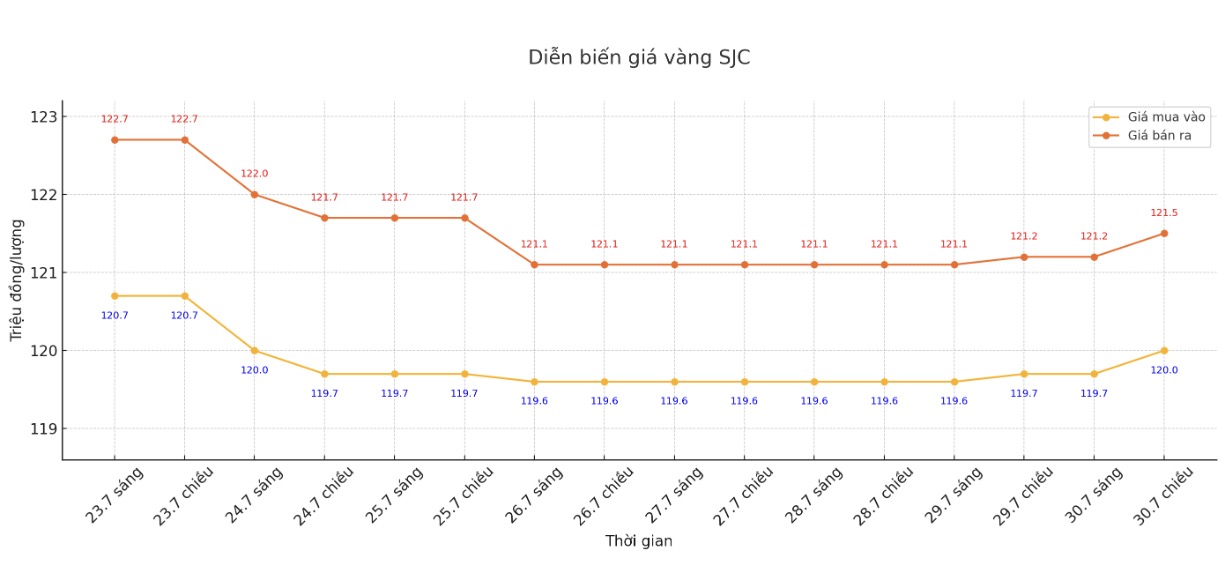

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.9-121.4 million/tael (buy in - sell out); down VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.7-121.2 million VND/tael (buy - sell); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy - sell); down 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy in - sell out); down 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

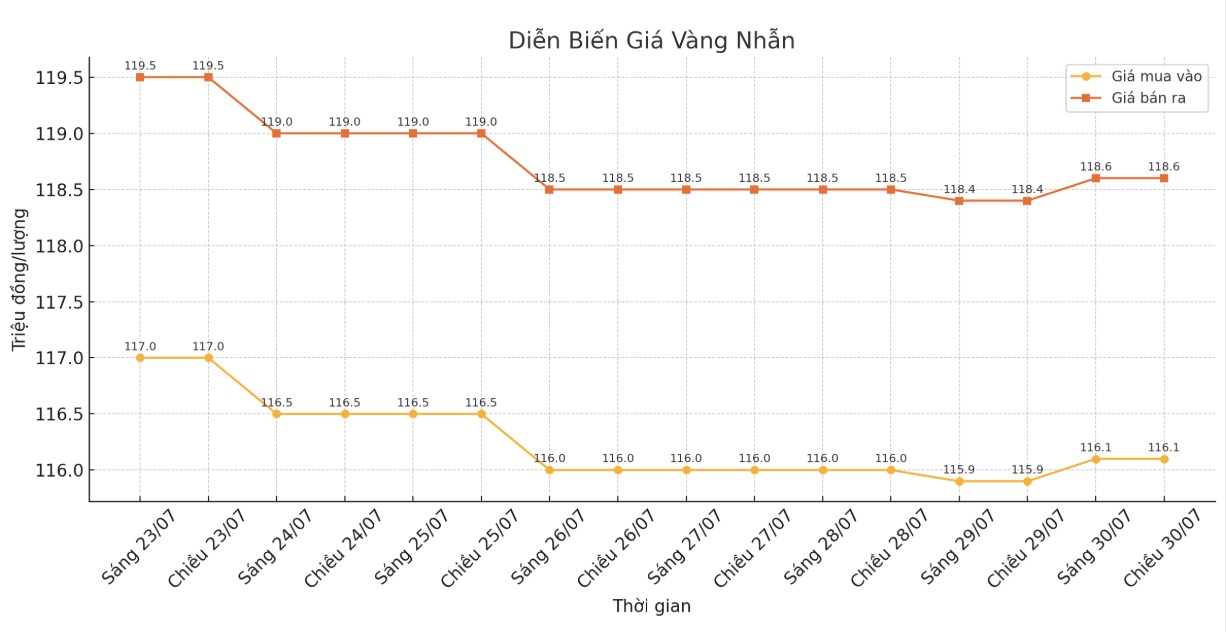

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 115.8-118.3 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

