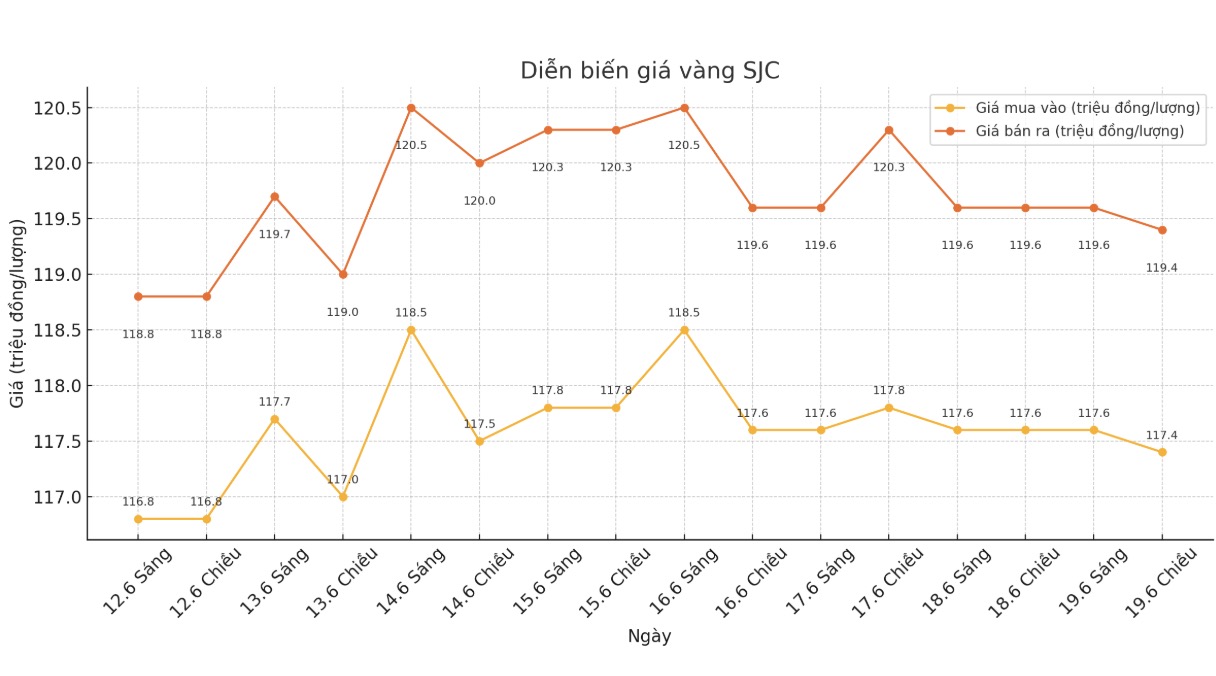

SJC gold bar price

As of 6:00 a.m. on June 20, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.4-119 1.4 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.4-1194 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.4-1194 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-119 1.4 million VND/tael (buy in - sell out); down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 gold ring price

As of 6:00 a.m. on June 20, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND114.5-116.5 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

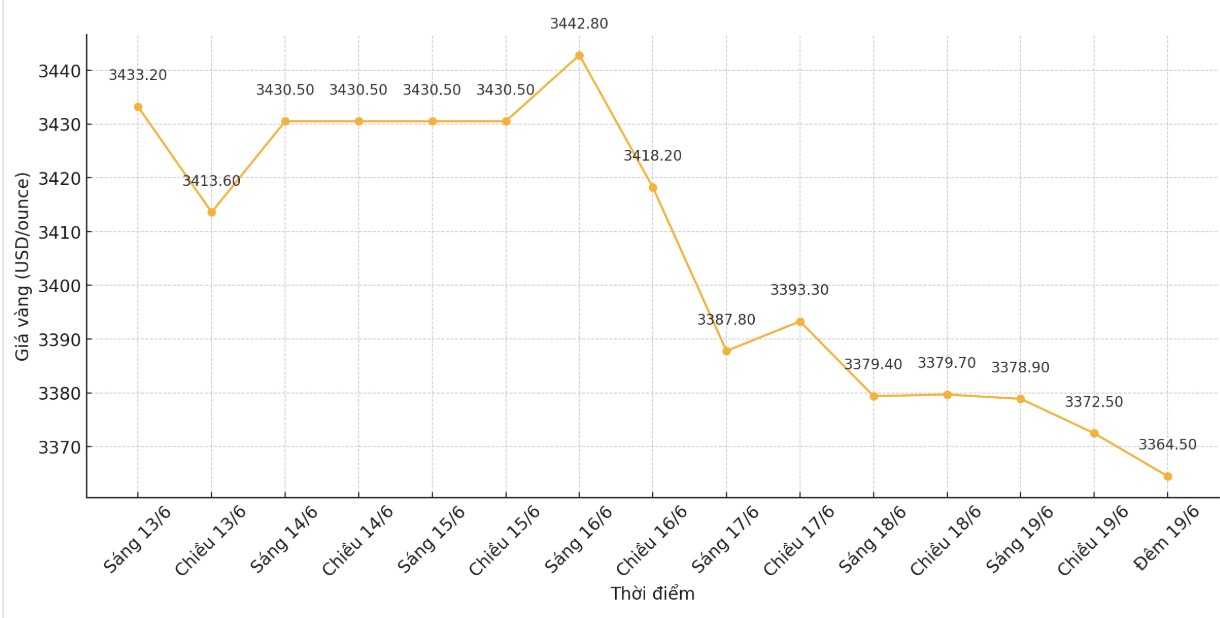

World gold price

The world gold price was listed at 9:45 p.m. on June 19 at 3,364.5 USD/ounce, down slightly compared to a day ago.

Gold price forecast

Gold prices this week saw strong fluctuations, reflecting long-term attractiveness as a safe-haven asset, but could also retreat soon.

Last Friday, Israel attacked Iran's nuclear facility, causing spot gold prices to set a record of $3,432.63/ounce, and the contract in August 2025 soared to $3,452.4/ounce. However, gold quickly lost momentum, plummeted, closed the second session at 3,404.3 USD/ounce and continued to decline to 3,386.4 USD/ounce, then broke through the 3,400 USD mark.

The latest policy announcement from the US Federal Reserve (FED) further complicates the story of gold. The Fed kept the reference interest rate unchanged at around 4.25% - 4.50%, maintaining a cautious data-based approach, while continuing to monitor the impact of President Donald Trump's trade policies, especially tariffs.

The Fed forecasts inflationary pressures to increase in the next few months, but still maintains plans to cut rates by two more rates before the end of the year, as oriented in March.

Fed Chairman Jerome Powell stressed caution, saying policymakers are in a good position to wait for more information on the economic outlook before adjusting policy.

The Fed's statement also admitted that "the level of uncertainty about economic prospects has decreased", but is still "high", reflecting many intertwined factors that the Fed is facing.

The fundamental factors that pushed gold prices to a peak on Monday remain intact. Central banks around the world continue to accumulate gold strongly; tensions in Ukraine and the Middle East play a key role, strengthening gold's position as a hedge against instability. In addition, expectations of falling interest rates in the future are also beneficial for gold as they reduce opportunity costs compared to other profitable assets.

Fawad Razaqzada, market analyst at City Index and FOREX.com, said: We are seeing safe-haven cash flow flow flow into gold, which is not surprising given the war between Iran and Israel.

Mr. Razaqzada added that the stock market is also supporting gold prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...