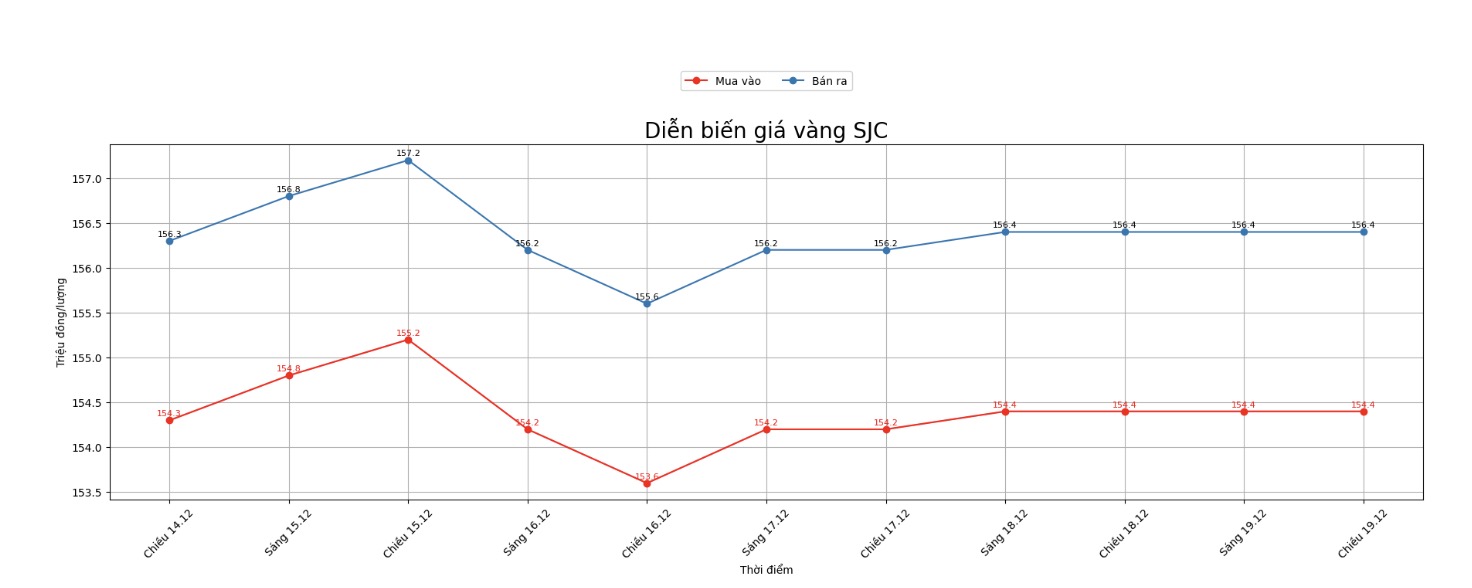

SJC gold bar price

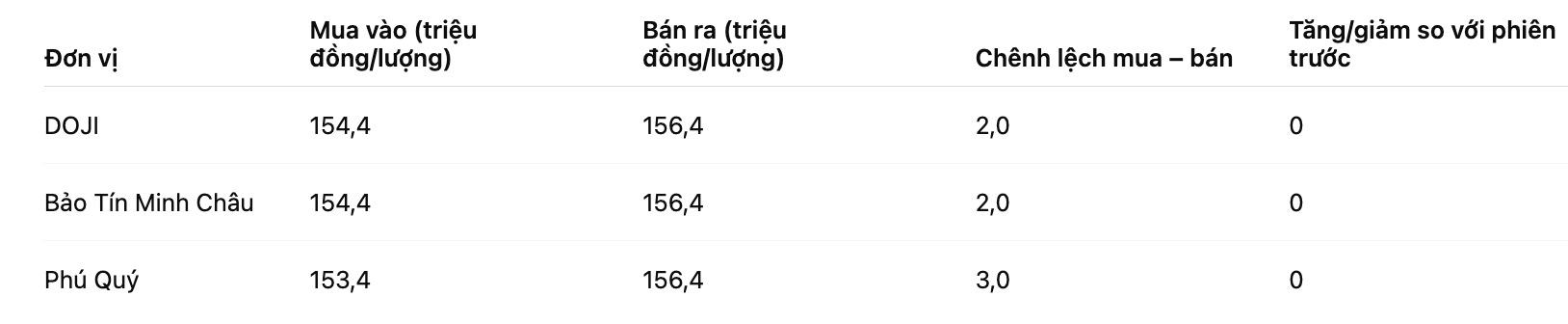

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND154.4-156.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.4-156.