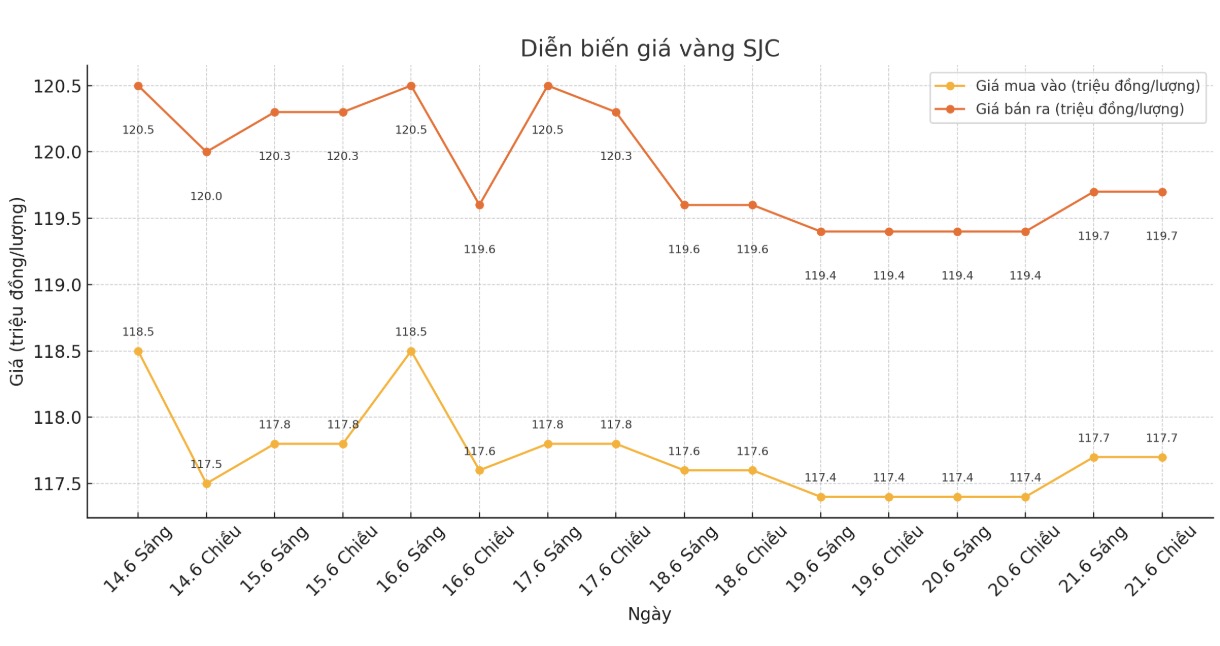

SJC gold bar price

As of 5:38 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 hyd 19.7 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-119 7.5 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and kept unchanged for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

