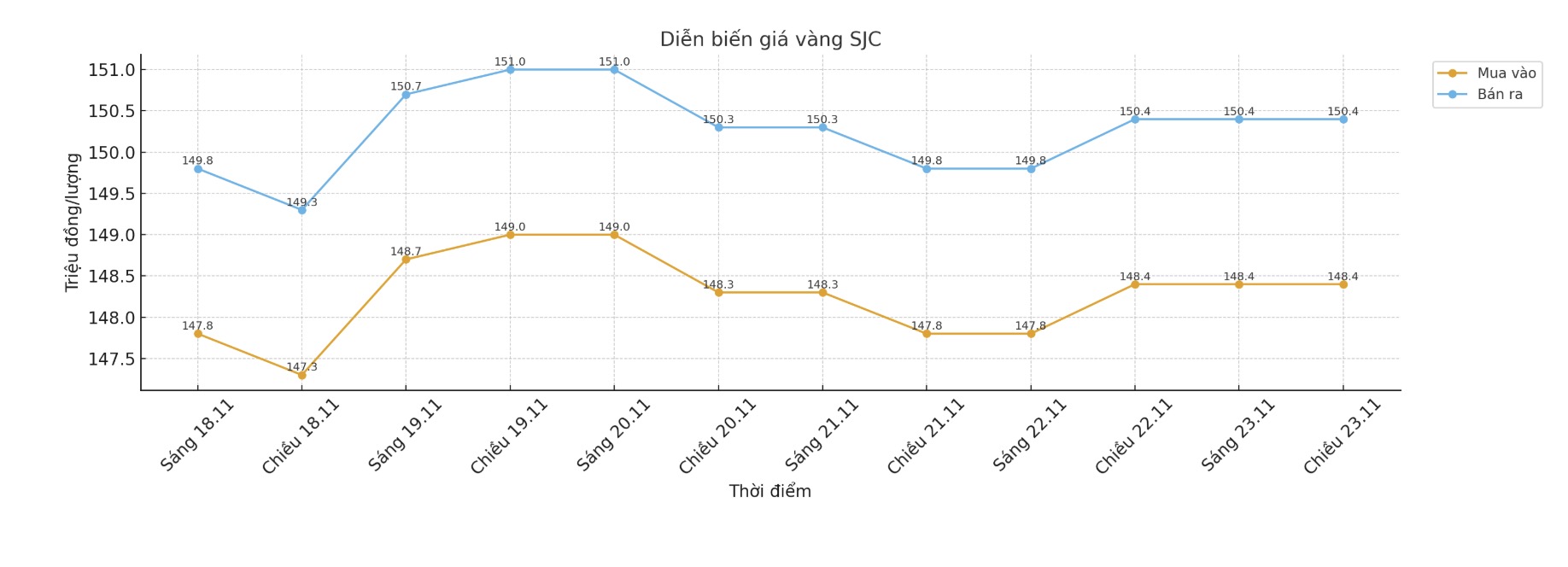

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 148.4-150.4 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.9-150.4 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.9-150.4 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

