Update SJC gold price

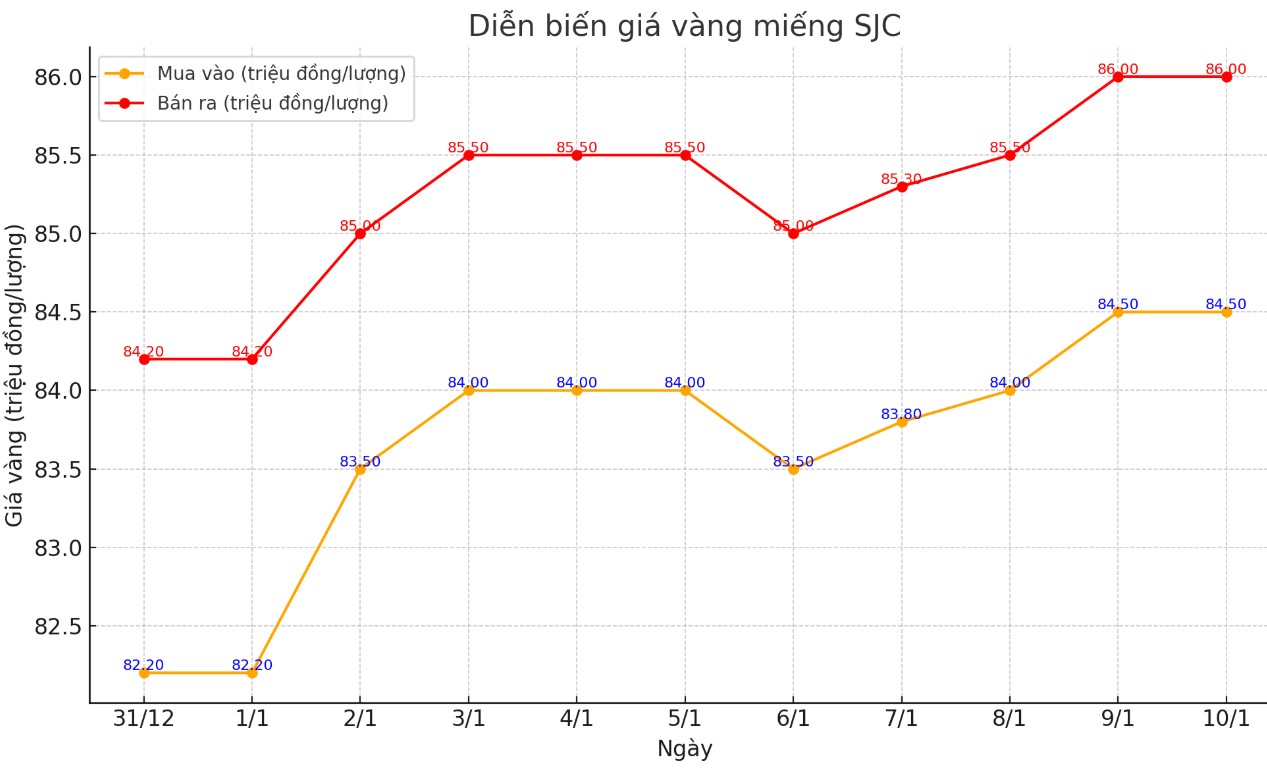

As of 10:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.5-86 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.5-86 million VND/tael (buy - sell); both buying and selling prices remain unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.6-86 million VND/tael (buy - sell); reduced 100,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

