 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased in the context of the USD index tending to decrease. Recorded at 7:30 p.m. on January 10, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 108.980 points (down 0.03%).

Gold futures have shown impressive strength for three straight trading sessions, rising from a low of $2,624.60 on Monday to nearly $2,700 an ounce.

“Safe-haven demand is modestly supporting gold, offsetting the downward pressure from a stronger dollar and higher interest rates,” said UBS analyst Giovanni Staunovo.

Adding to the market’s moves was news surrounding the inauguration of President-elect Donald Trump. Sources close to the incoming administration said Trump is considering declaring a national economic emergency to justify imposing broad tariffs on both allies and adversaries.

According to Reuters, these tariffs could cause a trade war and inflation when Mr. Trump takes office on January 20 - scenarios in which gold, which is considered a hedge against inflation, usually performs well.

This political backdrop intersects with recent employment data that shows signs of a slowdown in the labor market. The ADP private payrolls report released yesterday showed 122,000 new jobs in December, down from 146,000 in November and below expectations of 136,000. The soft reading could signal the release of the all-important nonfarm payrolls report. Analysts polled by Reuters had expected 160,000 new jobs in December — down sharply from 227,000 in November.

Market attention is now focused on the US non-farm payrolls report released today, January 10 (local time), combined with data from ADP, which could influence the upcoming monetary policy decision of the US Federal Reserve on January 29.

Analysts Lina Thomas and Daan Struyven of this bank predict that the price of gold will reach $ 2,910 / ounce by the end of 2025. The decrease in ETF inflows into gold in December 2024, due to the decrease in uncertainty after the US election, is also a factor that caused the price of gold to start the new year lower.

In another forecast, Dmitry Puchkarev - stock market expert at BCS World of Investments - said that in 2025, the world gold price will increase to 2,600-2,900 USD/ounce.

See more news related to gold prices HERE...