Gold prices are under pressure from both sides, one of which is that the US economy recovered more strongly than expected. On the other hand, the pressure on gold prices comes from the caution of central banks, including the Bank of Canada (BoC), when they are not in a hurry to loosen monetary policy in the short term.

US GDP increases sharply, dispelling fears of recession

According to preliminary data released by the US Department of Commerce, the world's largest economy's gross domestic product (GDP) increased by 3.0% in the second quarter of 2025 - a clear turning point compared to a decrease of 0.5% in the previous quarter. This figure also far exceeded experts' expectations of 2.5%, showing that the US economy is recovering better than expected.

The report stated that growth is mainly due to increased consumer spending and sharp decline in imports which are factors deducted from GDP calculations. However, private investment and exports recorded a decrease, partly reflecting the impact of the trade war initiated by President Donald Trump.

Jeffrey Roach - Chief Economist at LPL Financial - commented that although GDP data seems positive, the current growth momentum is unlikely to be maintained long-term. He warned that increasing momentum is weakening, with domestic final spending including consumption and private investment increasing by only 1.2% in the second quarter, down sharply from 1.9% in the first quarter. Notably, the situation of overdue debt is starting to spread to high-income consumers a sign that consumption is likely to decrease further in the coming quarters.

From an inflationary perspective, the GDP Price Index (GDP Price Index) increased by 2.0% in the second quarter, down sharply from 3.8% in the previous quarter. Meanwhile, the core personal consumption expenditure (core PCE) - the Fed's preferred inflation measure - increased slightly to 2.5%. Although not at the level that causes policy pressure, this data shows persistent inflation, causing the FED to need more time to consider before cutting interest rates.

The Central Bank of Canada keeps interest rates unchanged, global general signal

At the same time, the Bank of Canada (BoC) also decided to keep the overnight interest rate unchanged at 2.75%, while the lending interest rate (Bank Rate) and deposit interest rates are also at 3% and 2.70%, respectively. This is the second consecutive time the BoC has decided not to change policy, despite Canada's GDP forecast to decrease by about 1.5% in the second quarter - mainly due to a reversal in exports after a sudden increase in the first quarter to avoid tariffs from the US.

The BoC acknowledged that the global economic outlook is still fraught with risks, especially from trade uncertainty and rising input costs. However, they said they will not rush to act but continue to closely monitor both factors: (1) inflationary downward pressure from a weak economy, and (2) price increase pressure from high costs due to supply chain restructuring.

In the event that factors that reduce inflation continue to dominate, and price pressure due to trade disruptions is well controlled, we can consider cutting policy interest rates, the BoC said in its latest monetary policy report.

However, the BoC's failure to act has caused investors to temporarily lower expectations for a global rate cut cycle - a factor that supported gold in the first half of 2025.

USD and CAD increase in price, gold is under double pressure

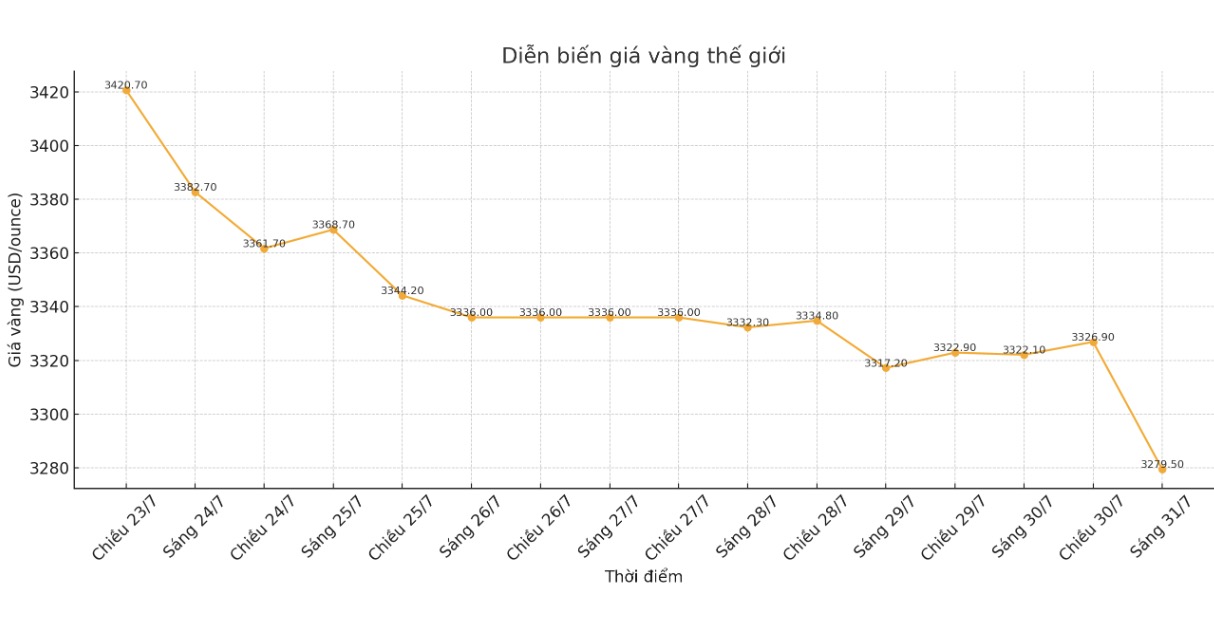

Right after a series of data and monetary policy decisions, gold prices continued to fall sharply. As of 6:35 a.m. on July 31 (Vietnam time), the world gold price was listed at 3,279.5 USD/ounce, down 43.5 USD compared to 1 day ago.

This decline shows that gold is weakening across the entire currency market, not only for the USD but also for CAD clearly reflecting the sentiment that investors are withdrawing from safe-haven assets to return to strong currencies, in the context of delayed interest rate cut expectations.

With the US economy growing better than expected and central banks cautiously cautious about easing, gold is gradually losing its traditional role as a safe haven. Along with that, as data shows inflation remains under control, the market is no longer too hasty in predicting the Fed will soon cut interest rates a factor that was the main driver pushing gold prices to record highs at the beginning of the year.

Despite maintaining the technical support zone above $3,300/ounce, the current decline is warning of a deeper correction period if market sentiment continues to change in an optimistic direction towards the economy and there are few concerns about macro risks.