Update SJC gold price

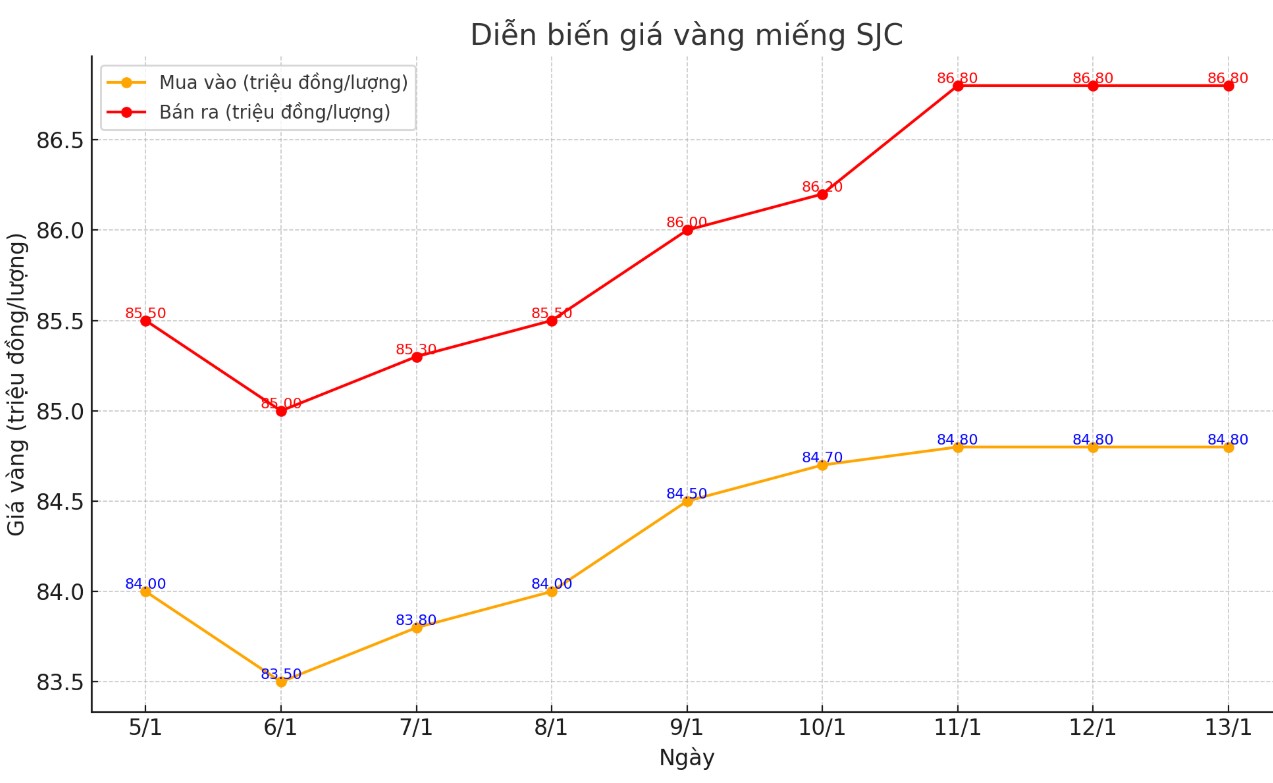

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

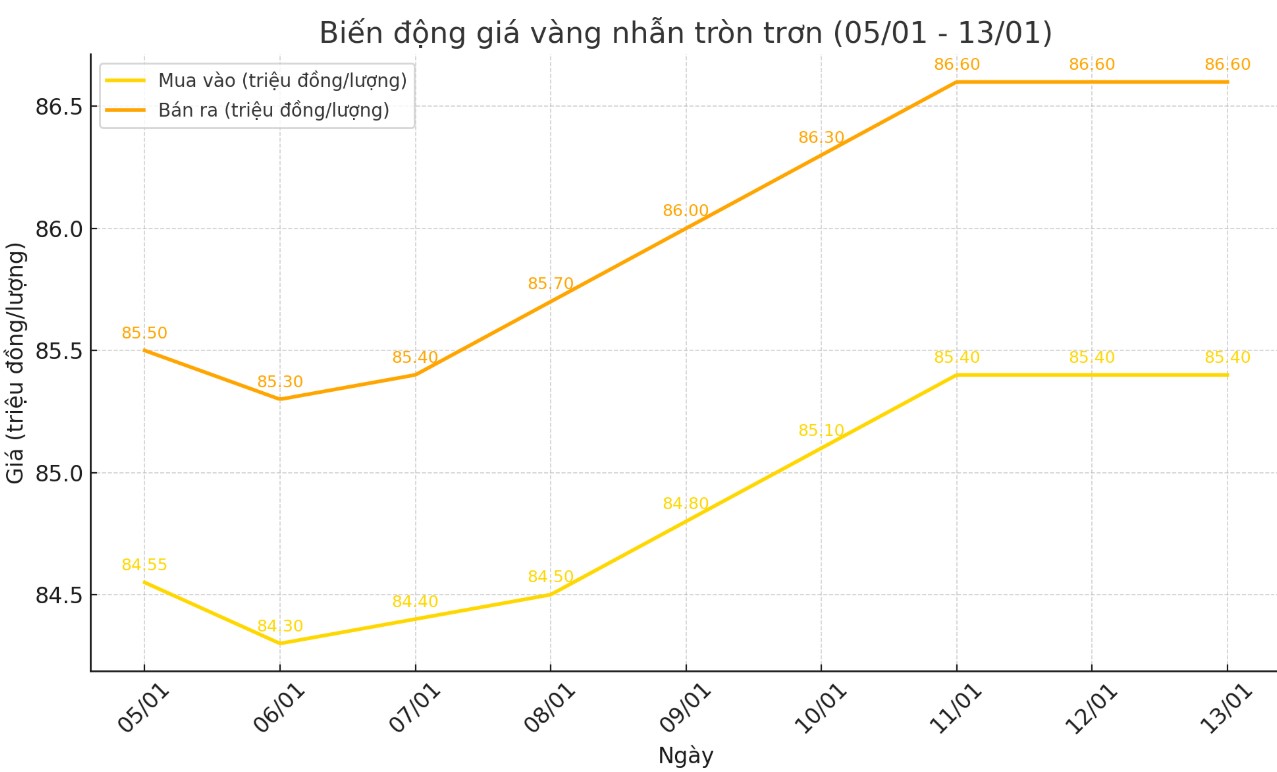

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.4-86.6 million VND/tael (buy - sell); unchanged.

Bao Tin Minh Chau listed the price of gold rings at 85.5-86.9 million VND/tael (buy - sell), unchanged.

World gold price

As of 6:00 a.m. on January 13 (Vietnam time), the world gold price listed on Kitco was at 2,689.3 USD/ounce.

Gold Price Forecast

World gold prices tend to increase despite the strong increase of the USD. Recorded at 6:00 a.m. on January 13, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 109,490 points (up 0.45%).

Gold prices rose after the release of strong US jobs data last Friday, overcoming pressure from the US dollar and bond yields. The breakdown in the correlation between gold, the US dollar and bond yields may be sending an important message to the market, according to one analyst.

Many market analysts say gold’s positive performance reflects broader concerns beyond traditional interest rate factors. While the strong jobs report reduced the odds of the Federal Reserve cutting interest rates in January to 2.7%, and there is a 74% probability that rates will remain at 4.25% to 4.5%, investors appear to be focused on a number of other risk factors.

