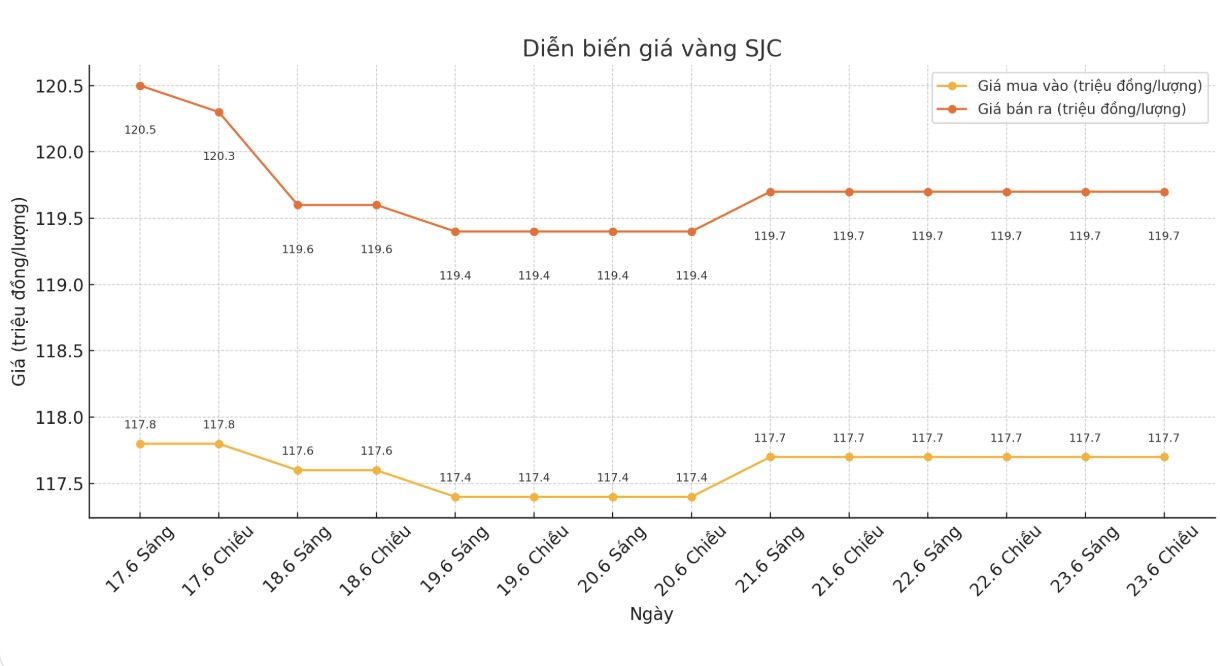

SJC gold bar price

As of 6:00 a.m. on June 24, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7/19 7.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 7.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

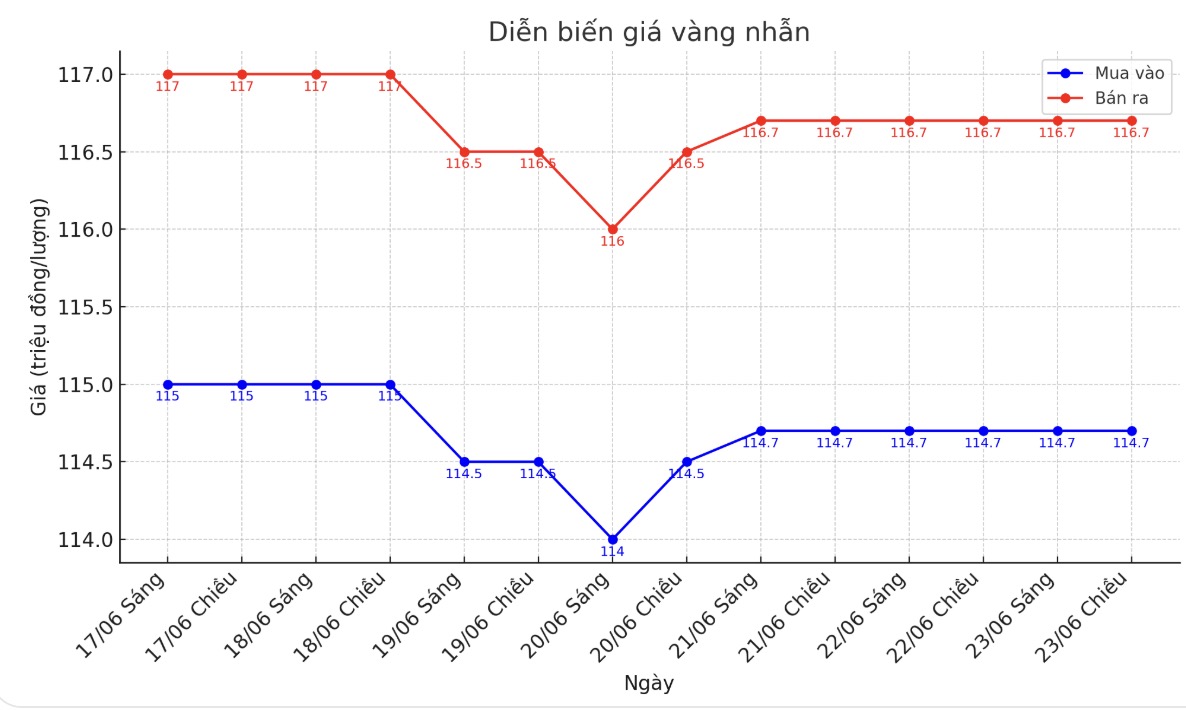

9999 gold ring price

As of 6:00 a.m. on June 24, Bao Tin Minh Chau listed the price of gold rings at VND 114.6-117.6 million/tael (buy in - sell out), an increase of VND 100,000/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