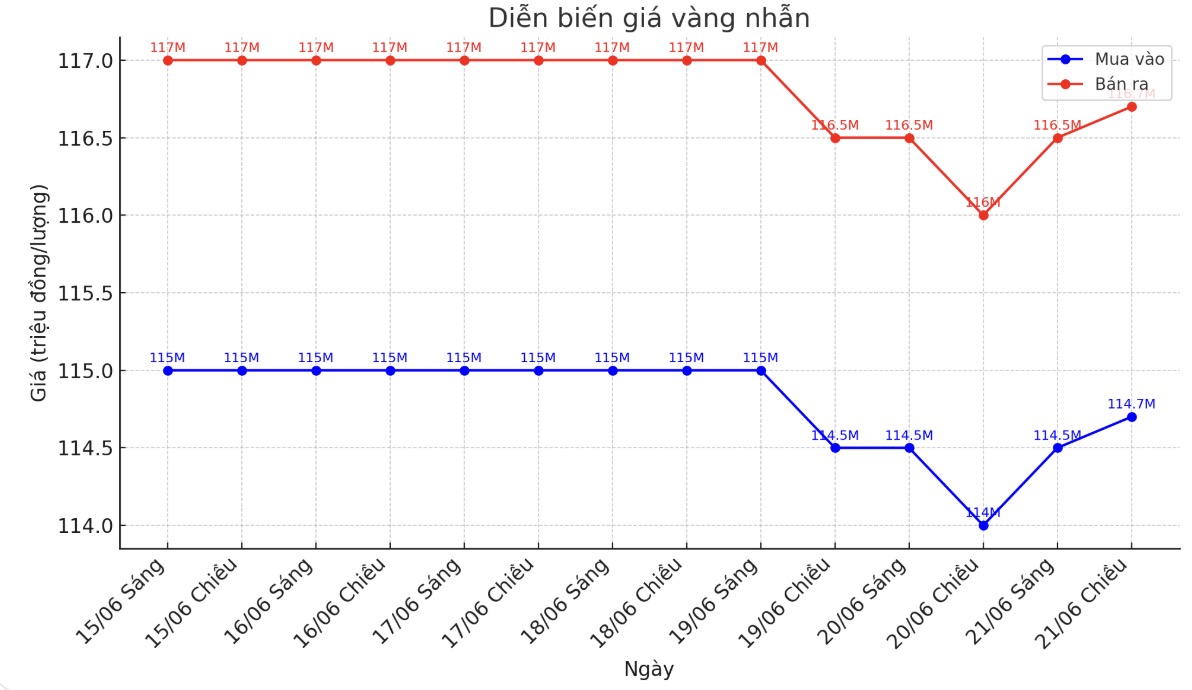

9999 gold ring price

As of 5:44 p.m., Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

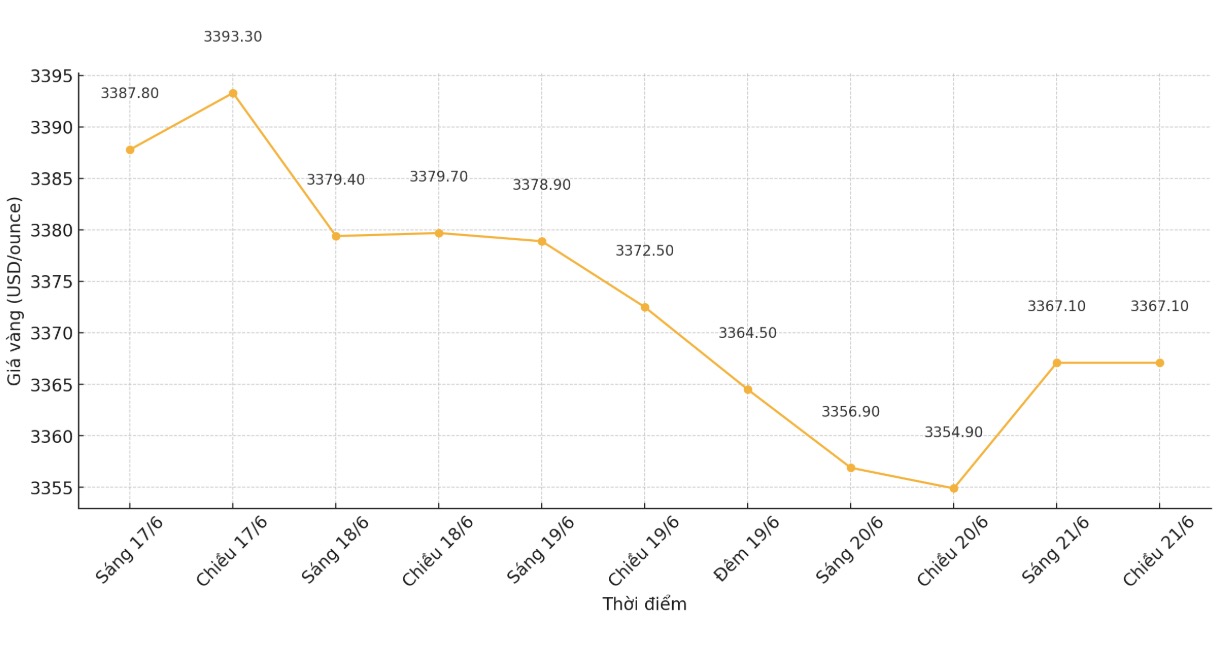

World gold price

The world gold price was listed at 5:45 p.m. at 3,367.1 USD/ounce, up 12.2 USD.

Gold price forecast

World gold prices are under downward pressure as short-term futures traders take advantage of profit-taking before the weekend break. The latest record shows spot gold prices at $3,369.54/ounce, almost unchanged from the previous session but have been revised up from $3,454/ounce not long ago.

In this context, Citigroup made a surprising forecast when lowering the gold price target, warning that this precious metal could fall below $3,000/ounce by the end of this year. The bank has adjusted its 0-3 month gold price target from $3,500/ounce to $3,300/ounce, while its 1-2 month target decreased from $3,000/ounce to $2,800/ounce. This forecast means that gold is likely to fall about 16% compared to current prices.

Citigroup analysts believe that safe-haven demand for gold will weaken as we move into 2026, in the context of an improving global economy and confidence in US President Donald Trump to consolidate growth momentum, especially as the midterm election is approaching.

However, not all financial institutions are optimistic. Goldman Sachs remains optimistic, continuing to forecast gold prices to reach the $4,000/ounce mark next year, despite short-term fluctuations.

From another perspective, Christopher Vecchio - Head of futures and foreign exchange at Tastylive.com - said that gold is still in a long-term uptrend, but he warned that current speculative positions could create challenges in the short term.

Its difficult for gold to maintain a price increase above $3,400 an ounce when everyone is optimistic and the USD is sold at a high level, which creates a certain resistance, Mr. Vecchio analyzed.

Mike McGlone, senior macro strategist at Bloomberg Intelligence, agreed, saying the current correction is just a necessary consolidation phase. When the market reaches historical peaks, prices often accumulate before continuing to increase. Gold is representing that model, said McGlone.

In addition, according to Dan Pavilonis - senior market strategist at RJO Futures, tensions in the Middle East have temporarily eased safe-haven demand, contributing to the decline in gold prices. In addition, US President Donald Trump has just said he will spend about two weeks in advance deciding on any military action against Iran, further reducing geopolitical concerns.

The report from ANZ Bank also pointed out macro factors such as stable bond yields, stronger USD and the cautious stance of the US Federal Reserve (FED) that have limited expectations for interest rate cuts this year, thereby not creating more momentum to support gold prices.

Gold trader Tai Wong predicts a correction to $3,250 an ounce as entirely possible, but stressed that recent declines have often been bought strongly by investors, reflecting long-term confidence in the precious metal.

See more news related to gold prices HERE...