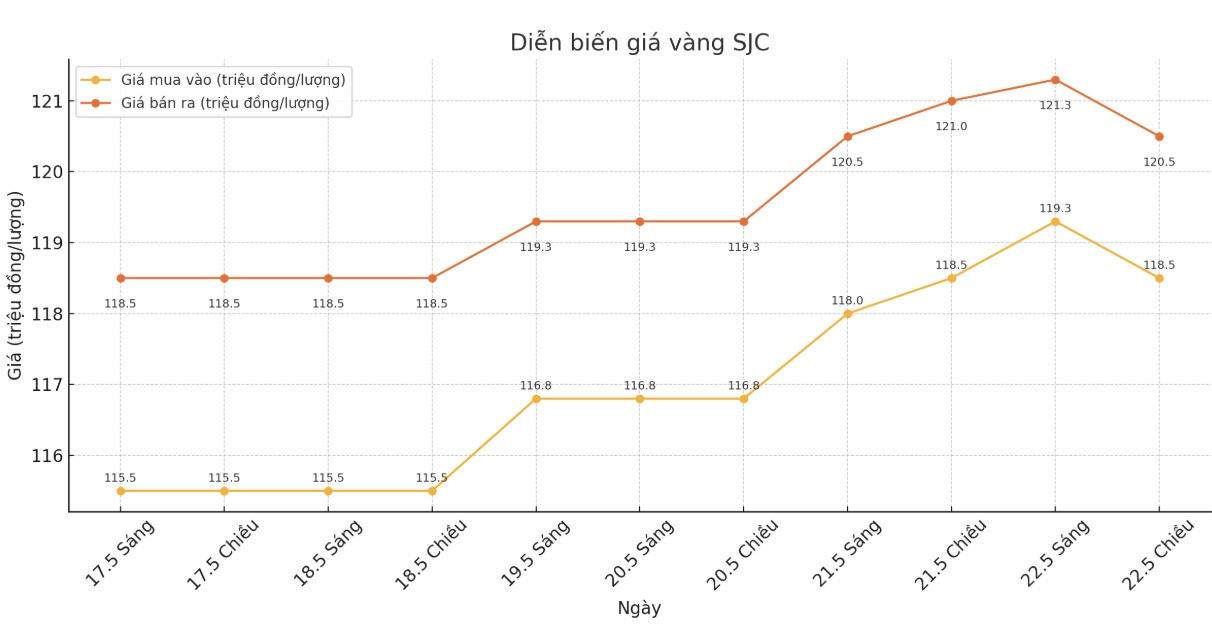

Updated SJC gold price

As of 6:00 a.m. on May 23, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), unchanged for buying and down VND 500,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy - sell), unchanged for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell), keeping the same for buying and decreasing by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.8-120.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

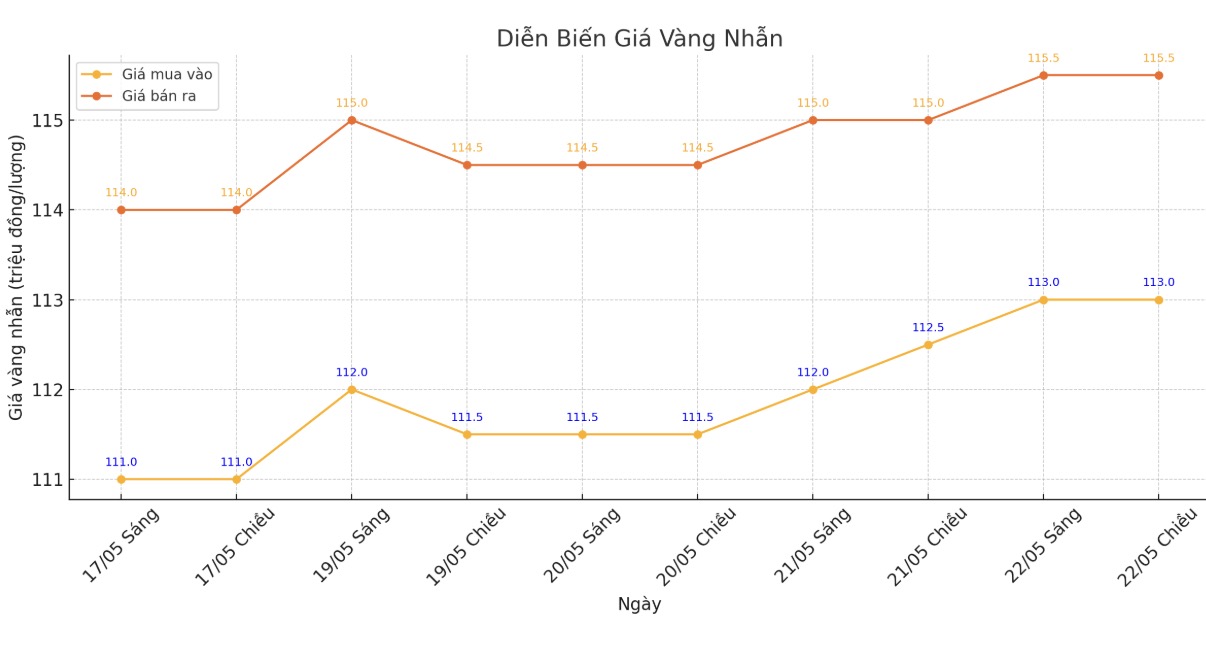

9999 round gold ring price

As of 6:00 a.m. on May 23, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113-125.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