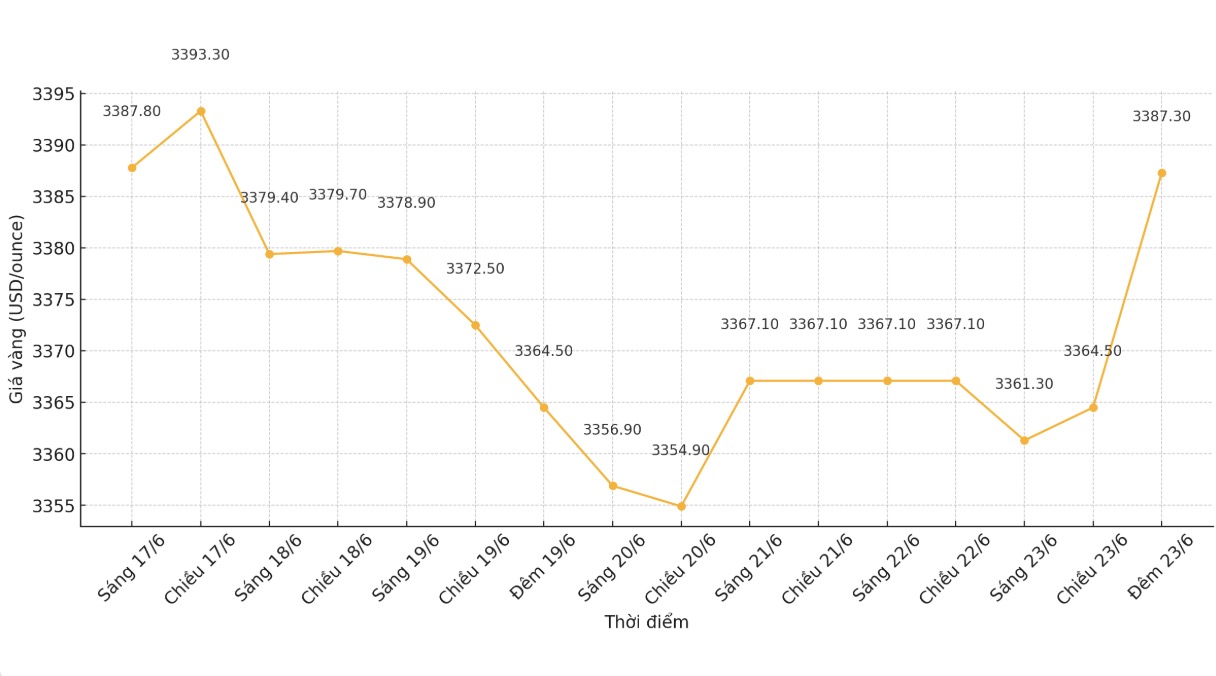

World gold price

The world gold price listed at 55 p.m. increased sharply to 3,387.3 USD/ounce.

Gold price forecast

Gold prices received support as concerns about increased risks after the US launched airstrikes on Iran's nuclear plants over the weekend.

August gold contract has just increased by 7.5 USD to 3,393.2 USD/ounce. July silver price has just increased by 0.108 USD to 36.125 USD/ounce.

David Morrison from Trade Nation said that it is noteworthy that there was no wave of escape from risky assets in the second session. The general view seems to be that the US will participate at a limited military level but effectively, significantly weakening Iran's nuclear ambitions.

Investors also believe that Iran's retaliatory capabilities have been severely limited. The situation is still fluctuating. It is not yet clear how successful the US has been and whether this military action will continue. At the same time, there is much speculation about how Iran will react, if it has the ability. Investors are looking at everything quite optimistically.

Asian and European stocks traded in opposite directions overnight. US stock indexes are also expected to open slightly in New York.

Technically, the August gold contract still has a clear technical advantage in the short term. The next target for buyers is to close above the resistance level of 3,476.30 USD/ounce. The nearest target for the sellers is to push the price below 3,300 USD/ounce.

The first resistance was the night peak of $3,413.8/ounce, followed by $3,450/ounce. First support was last week's low of $3,356.20 an ounce, followed by June's low of $3,313.10 an ounce.

In outside markets, the USD index is higher. Nymex crude oil prices increased and traded around 74.75 USD/barrel. The yield on the 10-year US government bond is currently at 4.39%.

Economic data to watch this week

Tuesday: US consumer confidence; Chairman of the US Federal Reserve (FED) auctioned before the House Financial Services Committee.

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...