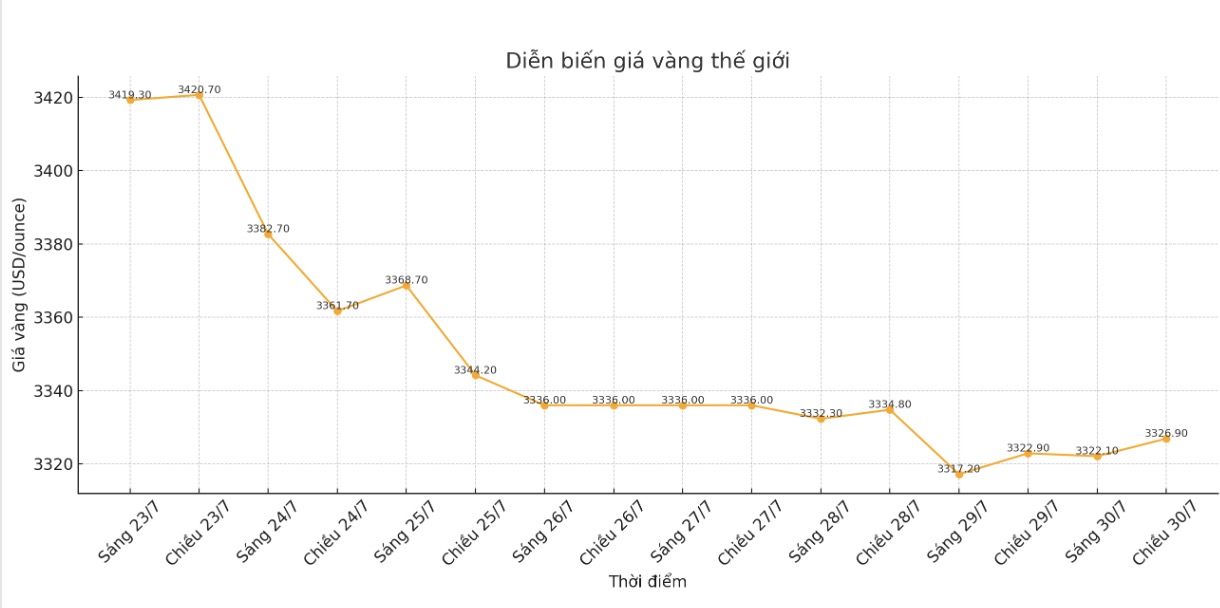

World gold price

The world gold price was listed at 6:00 p.m. at 3,295.6 USD/ounce, down 31.3 USD compared to 1 day ago.

Gold price forecast

World gold prices are under pressure from both sides, one of which is that the US economy recovered more strongly than expected. On the other hand, the pressure on gold prices comes from the caution of central banks, including the Bank of Canada (BoC), when they are not in a hurry to loosen monetary policy in the short term.

According to preliminary data released by the US Department of Commerce, the world's largest economy's gross domestic product (GDP) increased by 3.0% in the second quarter of 2025 - a clear turning point compared to a decrease of 0.5% in the previous quarter. This figure also far exceeded experts' expectations of 2.5%, showing that the US economy is recovering better than expected.

At the same time, the Bank of Canada (BoC) also decided to keep the overnight interest rate unchanged at 2.75%, while the lending interest rate (Bank Rate) and deposit interest rates are also at 3% and 2.70%, respectively. This is the second consecutive time the BoC has decided not to change policy, despite Canada's GDP forecast to decrease by about 1.5% in the second quarter - mainly due to a reversal in exports after a sudden increase in the first quarter to avoid tariffs from the US.

As of 8:30 p.m. on July 30 (Vietnam time), according to signals from the CME FedWatch tool, the market is betting on a 57.9% chance that the FED will cut interest rates by 0.25 percentage points on September 17, with a 1.8% chance that the FED will cut interest rates by 0.5 percentage points. There is only a 40.2% chance that the US central bank will keep interest rates unchanged at 4.25-4.5%/year.

In another development, the World Gold Council (WGC) said that gold consumption in India in 2025 is expected to decrease to a 5-year low, as record gold prices are reducing jewelry purchasing power, although investment demand has increased slightly.

According to Sachin Jain - WGC CEO in India, demand for gold in the world's second largest gold consumer country may fluctuate between 600 to 700 tons this year - the lowest level since 2020, down from 802.8 tons last year.

He said that if gold prices are stable, demand could reach 700 tons. However, if prices increase by 10%-15% due to geopolitical factors, consumption may decrease to the bottom of the forecast range.

So far, domestic gold prices in India have risen 28% in 2025, after rising 21% in 2024. In June, gold prices hit a record high of 101,078 rupees/10 grams.

Economic data to watch this week

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...