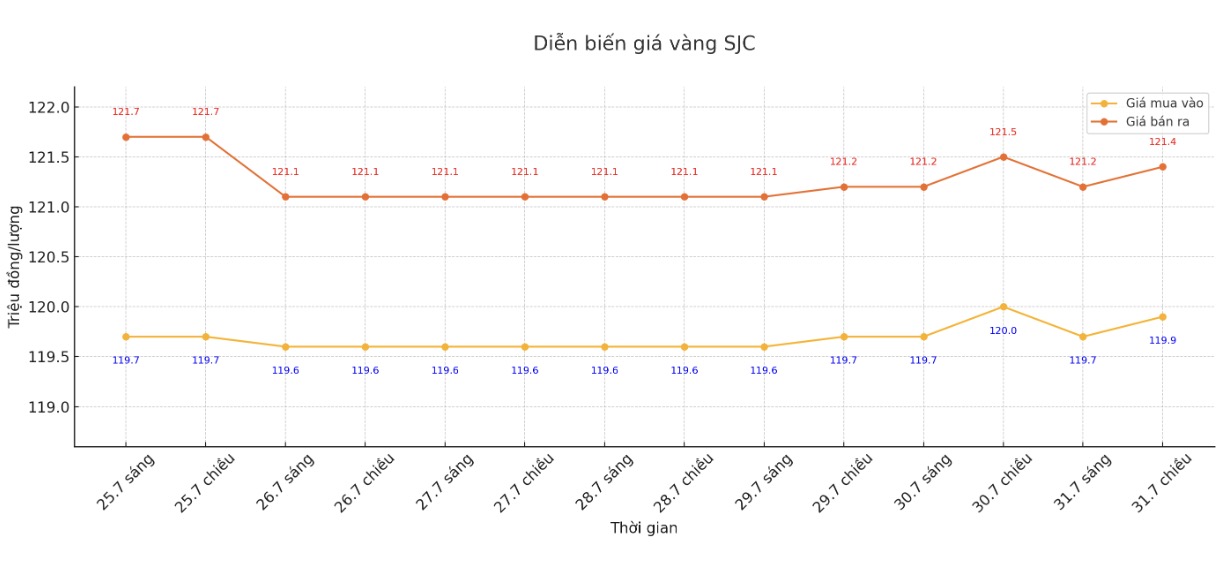

SJC gold bar price

As of 6:00 a.m. on August 1, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.9-121.4 million/tael (buy in - sell out); down VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.7-121.2 million VND/tael (buy - sell); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy - sell); down 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy in - sell out); down 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

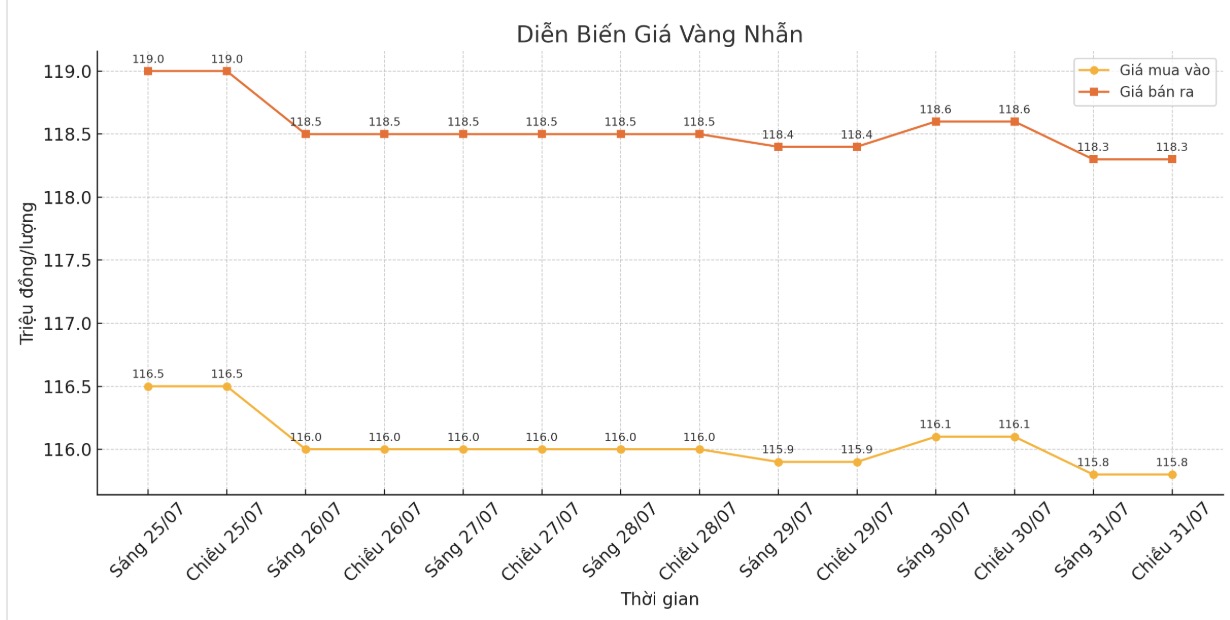

9999 gold ring price

As of 6:00 a.m. on August 1, DOJI Group listed the price of gold rings at 115.8-118.3 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