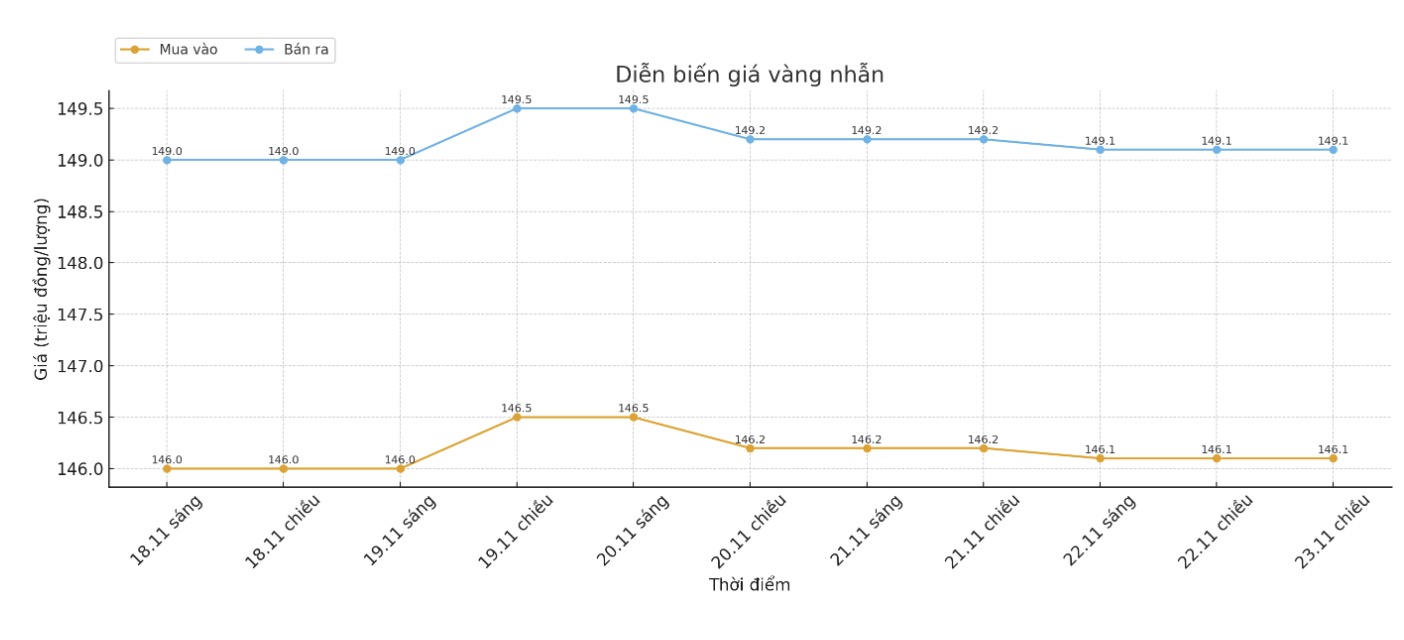

9999 gold ring price

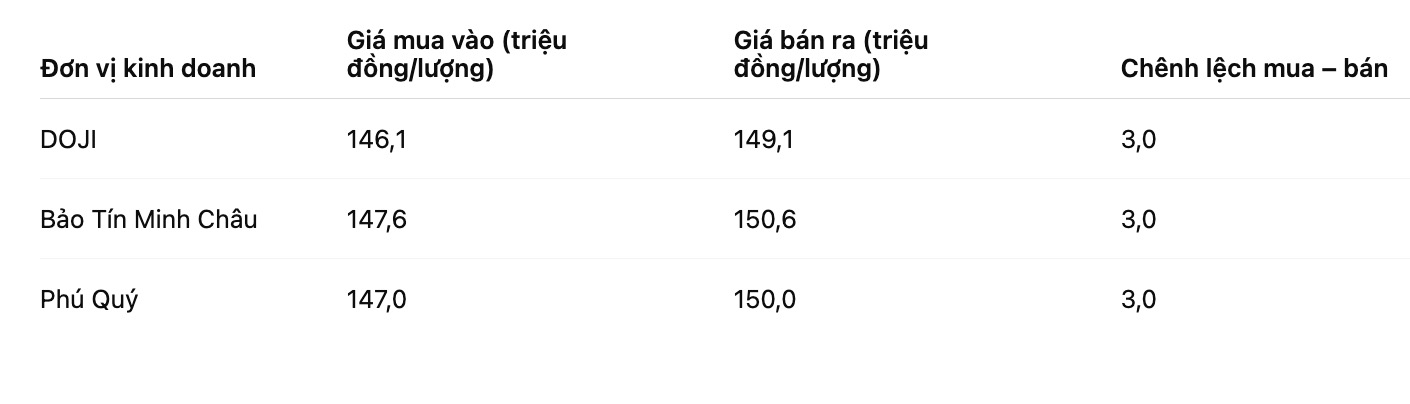

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.6-150.6 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147-150 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