These concerns include potential inflationary pressures, ongoing geopolitical tensions and domestic political uncertainties. Attention is focused on potential policies from the administration of US President-elect Donald Trump, particularly on tariffs and their inflationary impact, as well as concerns about rising sovereign debt. These factors have prompted Chinese traders to increase their physical gold holdings, Saxo analysts said.

In an interview with Kitco News, Kathy Lien, Director of FX Strategy at BK Asset Management and co-founder of BKForex.com, said that before the data was released, the market had expected the FED to keep interest rates unchanged at its meeting later this month.

Expectations for the Fed's easing path continued to tilt more hawkish after minutes of the December monetary policy meeting revealed that some policymakers still viewed interest rates as approaching neutral levels, as the US economy and labor market remained relatively stable.

Ms. Lien noted that the gold price move reflects broader risk-off sentiment in the stock market. Despite the positive economic data, the S&P 500 fell 85 points, or more than 1%, to last trade at 5,832.

Ole Hansen, head of commodity strategy at Saxo Bank, said that although gold has hit new records in 2024, silver still has great potential to outperform gold this year.

The expert predicts that the gold-silver ratio, currently at 87, could fall to 75. If gold reaches the forecast level of $3,000/ounce (up 13%), silver could reach $40/ounce (up more than 25%).

See more news related to gold prices HERE...