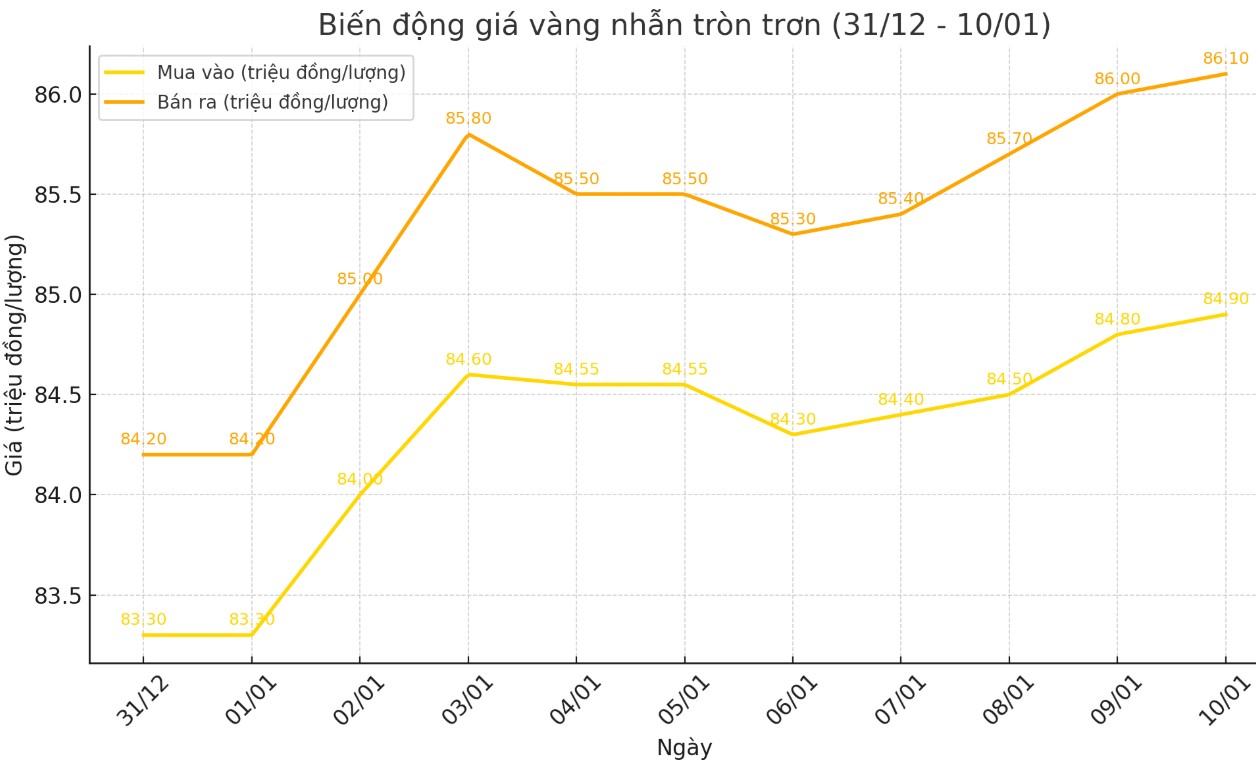

As of 10:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.9-86.1 million VND/tael (buy - sell); an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85-86.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 10:00 a.m., the world gold price listed on Kitco was at 2,673.8 USD/ounce, up 15.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the high USD. Recorded at 10:00 on January 10, the US Dollar Index measuring the greenback's fluctuations against 6 major currencies was at 109.050 points (up 0.02%).

Gold prices hit a near four-week high on safe-haven demand amid financial market turmoil, as investors sought safety amid concerns about Britain’s finances and President-elect Donald Trump’s economic policies.

In Britain, concerns about the budget deficit sent the pound to its lowest level in more than a year against the dollar, with 10-year government bond yields rising to 4.92% and the FTSE 250 index falling for a third straight day, raising concerns about the risk of global financial contagion.

Meanwhile, market attention turns to Friday's US nonfarm payrolls report, which is expected to show the number of new jobs in December fell to 160,000, compared with 227,000 in November.

Gold is being supported by safe-haven demand, offsetting downward pressure from a rising dollar and near eight-month highs in US Treasury yields, according to UBS expert Giovanni Staunovo. Uncertainty over Trump’s proposed tariffs and the risk of inflation are also helping to boost gold prices.

Forecasting for 2025, Paul Williams, CEO of Solomon Global, said that geopolitical uncertainties and deglobalization trends will continue to support gold prices. Central banks are expected to increase gold purchases to diversify their investment portfolios, helping the precious metal maintain its role as a leading safe-haven asset.

See more news related to gold prices HERE...