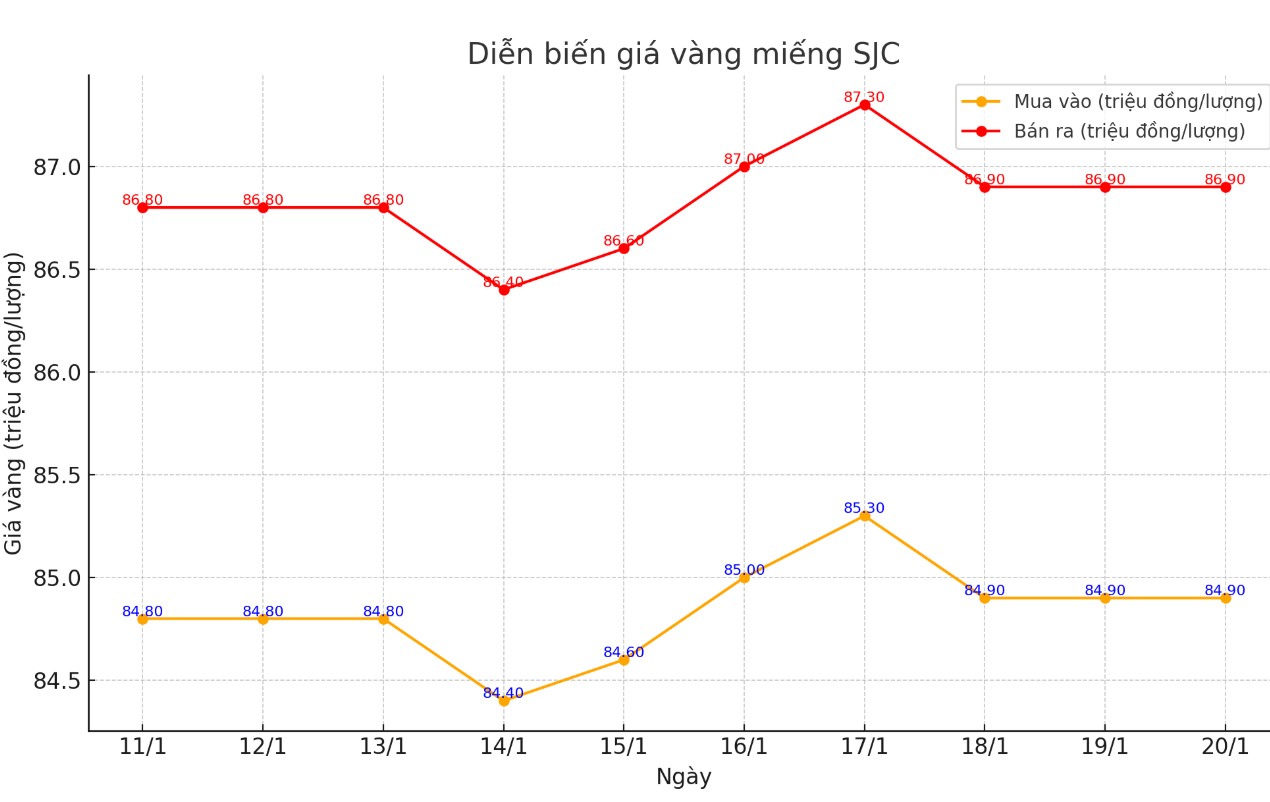

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.9-86.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