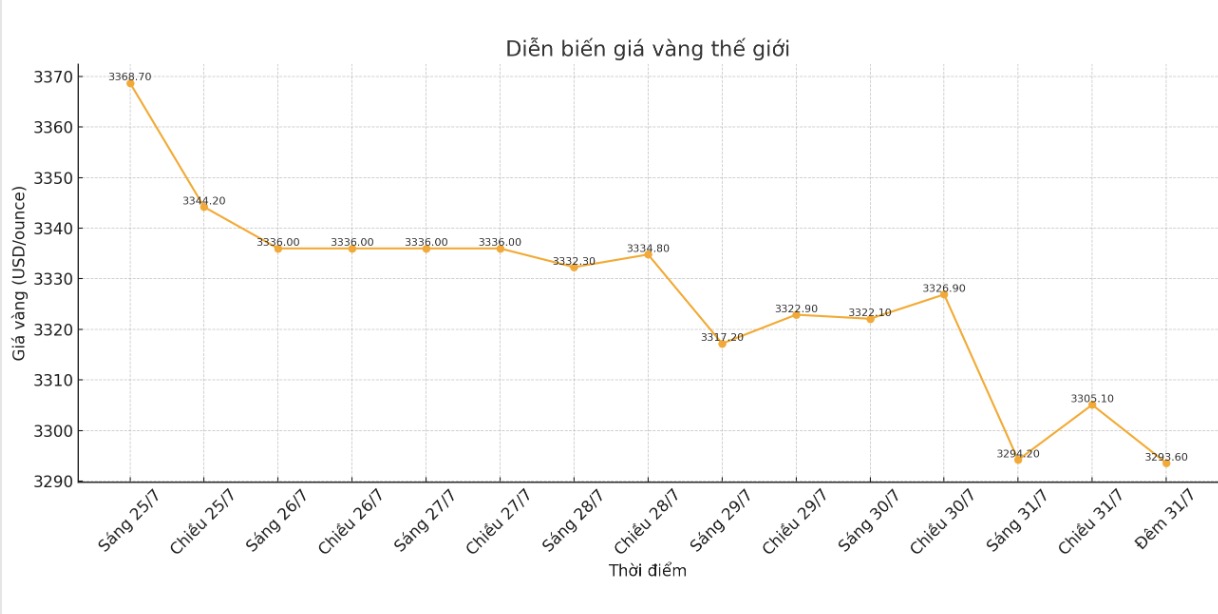

World gold price

The world gold price was listed at 23:00 on July 31 at 3,293.6 USD/ounce, up 14.1 USD compared to 1 day before.

Gold price forecast

World gold prices recovered slightly due to bottom-fishing buying pressure after recent sell-offs. Meanwhile, silver prices fell sharply and hit a 4-week low due to weak buying position settlement activities in the futures market.

December gold futures rose 5.30 USD to 3,358.60 USD/ounce, while September silver futures fell 1.059 USD to 36.68 USD/ounce.

The strong selling pressure on silver prices is likely to be affected by a wave of sell-offs due to the chain effect of the copper market, which has collapsed in the past two days.

US President Donald Trump caused a stir in the market when he suddenly announced a new tax regulation, exempting refined copper from the 50% tax rate as previously announced.

US gold futures fell as much as 6% in the overnight session, following a record drop of 18% on Wednesday.

Asian and European stocks in the past session had mixed developments, mostly increasing. The US stock index is also expected to open in the green and is at a record high.

In another notable news, Federal Reserve Chairman Jerome Powell rejected pressure from the White House and rejected a proposal to cut interest rates by two members at the Federal Open Market Committee (FOMC). At the same time, he emphasized that the FED needs to remain vigilant against the risk of inflation.

This FOMC meeting continued to keep interest rates unchanged for the fifth consecutive time, but also marked the first time in more than 30 years that there were two disagreements within the Fed. At the press conference, Mr. Powell affirmed that the FED is in a good position at the moment, amid much uncertainty surrounding US tariffs and their economic impact.

This statement is considered balanced, not confirming that interest rates will be cut in September, but also not excluding that possibility. The market did not respond strongly to the message from the FED and Mr. Powell.

According to the World Gold Council, demand for gold from central banks and the gold industry decreased in the second quarter of 2025 as gold prices recently hit a record high.

Accordingly, central banks bought 166.5 tons of gold in the second quarter of 2025, down 1/3 compared to the first quarter of 2025, bringing the total purchases in the first half of the year to the lowest level since 2022. It is forecasted that in 2025, the central bank's demand for gold will reach about 815 tons.

In outside markets, the USD index is rising slightly. WTI crude oil on Nymex was weaker, trading around 69.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.35%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...