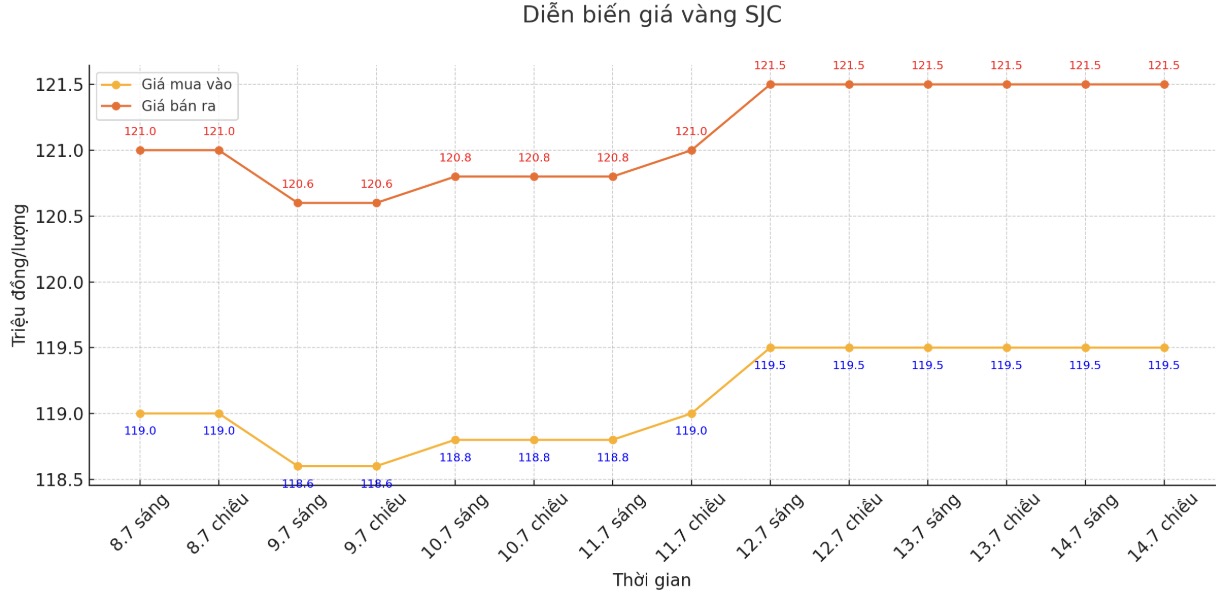

SJC gold bar price

As of 6:00 a.m. on July 15, the price of SJC gold bars was listed by Saigon Jewelry Company at VND119.5-121.5 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.5-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.5-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

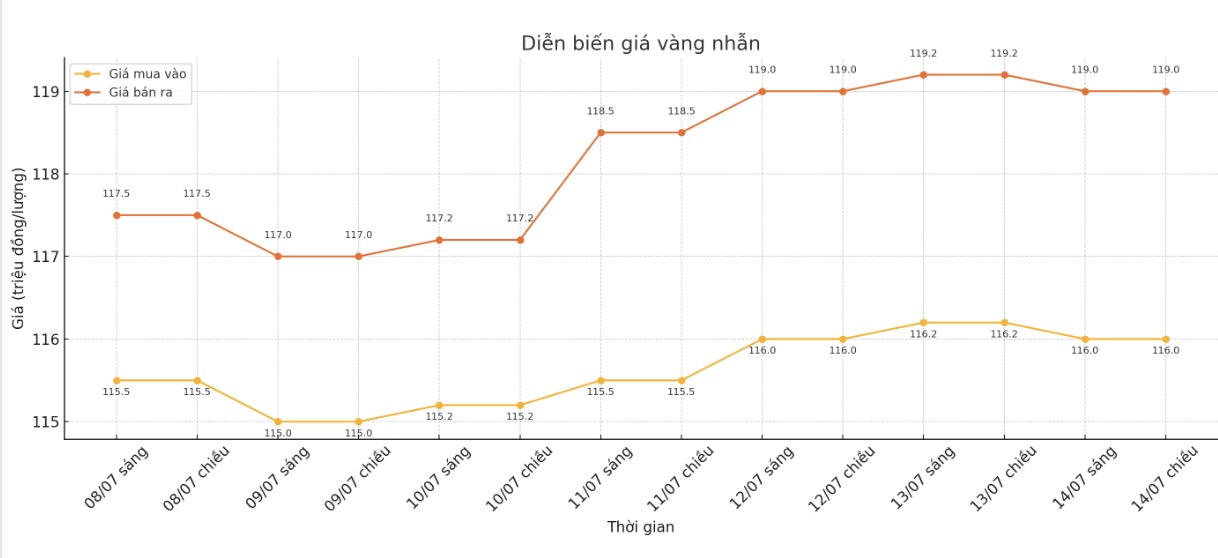

9999 gold ring price

As of 6:00 a.m. on July 15, DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.3-118.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