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

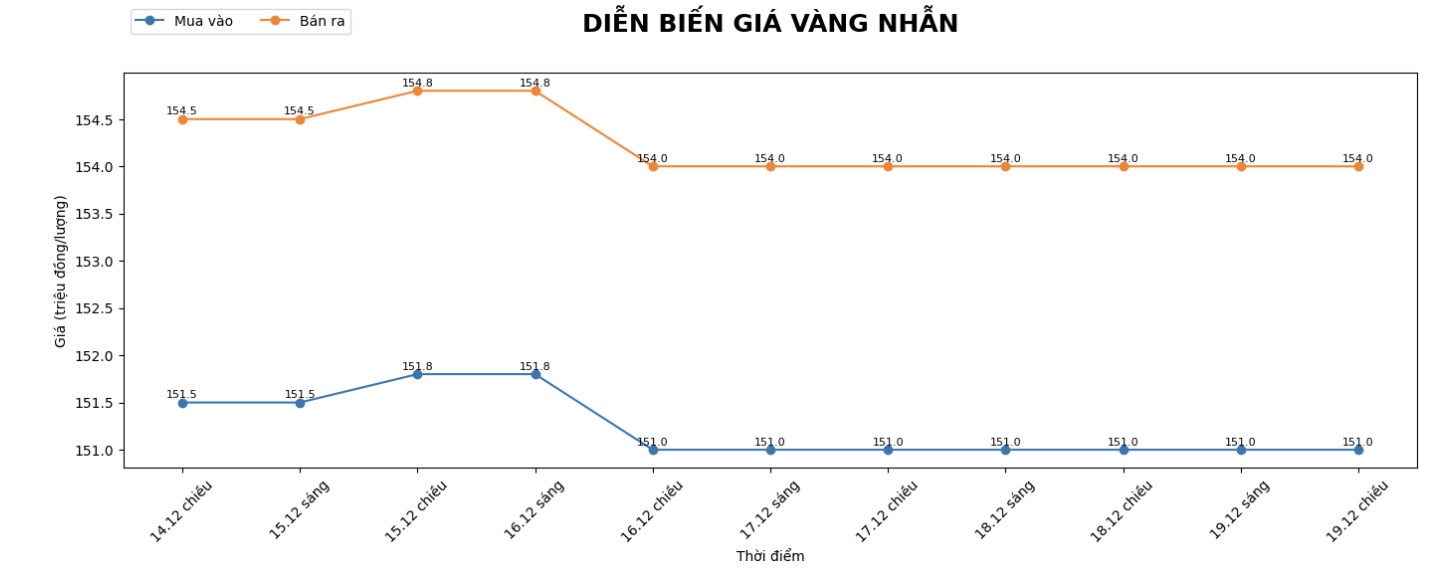

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.4-154.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

