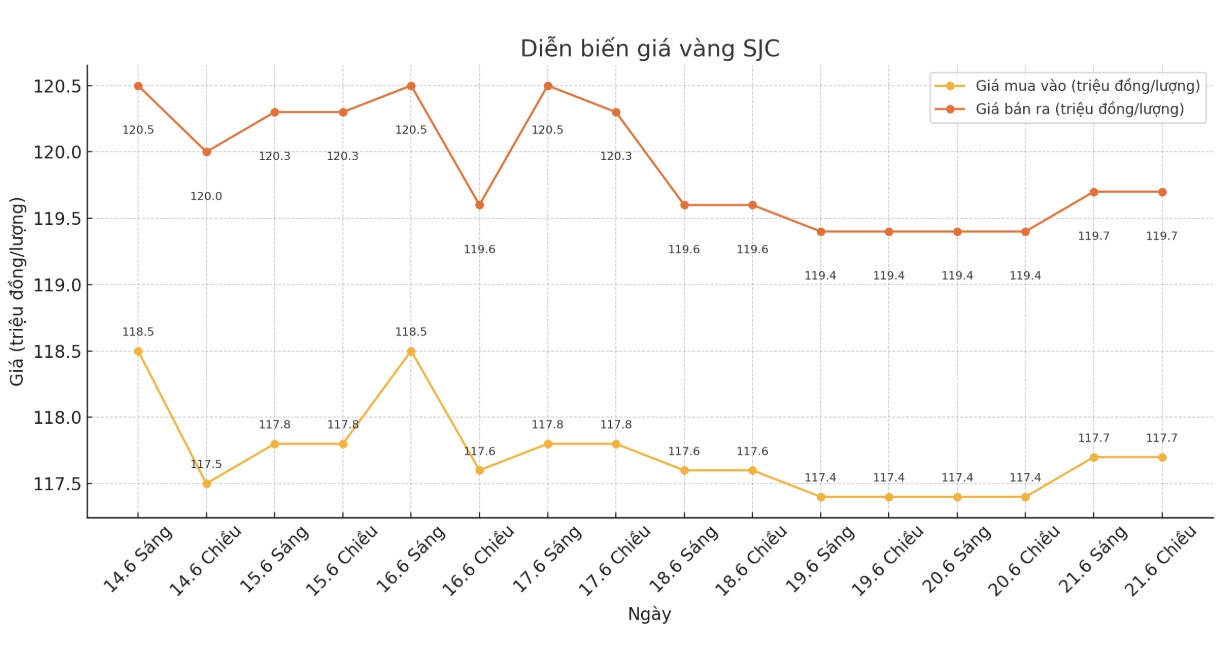

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 117.7 hyd 19.7 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session (June 15, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by VND100,000/tael for buying and VND600,000/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.7-119 seven million VND/tael (buy in - sell out). Compared to a week ago, Bao Tin Minh Chau adjusted the price of SJC gold bars down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC on June 15 and selling it today (6, 22), buyers will lose VND 2.6 million/tael.

