Updated SJC gold price

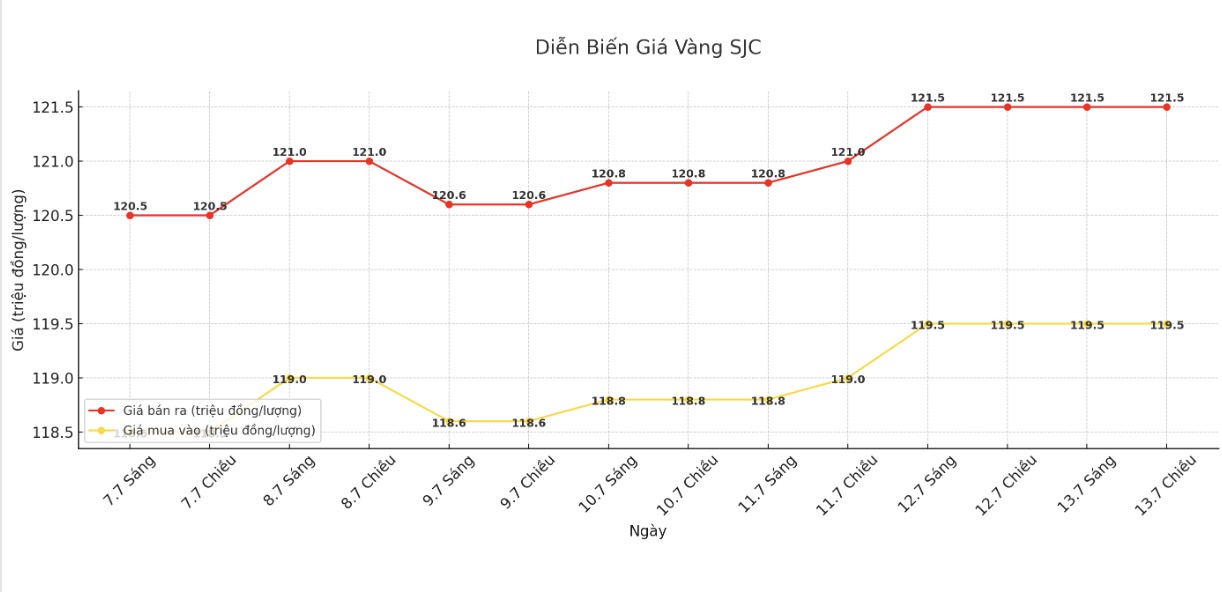

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 119.5-121.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 round gold ring price

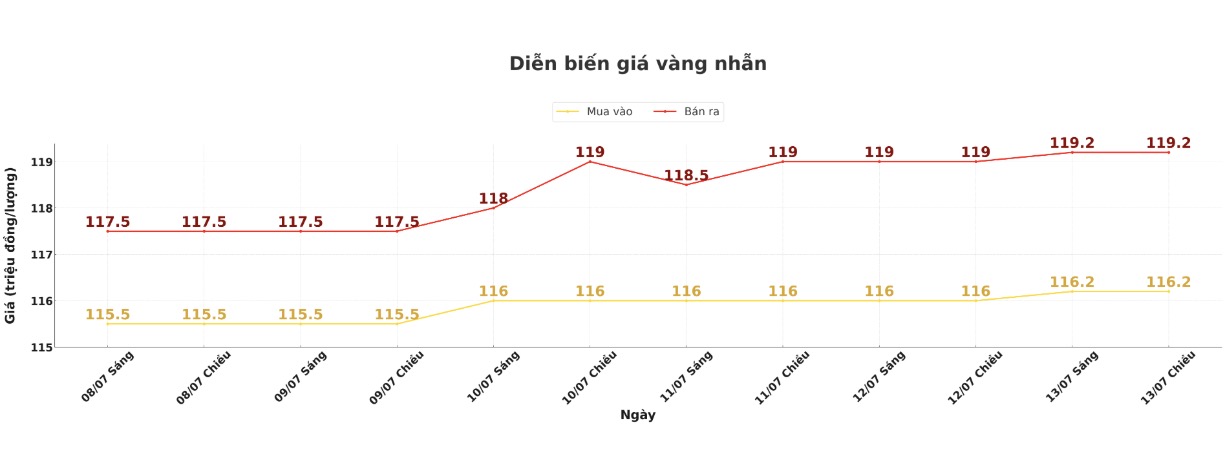

As of 9:10 a.m., DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.3-118.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the buying-selling gap is pushed to a very high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

