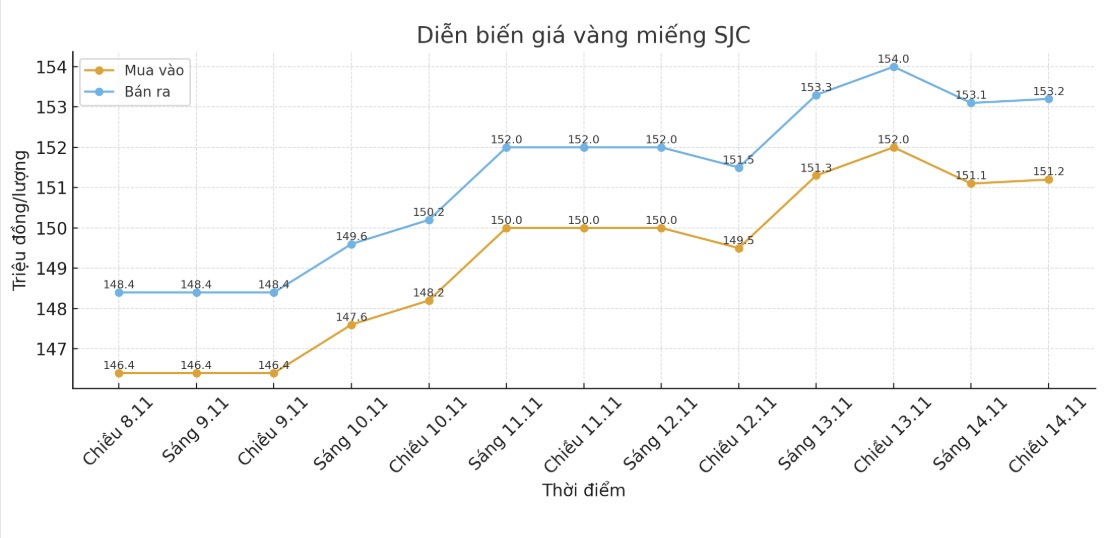

SJC gold bar price

As of 6:00 a.m. on November 15, the price of SJC gold bars was listed by DOJI Group at VND151.2-153.2 million/tael (buy in - sell out), down VND800,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.2-153.2 million VND/tael (buy - sell), down 1.8 million VND/tael for buying and down 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.2-153.2 million VND/tael (buy - sell), down 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

