This development comes from a combination of two factors: The decline in gold prices and the high difference between buying and selling at gold trading enterprises.

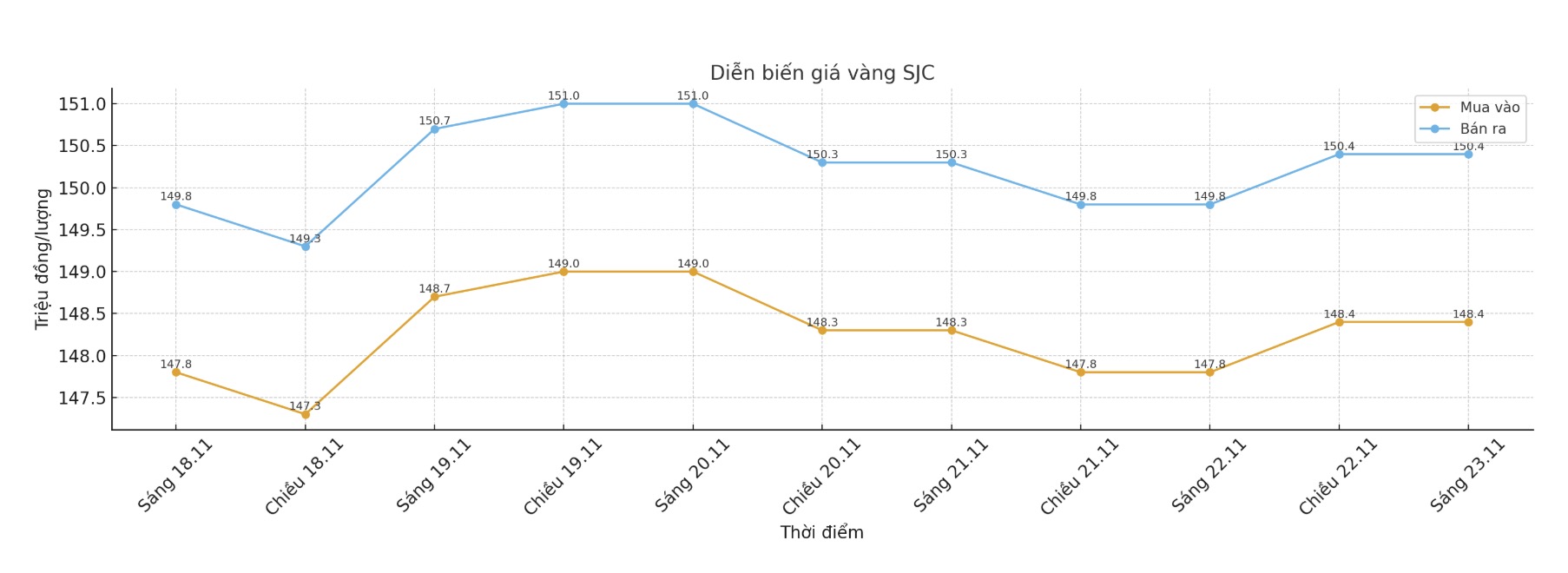

At the end of the trading session on November 23, Saigon Jewelry Company SJC listed the price of SJC gold bars at 148.4 million VND/tael for buying and 150.4 million VND/tael for selling, down 600,000 VND/tael in both directions compared to November 16.

With this price, buyers of SJC gold in the session of November 16 (when the price was listed at 149 million VND for buying and 151 million VND for selling) and sell today must accept a loss of up to 2.6 million VND/tael.

At Bao Tin Minh Chau, the price of SJC gold bars is currently traded at 148.9 million VND/tael for buying and 150.4 million VND/tael for selling. Compared to the price of 149 million VND for buying and 151 million VND for selling last week, those who bought on November 16 and sold today also suffered a loss of about 2.1 million VND/tael, although the adjusted price was not too strong.

