Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.1-85.1 million/tael (buy - sell); increased by VND500,000/tael for buying and remained unchanged for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.6-85.1 million VND/tael (buy - sell); unchanged in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.1-85.1 million VND/tael (buy - sell); increased 500,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

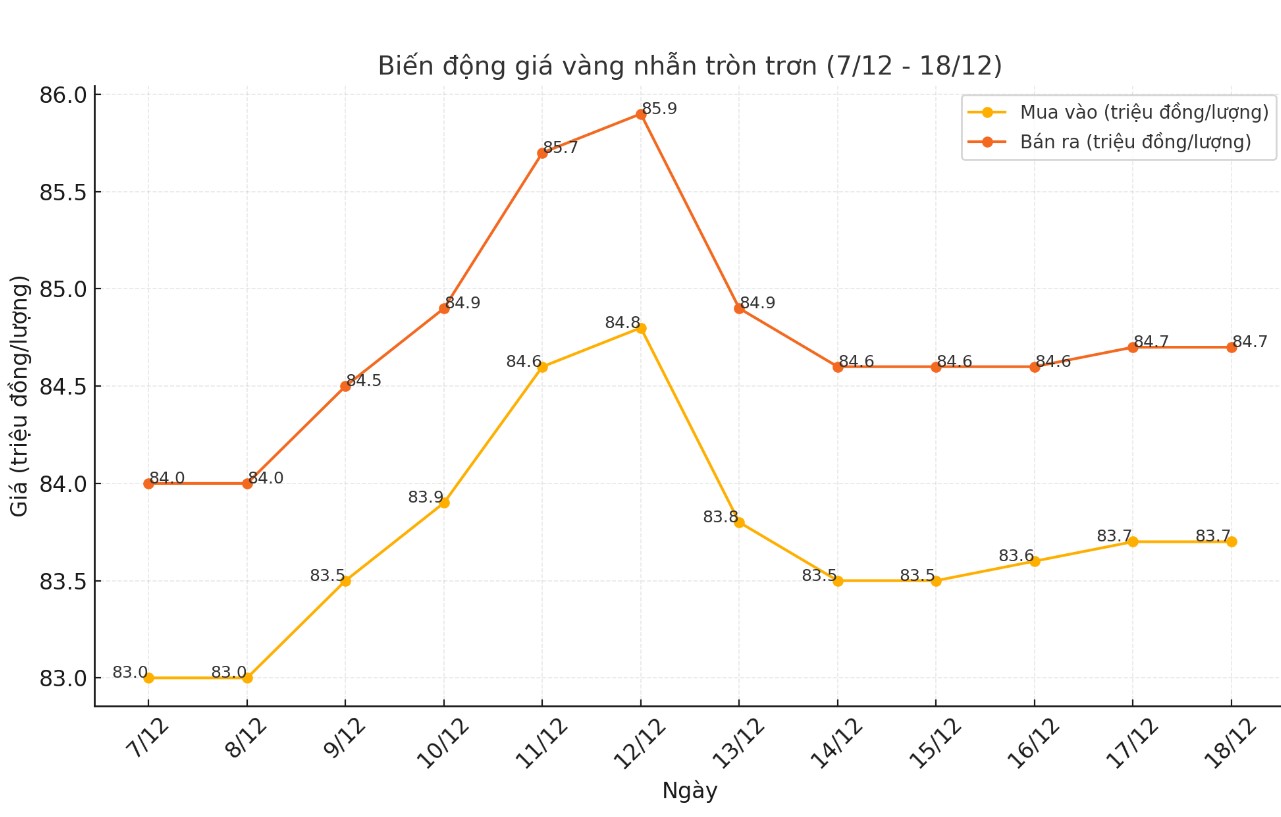

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.7-84.7 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.73-85.03 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

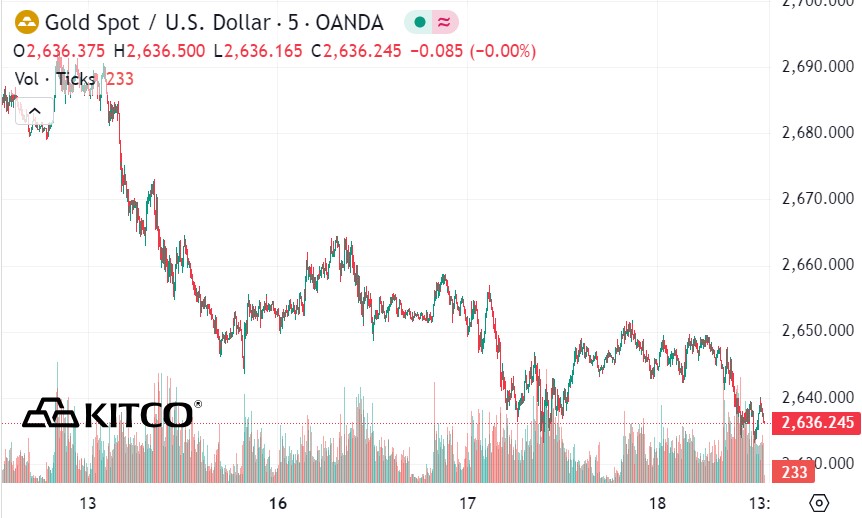

World gold price

As of 1:00 a.m. on December 19 (Vietnam time), the world gold price listed on Kitco was at 2,636.2 USD/ounce, down 3.3 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices fell slightly as the USD index increased. Recorded at 1:00 a.m. on December 19, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.820 points (up 0.15%).

Gold prices fell slightly as the market anxiously awaited the results of the US Federal Open Market Committee (FOMC) meeting, which will end this afternoon with a statement and press conference by US Federal Reserve Chairman Jerome Powell.

The FOMC is almost certain to cut the US benchmark interest rate by another 0.25 percentage points, in what some experts call a “hawkish rate cut.” The FOMC statement and Powell’s remarks are likely to signal fewer rate cuts next year than previously forecast.

“Bond traders are not entirely sold on the forecast, with expectations growing that the Fed will signal more aggressive rate cuts than the market currently anticipates,” Bloomberg reported.

Elsewhere in Brazil, financial market turmoil is mounting, with traders facing the prospect of a financial crisis that could engulf assets from stocks to bonds. “The broader sell-off reflects growing investor skepticism that President Luiz Inacio Lula da Silva is serious about reining in the country’s ballooning fiscal deficit,” Bloomberg reported.

In Canada, Prime Minister Justin Trudeau is trying to play down the most serious challenge to his leadership after Finance Minister Chrystia Freeland unexpectedly resigned on Monday.

In the UK, inflation rose to an eight-month high in November, well above the Bank of England's 2% target, ending hopes of a rate cut at the BOE's monetary policy meeting on Thursday. The Bank of Japan is expected to keep rates unchanged after its meeting on Thursday.

Other major markets saw Nymex crude oil futures edge up slightly and trade around $70.50 a barrel. The yield on the 10-year US Treasury note is currently at 4.401%.

Hedge fund BlackRock said investors should consider adding more gold to their portfolios, saying U.S. government bonds have become less effective in countering sell-offs in risk assets like stocks.

Economic data calendar this week:

Thursday: Bank of England monetary policy decision, US weekly jobless claims, Q3 GDP final, Philly Fed manufacturing survey, existing home sales

Friday: US Personal Consumption Expenditures (PCE) Index.

See more news related to gold prices HERE...