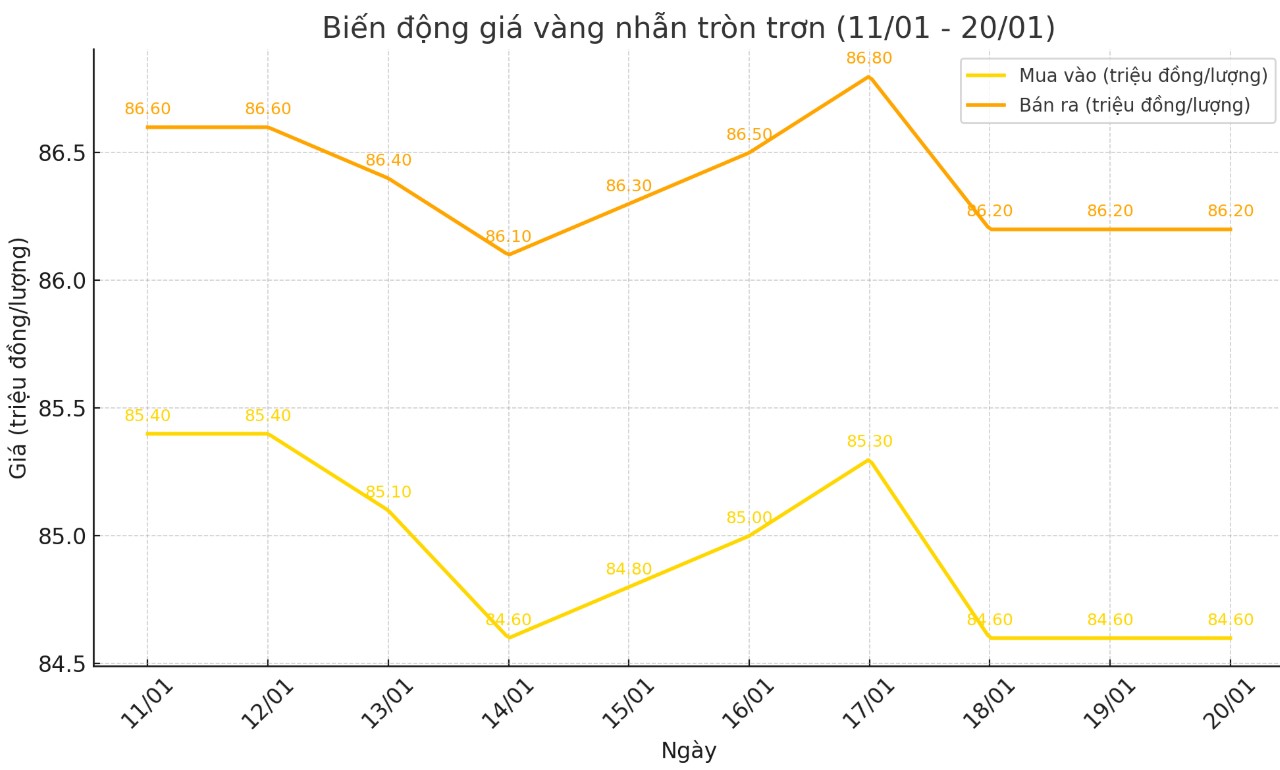

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-86.2 million VND/tael (buy - sell); unchanged in both directions compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.85 million VND/tael (buy - sell), keeping both selling prices unchanged compared to early this morning.

World gold price

As of 6:00 a.m. on January 20, the world gold price listed on Kitco was at 2,703.1 USD/ounce.