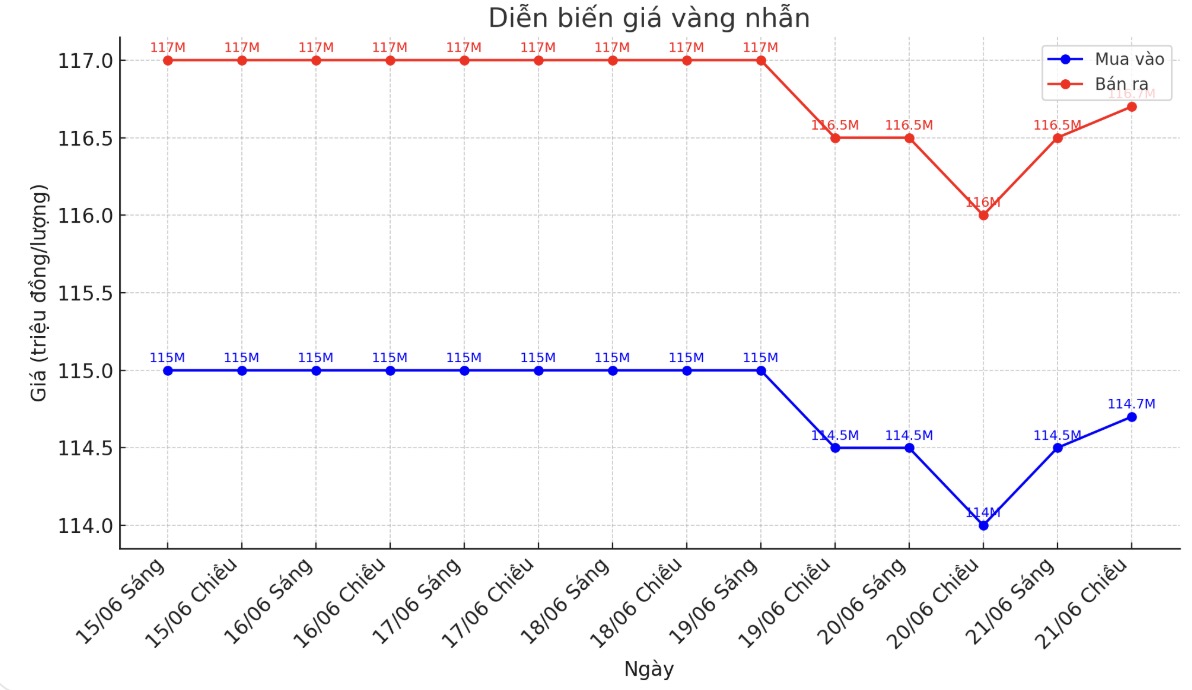

9999 gold ring price

This morning, Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell); down 1.5 million VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of June 15 and selling in today's session (6, 22), buyers at Bao Tin Minh Chau will lose 4.5 million VND/tael, while buyers at Phu Quy will lose 3.5 million VND/tael.

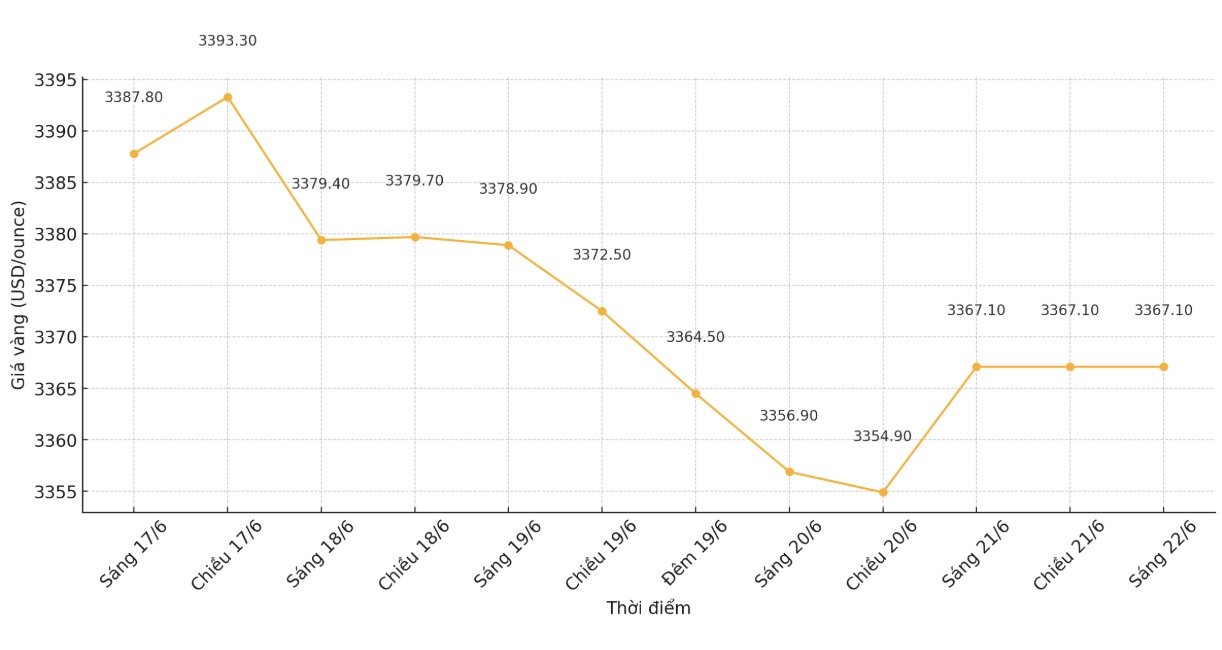

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,367.1 USD/ounce, down sharply by 63.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Philip Streible - Chief Market Strategist at Blue Line Futures - commented: "It is true that many people are currently pouring money into gold, but when it is not clear what the upcoming situation will be, keeping an asset without political risks is still a smart choice. Gold is the simplest way to balance portfolio risks. In my opinion, investors should keep a portion of their gold before the weekend to be more assured.

Christopher Vecchio - Head of futures and exchange-traded contracts at Tastylive.com - said that gold is still maintaining a long-term uptrend as it continues to be considered an important monetary asset in the global market. However, he warned that current speculative activities suggest that the metal will face some challenges in the short term.

"Currently, gold has all the supporting factors but still cannot set a new peak. This should be a worrying signal for investors. Obviously, many people are buying gold and selling fake USDs, which is putting pressure on gold at the moment, Vecchio said.

Despite the pressure, many experts and investors are still optimistic about gold prices next week. A survey by a news agency that tracks the gold market shows that, out of 16 experts surveyed, 38% predict prices will continue to increase, 31% think prices will decrease and the rest believe that gold will go sideways.

The results of a survey of more than 250 individual investors also showed that nearly half of participants expected gold prices to increase, while the rest divided equally between two scenarios of decline and sideways.

Economic data to watch next week

Monday: S&P Preliminary PMI.

Tuesday: US consumer confidence; FED Chairman holds a hearing before the House Financial Services Committee.

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

See more news related to gold prices HERE...