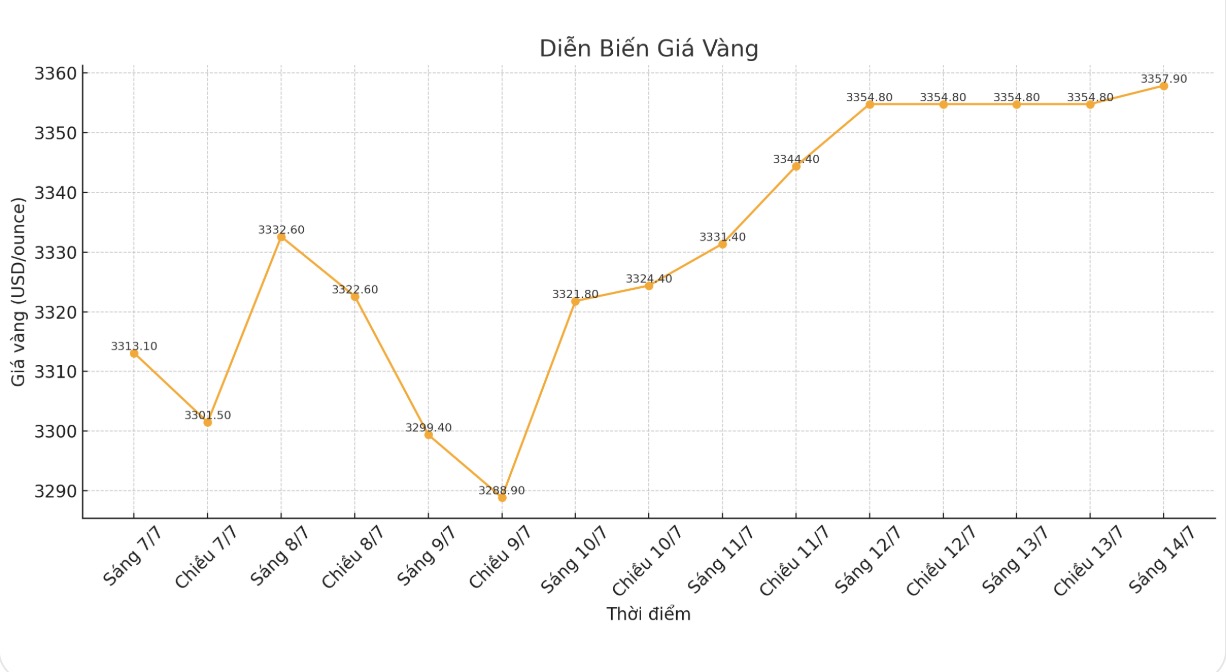

At 9:17 a.m., the world gold price was listed around 3,354.9 USD/ounce, almost unchanged.

Gold price forecast

Michael Moor - founder of Moor Analytics - believes that gold prices will continue to increase. On a long term, I have warned since 2018 that when gold breaks above $1,183/ounce, it will enter a new uptrend, and in fact prices have increased sharply. In the short term, on July 1, there were signs of price reversal and increase. If gold continues to surpass some key technical levels, prices could increase by 64 to 133 USD, he predicted.

Jim Wyckoff - a veteran expert in the precious metals industry also predicted that gold prices will increase again this week: "The urban area is still leaning towards an uptrend, and geopolitical tensions are escalating".

Alex Kuptsikevich - an analyst at FxPro commented that gold prices have been moving sideways in a narrow range for 12 weeks and the range of fluctuations is getting smaller. The 50-day average road continues to support prices. The main reason is the return of risk-off sentiment, which has caused long-term government bond yields to decrease - a rival to gold.

However, he also warned that the stronger USD trend is a strength for gold prices. The June FOMC meeting minutes supported gold, as two officials were ready to vote for policy easing in July, he said.

I am neutral on gold next week, said Colin Cieszynski, chief strategist at SIA Wealth Management. The main factor is still the fluctuations of the USD around political statements or tariffs which is very unpredictable.

Daniel Pavilonis - senior commodity broker at RJO Futures - analyzed the potential impact of the US budget bill on gold price increase:

The core thing is that debt is too large, and the only way out is to degrade currency and inflate to erase debt. That is the main driver for gold prices to increase recently, along with central bank purchases.

Gold has been moving sideways for the past few months. I used to think it was peaking and would fall to the 200-day moving average. But tariffs and sanctions on Russian oil could potentially keep gold prices high, he said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...