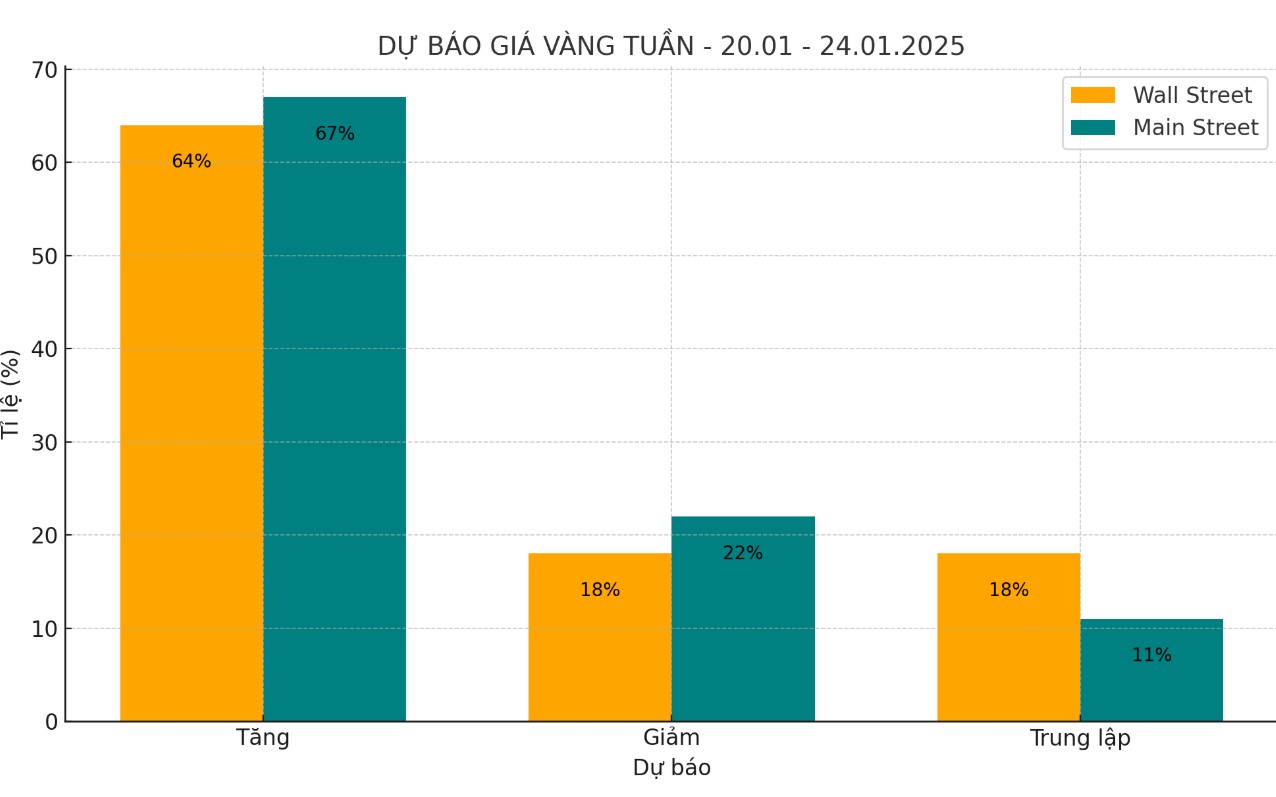

Gold Price Forecast

World gold prices are under pressure amid an increase in the USD index. Recorded at 6:00 a.m. on January 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (up 0.35%).

Commenting on short-term gold prices on Kitco, many experts gave quite positive forecasts.

“I’m still bullish, although there is potential for a correction,” said James Stanley, senior market strategist at Forex.com. Gold has just broken out of a triangle pattern that has been forming over the past few months.

Spot gold is testing resistance at $2,721/oz. This level has resulted in two strong reactions and this week it was the third. However, I think a slight correction to a higher low could be attractive for a continuation of the trend at this point."

Kevin Grady, president of Phoenix Futures and Options, agrees, seeing plenty of support for further gains: “I think the market has held some key levels. There are investors who are willing to buy on dips.

What pushed the price down was some weak investors or uncertain long positions, which scared them out of the market. But I think stronger investors, like central banks, came in and they kept buying."

Grady is bullish on the precious metal through 2025: “I think gold will hit $3,000 this year. The only issue is how the tariffs play out.”

However, Grady said it was difficult to predict where gold prices would go in the short term. “It’s hard to say where the price will go, but I still think there are strong investors in the market. Any dip in the price will be taken advantage of by them to buy,” he said.

Marc Chandler - CEO at Bannockburn Global Forex - predicts gold prices will hit a new record high in 2025 and the short-term outlook is also very positive.

“I like precious metals. Gold could hit new highs before facing a correction. Gold peaked in late October 2024 at around $2,790/oz and bottomed in mid-November at around $2,537/oz. Since then, prices have been rising in an inconsistent manner. On January 16, gold approached the upper limit of its recent range at $2,725/oz and briefly consolidated ahead of the weekend,” he said.

See more news related to gold prices HERE...