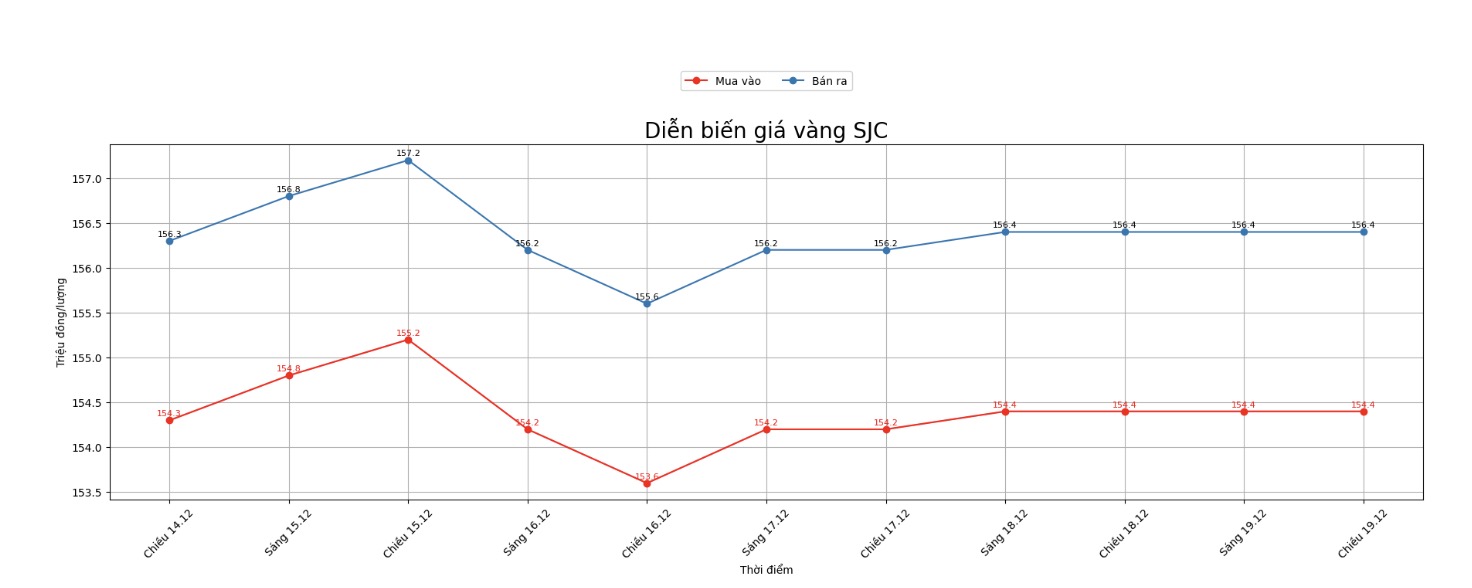

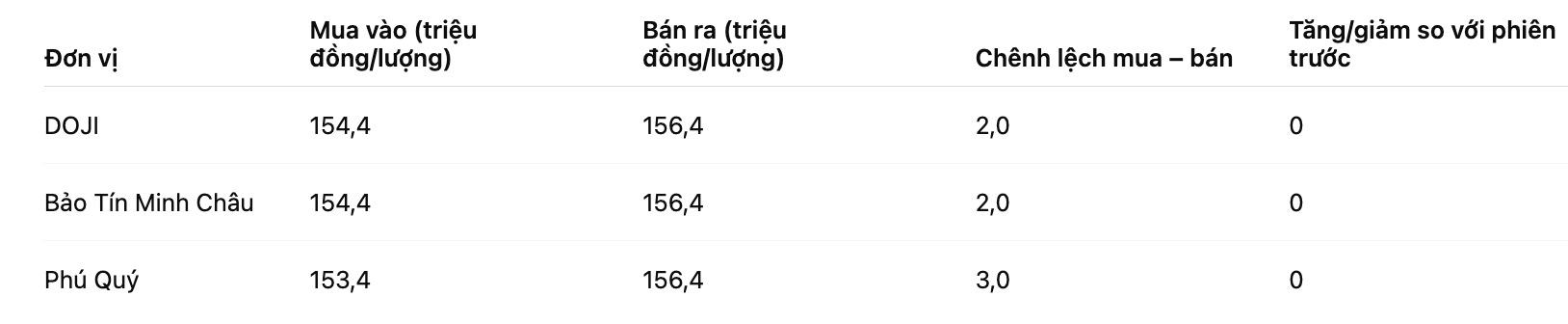

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 154.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