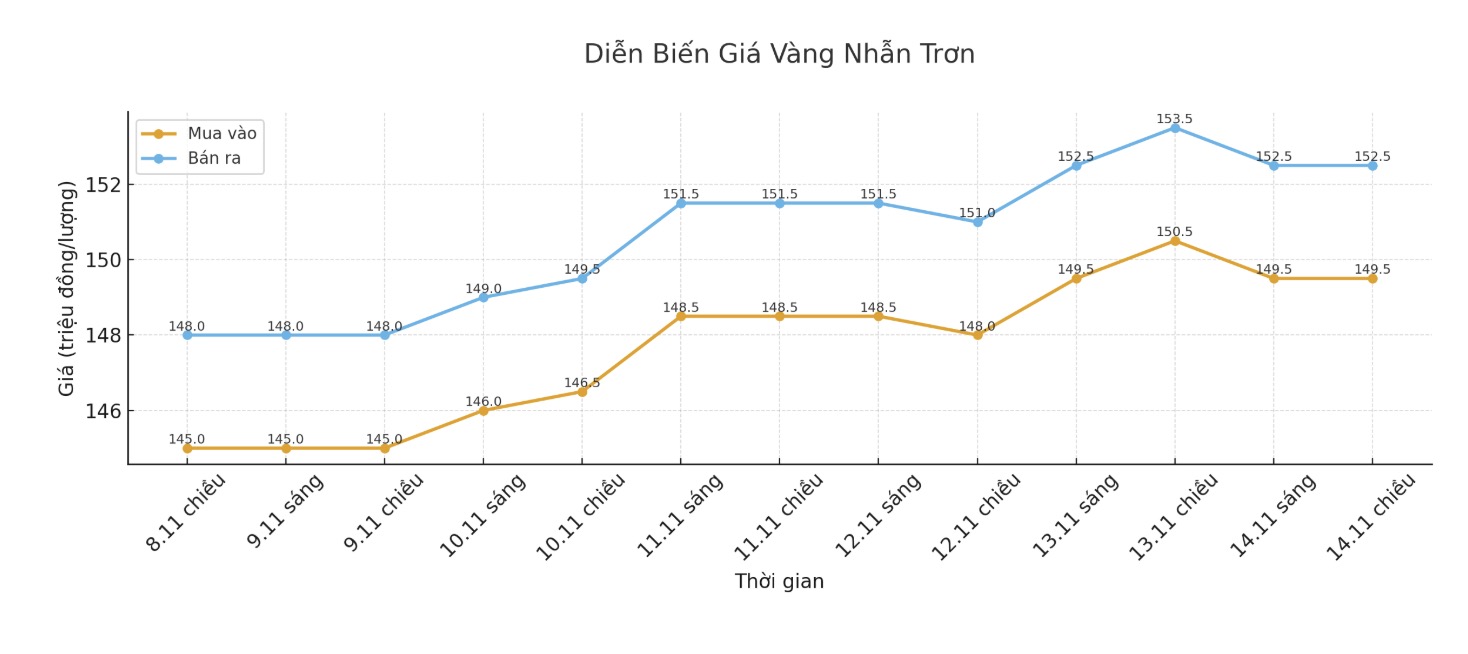

9999 gold ring price

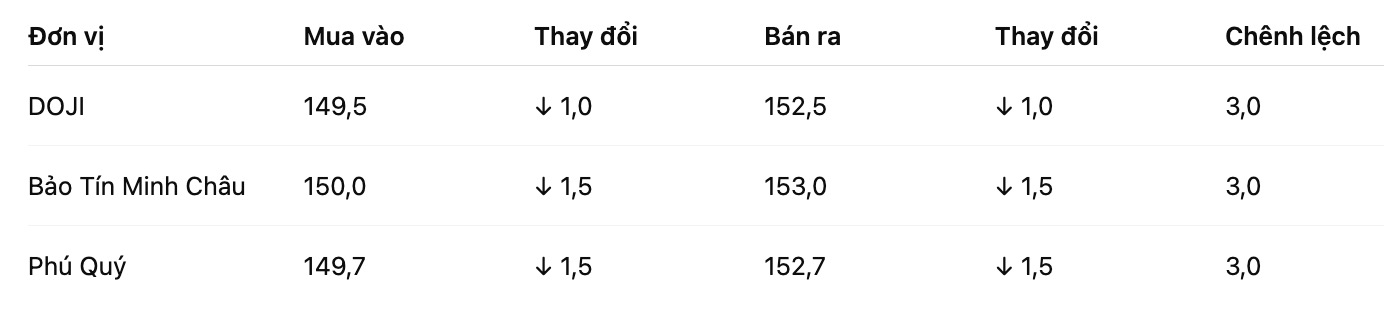

As of 6:00 a.m. on November 15, DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.7-152.7 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 10:32 p.m. on November 14 (Vietnam time) at 4,075.7 USD/ounce, down 131.9 USD compared to a day ago.

Gold price forecast

Gold and silver prices fell sharply as market expectations of the possibility of the US Federal Reserve (FED) cutting interest rates in December weakened this weekend. The pressure to take profits from short-term futures traders also appeared in both metals, along with the selling pressure to liquidate buying positions.

December gold contract fell 75.5 USD to 4,119 USD/ounce. December delivery silver price decreased by 1.53 USD to 51.63 USD/ounce.

Last month, the Fed cut interest rates by 25 basis points, but Fed Chairman Jerome Powell expressed reservations about another cut this year, partly due to a lack of necessary data.

According to CME Group's FEDWatch tool, traders are now pricing in the possibility of the Fed cutting another 25 basis points next month at 51%, down from 64% in the previous session.

Mr. Gary S. Wagner - a gold market analyst for the past 25 years, a writer at Kitco News - said that gold has broken the peak continuously, not falling sharply or reacting excessively, showing that this is not a bubble of speculation but a re-evaluation based on real risk.

According to Mr. Wagner, for gold, investors need to think long-term like running a marathon, not having to play quarterly or follow medium-term policy fluctuations. The US dollar remains the dominant currency, but rivals such as the yuan, the Euro or the expected BRICS common currency are only limited alternatives. Gold, on the other hand, is above all political and inflationary risks and is likened to a "eagle" flying high in the race of legal tender currencies.

Recent indicators further strengthen confidence in gold: Prices remain around $4,200/ounce, US gold ETFs increased strongly, trading volume set a record of08 billion USD/day in October, up more than 50% compared to the previous month. physical demand for gold in stores and online, especially in the US, has also increased sharply, reflecting consumer confidence.

Technically, the next target for December gold futures buyers is to close above the strong resistance level at a record $4,398/ounce. The latest downside target for the bears is to push prices below the solid support level of $4,000/ounce.

The first resistance level was seen at $4,200/ounce, followed by an overnight peak of $4,215.1/ounce. First support was at 4,100 USD/ounce and then 4,050 USD/ounce.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...