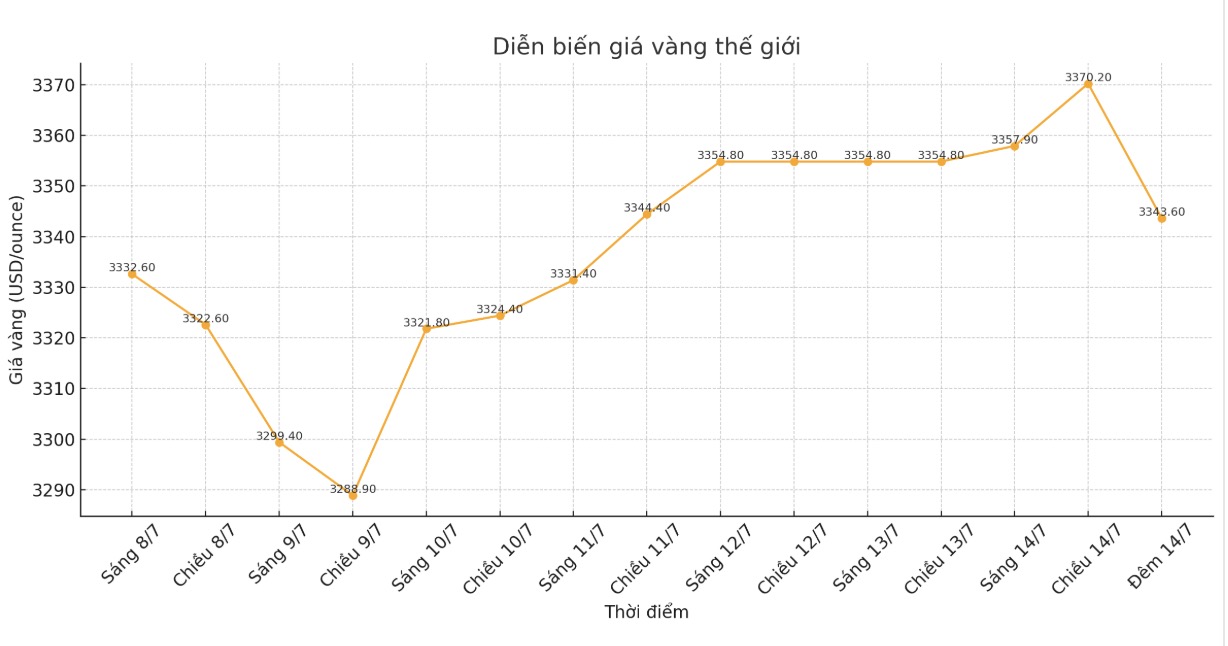

World gold price

Recorded at 11:12 p.m. on July 14, spot gold was listed at $3,343.6 an ounce, down $14.2.

Gold price forecast

Gold prices increased last night due to concerns about increased risks in the market at the beginning of the week, boosting demand for safe-haven metals. However, prices quickly decreased after that, due to investors' large profits.

The fear of increased risks as the market opened the trading week, after the Donald Trump administration showed a tougher stance on trade tariffs. The US government has recently sent notices to trading partners, threatening to impose import tariffs of around 20% to 30%. The European Union was told to face a 30% tariff over the weekend. Mexico and Canada are threatened with tariffs of 30% and 35%, respectively.

Asian and European stocks fluctuated in opposite directions and tended to decrease last night. US stock indexes are also expected to open lower than today in New York.

China showed that June exports rose 5.8% year-on-year, up from May's 4.8%. Imports increased by 1.1% in June, while in May they decreased by 3.4%.

Technical analysis, gold delivery in August is dominating buyers in the short term. The next upside target is to close above the strong resistance zone of $3,400/ounce. The most recent support level is $3,367/ounce, followed by $3,350/ounce. The first resistance level was $3,389.30/ounce and then $3,400/ounce.

In the peripheral market, the USD index decreased slightly. Nymex crude oil prices increased and fluctuated around 69.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.42%.

Economic data to watch next week

Tuesday: US Consumer Price Index (CPI), Empire State manufacturing survey.

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...