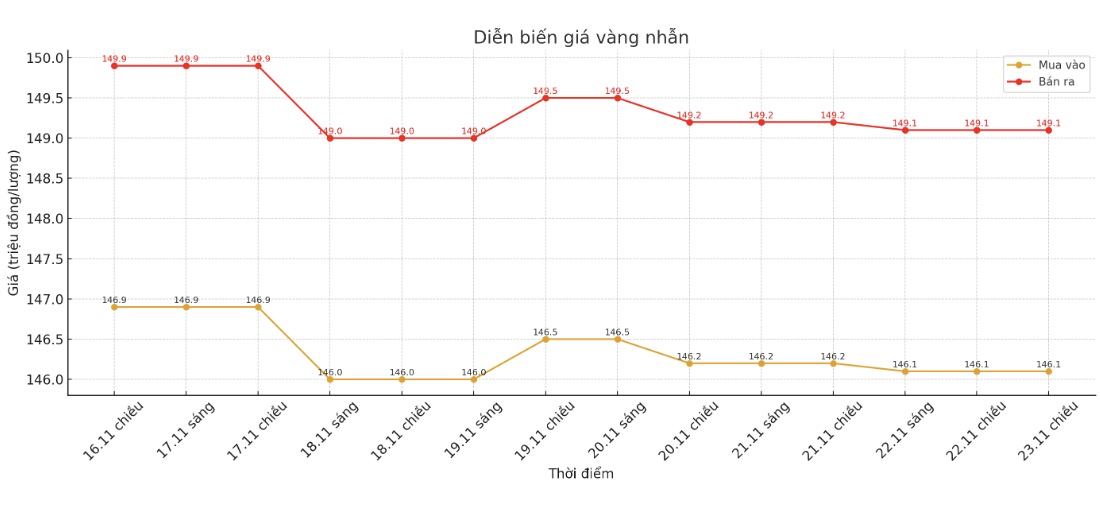

In the 9999 gold ring group, the loss was even heavier. At Bao Tin Minh Chau, gold rings are listed at 147.6 million VND/tael for buying and 150.6 million VND/tael for selling, down 200,000 VND/tael compared to last week. Those who bought at a higher price in the session on November 16 are currently losing up to 3.2 million VND/tael.

Meanwhile, in Phu Quy, gold rings are traded at 147 million VND/tael for buying and 150 million VND/tael for selling, 500,000 VND/tael lower than a week ago. Previous buyers are suffering losses of up to 3.5 million VND/tael.

These are heavy losses compared to actual declines, showing a high risk for those who buy gold during the period of market fluctuations.

The main reason lies in the wide buying and selling price range. For gold bars, the difference ranges from 1.5 to 2 million VND/tael; while gold rings often have a difference of up to 3 million VND/tael.

This causes buyers to almost suffer losses right after the transaction is completed. When gold prices decreased slightly during the week, this difference immediately swelled, causing investors to suffer heavy losses.

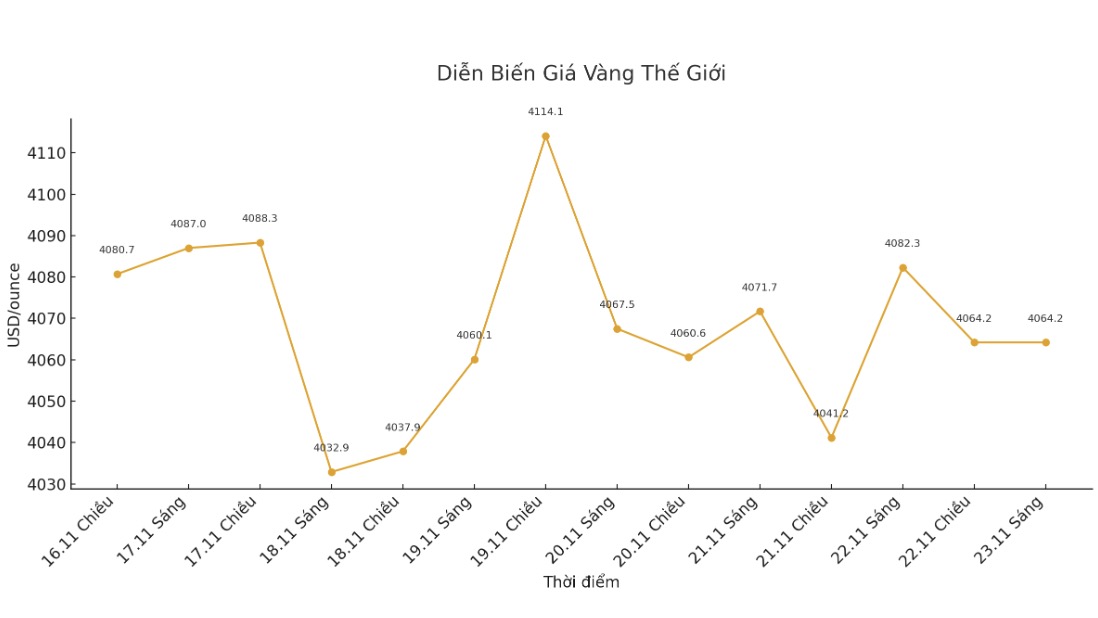

The domestic gold price movement in recent times has been significantly affected by the international market. At the end of the weekend trading session, the world gold price closed at 4,064.2 USD/ounce, down 16.5 USD/ounce compared to a week before.

Although the decrease is not too strong, the weakening of world gold has forced domestic enterprises to adjust to a general trend, contributing to the decline in retail prices in recent days.

In addition to price fluctuations, the domestic gold market is facing many risks when the difference between buying and selling is too high. Currently, the FOMO mentality (fear of missing out) has caused many people to rush to buy gold "surfing" at high prices, without fully assessing the trends and potential risks. This can easily lead to losses when the market reverses.

In addition, signals from the international market are not very positive. The latest weekly gold survey by an international financial information platform shows that experts' views are shifting in a cautious direction.

Of the 13 Wall Street analysts surveyed, only 2 (15%) predict gold prices will increase next week; 4 (31%) predict a decrease and the majority - 7 experts (54%) expect prices to remain flat. This trend of pessimistic or neutral assessment creates the risk that world gold may continue to correct, leading to downward pressure on domestic gold prices.

See more news related to gold prices HERE...