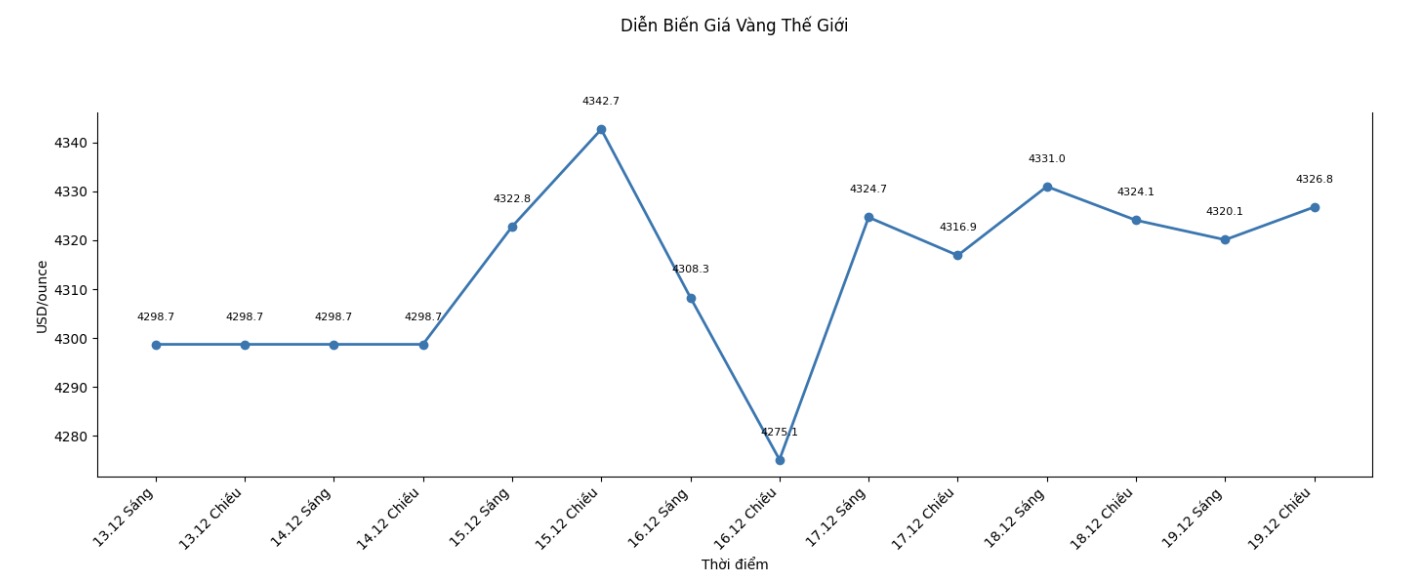

World gold price

The world gold price was listed at 6:05 p.m., at 4,326.8 USD/ounce, up 2.7 USD compared to a day ago.

Gold price forecast

Mr. Zain Vawda - an analyst at MarketPulse of OANDA - commented: "Gold is under some pressure today, most likely due to year-end position adjustment activities and a quiet trading atmosphere before the holiday".

He added that recent weaker-than-expected US economic data has supported the prospect of the US Federal Reserve cutting interest rates next year.

According to published data, the US consumer price index (CPI) in November increased by 2.7% compared to the same period last year, lower than the forecast of 3.1% by economists.

Meanwhile, Mr. Chris Zaccarelli - Investment Director of Northlight Asset Management - said that the US inflation data was much better than expected. Of course, this is just monthly data and could be volatile in the coming months, but the main concern for Fed officials - who are skeptical about continuing to cut interest rates - is persistent inflation and will not fall if they continue to cut interest rates. At this point, that seems no longer true.

While next year will certainly bring new challenges, from now until the end of the year, there is still room for the market to increase as corporate profits are increasing, GDP growth and inflation (at least for now) are still under control, added Chris Zaccarelli.

In the long term, in the 2026 commodity outlook review report, Goldman Sachs (a leading multinational investment and financial banking corporation in the US, with great influence globally) commented that the demand for gold at high levels is restructured from central banks, along with cyclical support from the Fed's interest rate cuts, will continue to push gold prices up.

The bank maintains its recommendation to hold a buying position for the precious metal.

Technically, buyers in the February gold futures market are holding a clear advantage. The next bullish target for the buying force is to get the closing price above the strong resistance zone at a record peak of 4,433 USD/ounce.

On the other hand, the short-term bearish target for the bears is to push gold prices below the important technical support zone at $4,200/ounce.

See more news related to gold prices HERE...