Gold prices plummeted after Federal Reserve Chairman Jerome Powell reaffirmed that the central bank was in no rush to cut interest rates, causing expectations of policy easing in September to be overwhelmed with cold water.

As expected, the FED voted to keep interest rates unchanged, but this decision did not reach absolute consensus. Two members of the Federal Open Market Committee (FOMC), Michelle Bowman and Christopher Waller, have disagreed, wanting to cut interest rates by another 25 basis points.

In its monetary policy statement, the Fed said economic activity had stagnated in the first half of the year. However, Powell noted that despite this slowdown, the labor market, consumer goods and the economy in general remain quite stable.

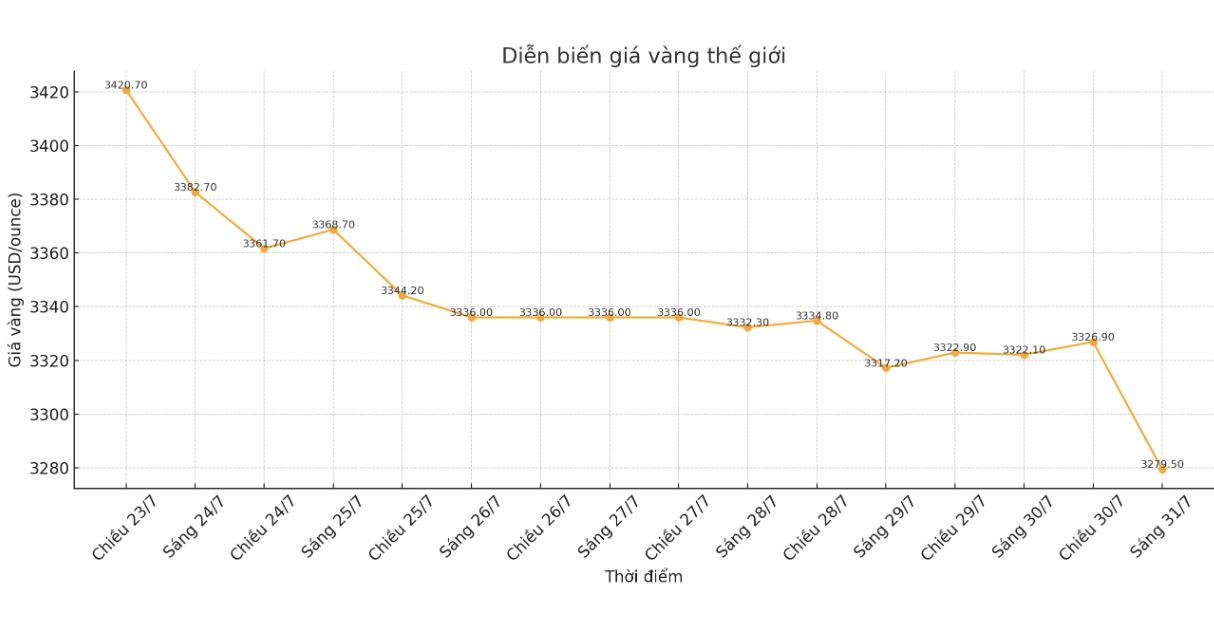

Although gold prices initially held key support at $3,300 an ounce after the announcement, Powell's failure to provide a clear direction has triggered a sell-off. The final spot gold price was recorded at 3,271.9 USD/ounce, down 1.6% on the day.

Powell stressed that there is still much economic data to assess ahead of the September meeting.

We have not made any decision for September. We will consider that information, along with all the other data, to make a decision at the September meeting, he said.

Although he did not announce a clear plan for the second half of the year, some analysts believe that Powell still left a few reserved signals for investors.

While the Feds statement did not provide significant new information, Chairman Powell made a few suggestions at the press conference that the possibility of a rate cut in September was higher.

He noted that most long-term inflation expectations are still in line with the 2% target, and said the impact of tariffs on inflation is only temporary reflecting a one-time price adjustment Chris Zaccarelli, chief investment officer at Northlight Asset Management, said.

Jeffrey Roach, chief economist at LPL Financial, also expects the Fed to start cutting interest rates after the summer.

The interest rate setting committee is ready to act at the next meeting. If economic conditions weaken, it is likely that the committee will cut interest rates by 0.25 percentage points in September, he said.

However, the market is still skeptical. Expectations of a rate cut have eased at Powell's press conference. According to the CME FedWatch tool tool, the market currently has only a 55.8% chance of the FED keeping interest rates unchanged in September, down from the 60% expectation of interest rate cuts before the press conference.

The Fed remains cautious about easing monetary policy this year, due to concerns that US President Donald Trump's trade policies could increase inflation.

However, this worry has somewhat subsided after the US announced new trade agreements with Japan and the European Union, including a 15% import tax increase. However, Mr. Powell still warned that the economy is still facing many uncertainties.

There are still many, many uncertainties, he said.

Powell also pointed out that US consumers have begun to feel the impact of rising tariffs.

We expect to see more of this. Studies show that companies intend to pass this cost on to consumers. But in reality, in many cases, they may not be able to do it, he said.

Despite rising inflationary pressures, Powell concluded that US consumers still have a solid financial foundation, according to current data.