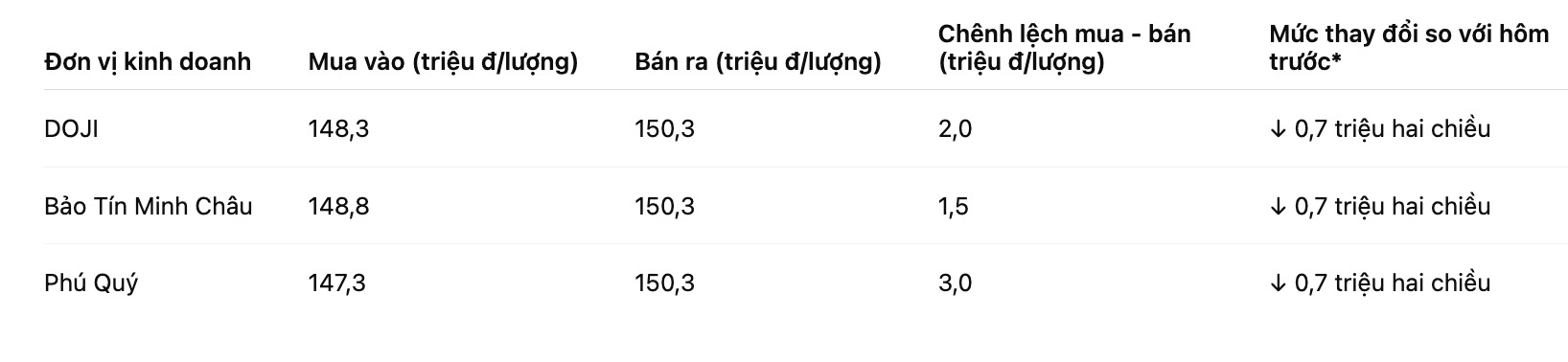

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 148.3-150.3 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.8-150.3 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.3-150.3 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.8-150.8 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147-150 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

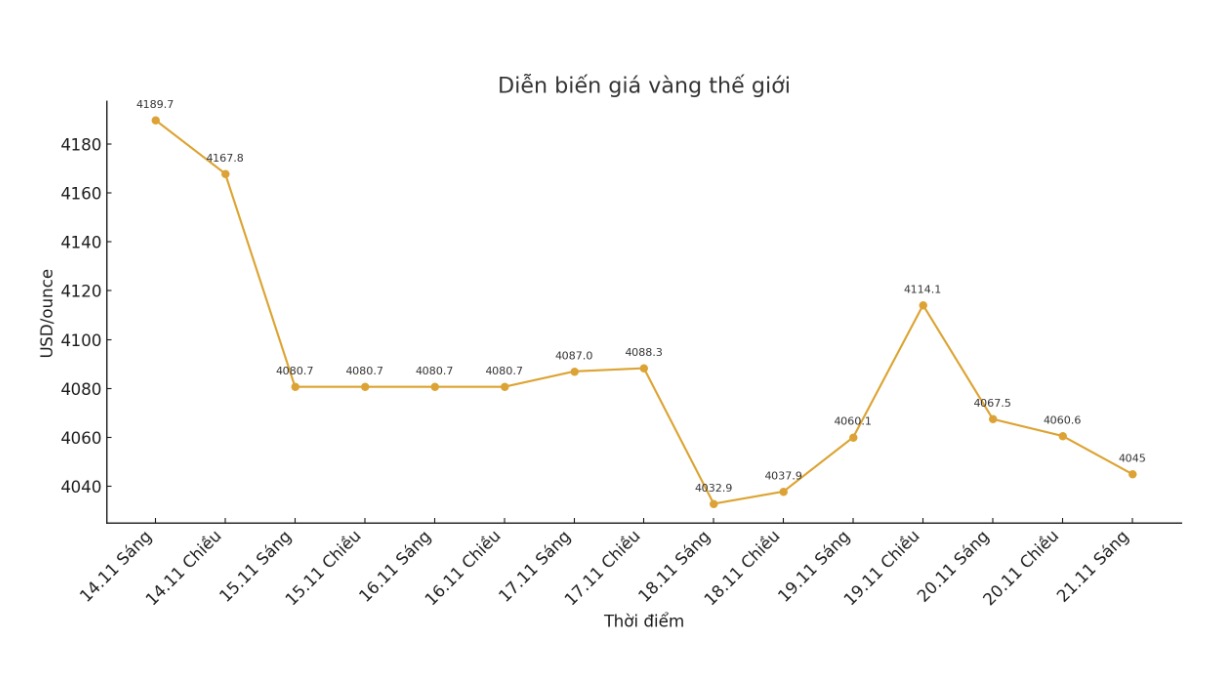

World gold price

The world gold price was listed at 0:08 at 4,045 USD/ounce, down 32 USD.

Gold price forecast

The gold market is struggling above $4,000/ounce, as US employment data which was delayed due to a 43-day government shutdown shows signs of resistance in the labor market.

The US Department of Labor finally released its non-farm payrolls (NFP) data for September, showing the economy created 119,000 more jobs, far exceeding the forecast of only 53,000. However, the unemployment rate increased more strongly than expected, to 4.4% compared to the expectation of staying at 4.3%. However, this agency affirmed that the general labor market has "slightly changed" since April.

Data adjustments in the summer continue to reflect the weakening of the job market. The August data was revised down to 4,000 job losses, while the July data was also revised down to 72,000, down from the previously announced 79,000. The report also showed quite modest wage growth: hourly earnings increased by 0.2%, reaching 36.67 USD, lower than the expectation of 0.3%. In the past 12 months, hourly income increased by 3.8%.

The gold market has barely reacted strongly to this outdated data. The statistics agency also said it will not release October data due to insufficient time and resources collected during the US Government's shutdown.

Meanwhile, the US real estate market showed signs of a slight improvement. According to the National Association of Realtors (NAR), existing home sales increased by 1.2% in October to 4.10 million units/year, higher than the forecast of 4.08 million. Compared to the same period in 2024, sales increased by 1.7%. NAR believes that buyers are taking advantage of lower mortgage rates, although many areas still face limited supply and high housing prices.

The NAR report said housing inventories reached 1.37 million units equivalent to 4.4 months of supply while trung tam housing prices increased by 2.1% to $406,800.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...