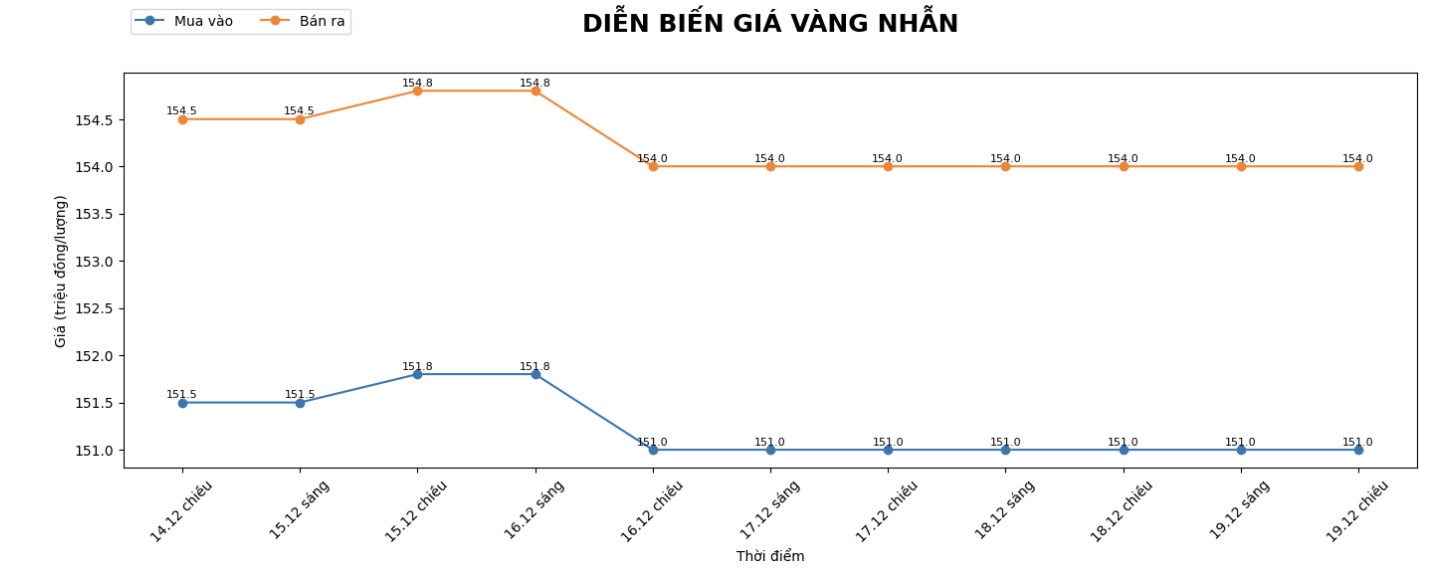

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.4-154.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

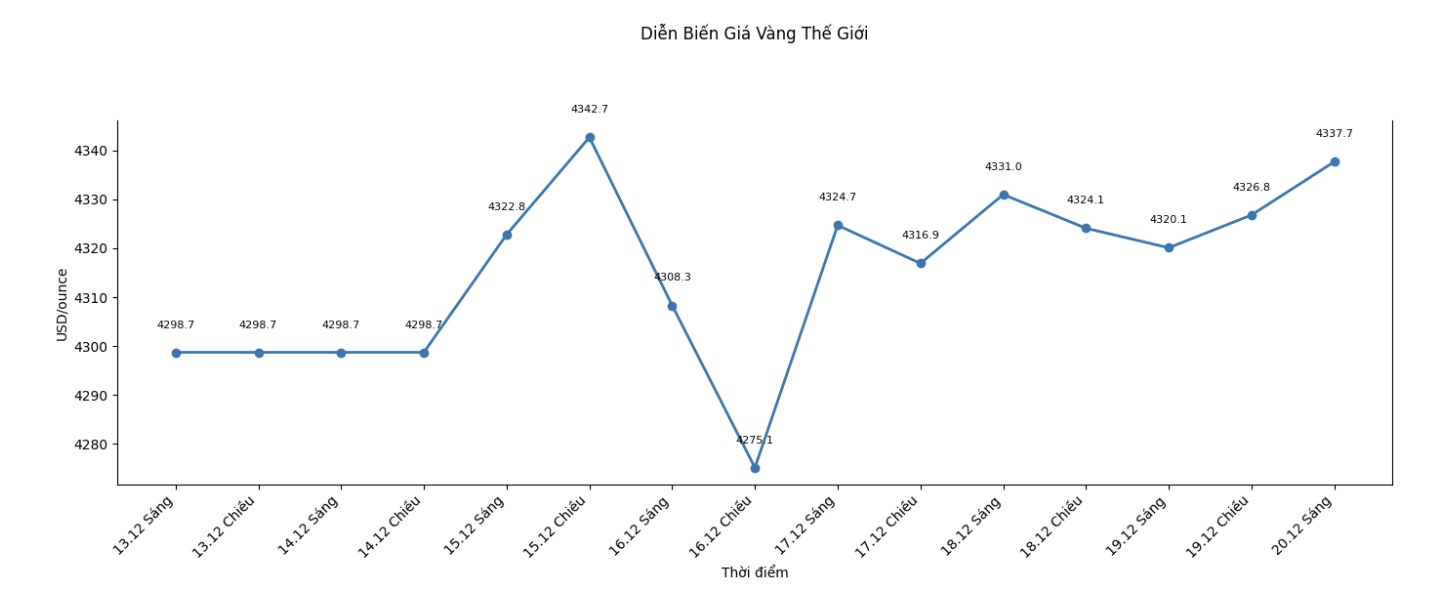

World gold price

The world gold price was listed at 5:32, at 4,337.7 USD/ounce, up 6.1 USD compared to a day ago.

Gold price forecast

Gold prices are heading for a week of price increases, while silver prices are rushing and are only a short way from this week's record high. Trading activities are generally calmer as the trading week gradually closes and the Christmas holiday is less than a week away.

The global stock market moved in opposite directions in the overnight trading session. In the US, stock indexes are expected to open slightly when the New York day trading session begins.

The Bank of Japan on Friday raised its key interest rate to a 30-year high and signaled that more rate hikes could be implemented in the coming time. However, the Japanese yen weakened as investors were disappointed by the message of not being strong enough from the central bank, according to Bloomberg.

The policy council headed by Governor Kazuo Ueda agreed to increase interest rates by 0.25 percentage points, bringing the rate to 0.75 percentage points.

The Bank of Japan said the ability to realize economic prospects is increasing, citing data showing that wage growth is still solid and risks related to tariffs from the US are gradually decreasing. This interest rate increase decision was predicted by all 50 economists participating in the Bloomberg survey.

Nymex crude oil prices fell around $56 a barrel today and are on track for a second consecutive week of decline, as concerns about supply overwhelms geopolitical risks.

In key outside markets, the USD index increased in today's session. Crude oil prices are almost flat, trading around 56.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.14%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...