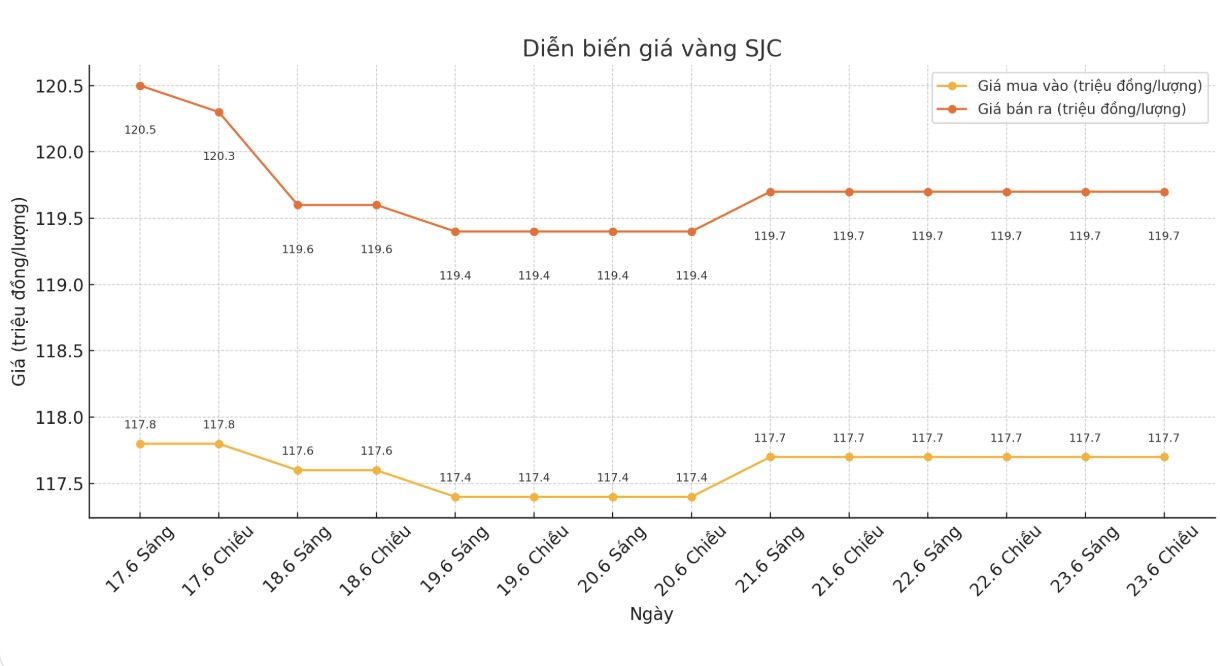

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 hydrologically and 7.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 7.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

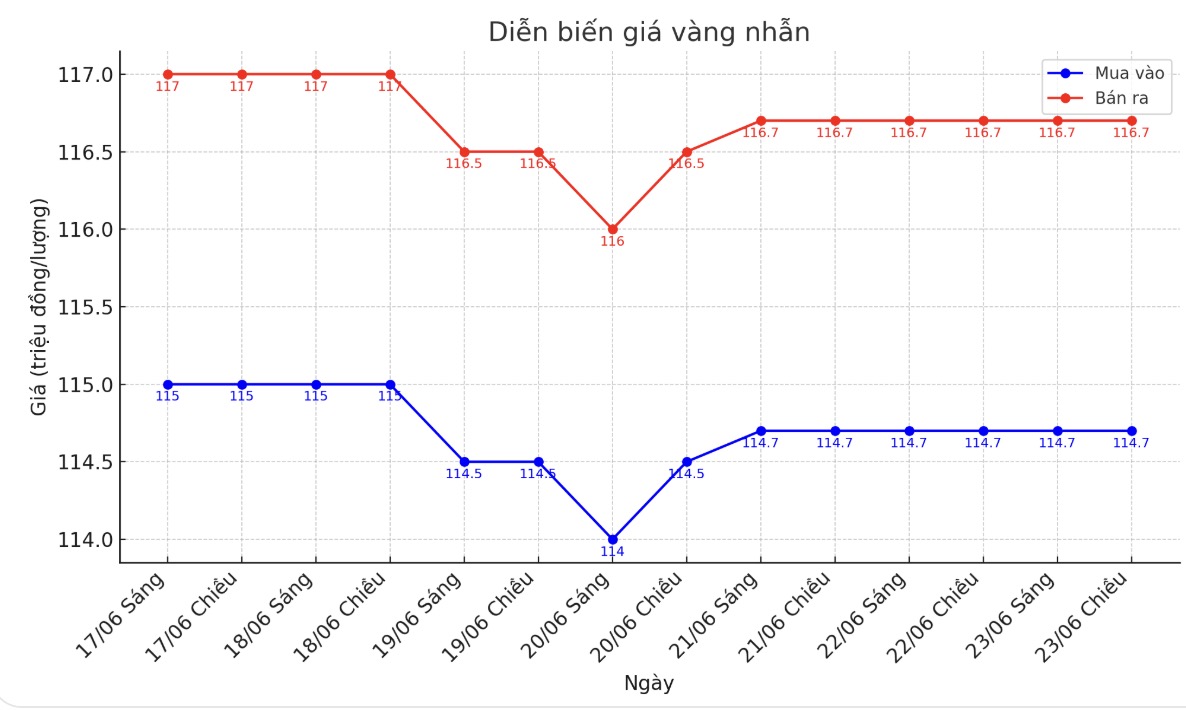

9999 gold ring price

As of 5:00 p.m., Bao Tin Minh Chau listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