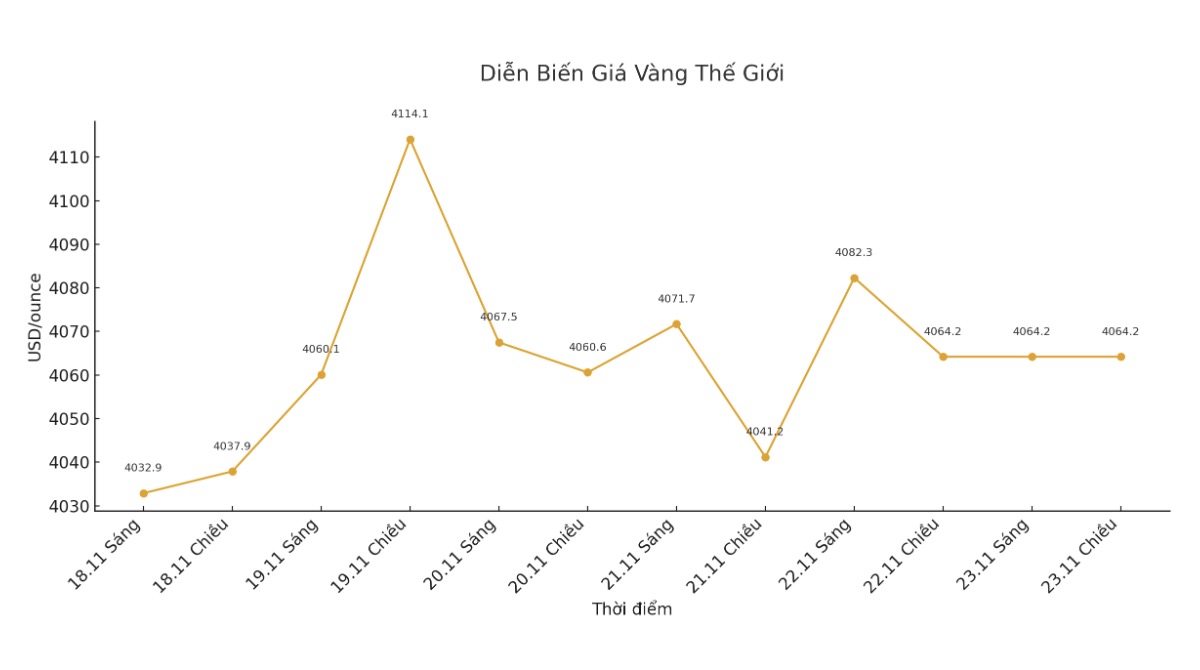

World gold price

The world gold price was listed at 6:00 a.m. at 4,064.2 USD/ounce.

Gold price forecast

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street experts have shifted to a bearish or neutral view this week.

There are 13 analysts participating in the gold survey, with only a small group of Wall Street experts holding an upward view. Only two people (equivalent to 15%) predict gold prices will increase next week, while four others (accounting for 31%), predict prices will decrease. The remaining seven analysts (equivalent to 54%) expect the precious metal to move sideways next week.

Ms. Barbara Lambrecht - commodity analyst at Commerzbank maintained a neutral view when saying that the market will continue to be dominated by the US Federal Reserve (FED).

Only when expectations of a rate cut increase again will gold prices be supported, she said. Its not over yet: the meeting was scheduled for December 9-10, and theres still a chance of one or two important economic data coming out before. However, if interest rate cut expectations do not increase, gold prices may continue to move sideways."

Commodity analysis at TD Securities said that investment demand for gold may stagnate until the Fed gives a clearer direction. In the past two months, gold prices have been moving sideways but still refused to fall sharply. Gold buying by central banks - despite signs of slowing down - is still a factor to hold the market. However, this factor alone cannot create explosive growth momentum like in previous months" - the report stated.

individual investors often react sensitively to the Feds interest rate outlook. Will a long period of Fed interest rate stability trigger a wave of capital withdrawals from precious metals? ".

Meanwhile, Mr. Lukman Otunuga - senior analyst at FXTM, predicted that gold prices will fluctuate within a narrow range next week. Retail sales reports, PPIs and more next week could provide a clearer look at US economic health. If data is weak, expectations of a Fed rate cut could recover thereby pulling gold back above $4,100/ounce.

Conversely, if strong data continues to reduce the possibility of the Fed cutting interest rates, gold could break the support level of $4,000/ounce, paving the way to $3,970/ounce and $3,930/ounce, said Lukman Otunuga.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...