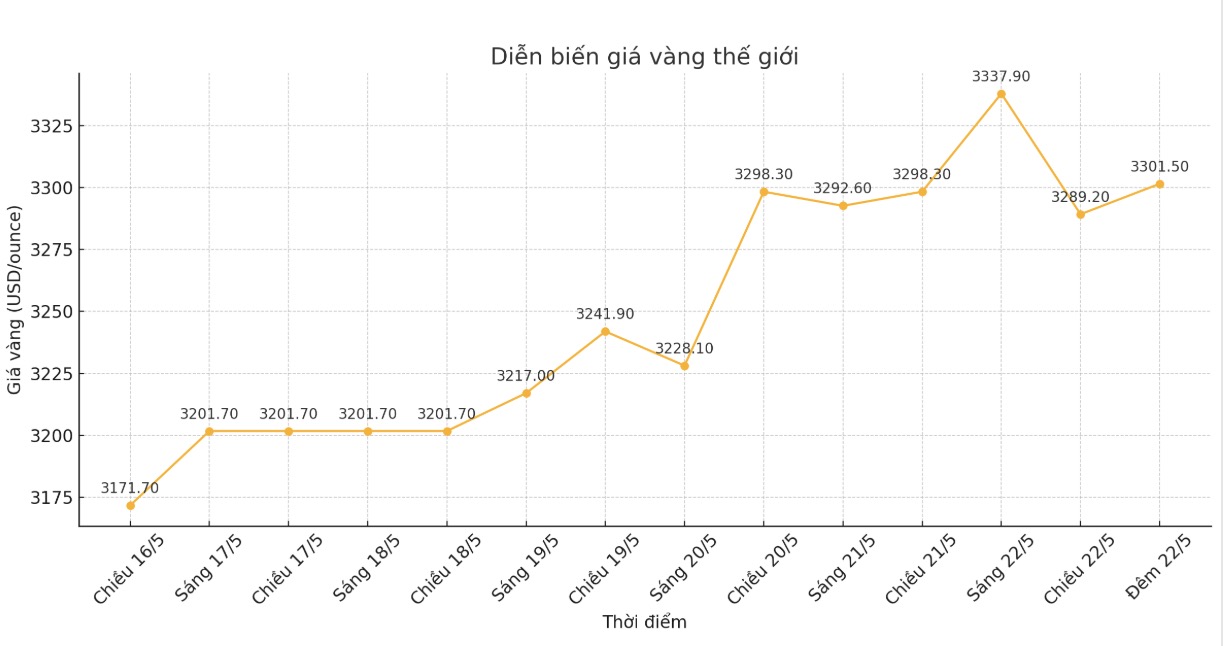

World gold price

At 11:47 p.m. on May 22, the world gold price listed on Kitco was around 3,301.5 USD/ounce, up 3.2 USD.

Gold price forecast

According to Kitco, gold prices yesterday decreased slightly due to profit-taking pressure from short-term contract investors. However, safe-haven cash flow remains positive as the global bond market becomes more volatile.

Gold futures for June saw a $6 decline to $3,307.5 an ounce. July silver futures fell $0.761 to $22.885 an ounce.

The market became unstable at the end of the week after the 20-year US government bond auction held in midday on Wednesday was not positively received by investors. This is an important event, commented barrons: The bond market is the big brother of the stock market, rarely having major fluctuations. But when there are, we need to be vigilant.

The yield on the 30-year US Treasury note has surpassed 5%, reaching its highest level since October 2023. After a weak US bidding session, Japanese bond yields increased sharply, with the yield on JGB's 30-year bond reaching a record high of 3.1872%. The global bond market also shook with this event.

The US bond market is also under pressure when the tax bill and new spending of the administration of Mr. Donald Trump are approved by the US Congress. The National Assembly Budget Office (CBO) warns that this bill will increase USD 3.8 trillion budget deficit in the period 2026-2034.

Meanwhile, Bitcoin skyrocketed to a record over $110,000 overnight, as the cryptocurrency market benefited from unusual fluctuations in traditional financial assets.

The Asian and European stock markets both recorded red in last night's session. In the US, stock indexes are expected to open with slight differentiation in New York.

Technically, June gold futures buyers are dominating the short term. The next target for buyers is to push prices above the threshold of 3,400 USD/ounce. Meanwhile, the sellers are aiming to push the price below the 3,123.3 USD/ounce zone.

The first resistance levels were $3,346.8/ounce and $3,375/ounce, respectively, while the support levels were $3,282.2/ounce and $3,250/ounce, respectively.

Overseas markets saw the USD index maintain its upward momentum. Nymex crude oil futures fell, trading around $60.25/barrel. The yield on the 10-year US Treasury note is currently at 4.6%.

See more news related to gold prices HERE...