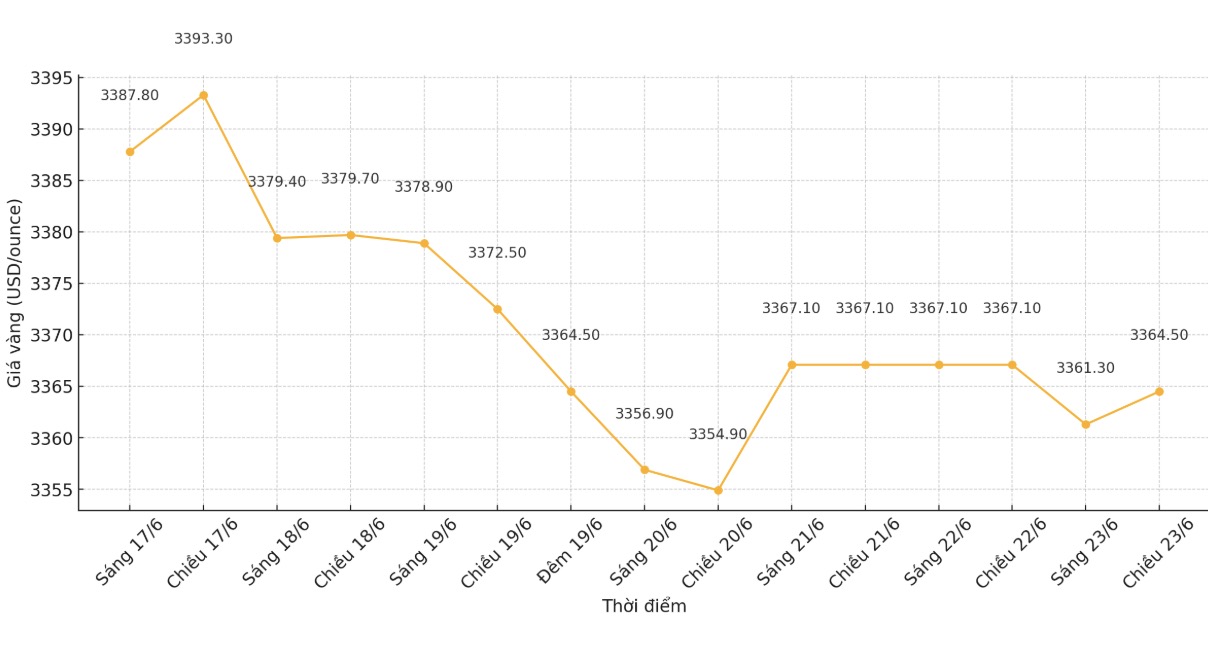

World gold price

The world gold price was listed at 5:00 p.m. at 3,364.5 USD/ounce, down 2.6 USD.

Gold price forecast

Gold prices fell slightly in the trading session on Monday as the USD maintained its upward momentum, while investors remained cautious, watching for the possibility of Iran retaliating against US airstrikes on nuclear facilities.

The US dollar rose 0.4% against other currencies, making gold more expensive for foreign buyers.

Ole Hansen, head of commodity strategy at Saxo Bank, said: Higher energy prices could delay the US Federal Reserves (FED) interest rate cut and strengthen the USD.

He added that continued and multidimensional geopolitical uncertainties will continue to support and prevent gold prices from adjusting further.

Iran and Israel responded to each other's missile and airstrike attacks, as the world awaited Tehran's response after the US attack on Iran's nuclear facilities. US President Donald Trump also mentioned the possibility of regime change in this Islamic Republic.

Iran has said it will defend itself after the US dropped a 30,000-pound leaked bomb on a mountain above Iran's Fordow nuclear facility.

The US airstrike increased uncertainty about inflation prospects and economic growth. This week, the market is also under pressure as it rushes to receive economic data and follow Fed Chairman Jerome Powell's two-day hearing before the National Assembly.

Last week, the FED kept interest rates unchanged but lowered the prospect of cutting interest rates due to the more difficult economic situation. Investors are now expecting a total of 50 basis points cut by the Fed by the end of this year, starting in October.

Gold often benefits in a low interest rate environment and when uncertainty increases.

Rich Checkan, chairman of an asset management company, believes gold could rebound: Mid-East tensions are escalating, while golds correction has gone too far. I believe the uptrend is not over yet.

Darin Newsom - market analyst - still rates gold as a long-term safe haven: "Despite short-term selling, global economic and political instability will continue to keep gold as a safe haven".

On the contrary, Adrian Day - Chairman of a fund management company - said that China's buying momentum is slowing down: "Western demand has increased but not strong enough to make gold prices break out. If there are no unexpected events, gold will move sideways or decrease slightly.

Adam Button - a currency strategist - commented: "Gold is currently reacting to the risk of war in Iran. If I knew the exact situation of the war, I would immediately know the direction of gold prices. Even if gold failed to surpass the April peak, the current price is still quite positive.

In other precious metals, spot silver rose 0.4% to $36.12 an ounce, platinum rose 2.3% to $1,293.9 an ounce.

See more news related to gold prices HERE...