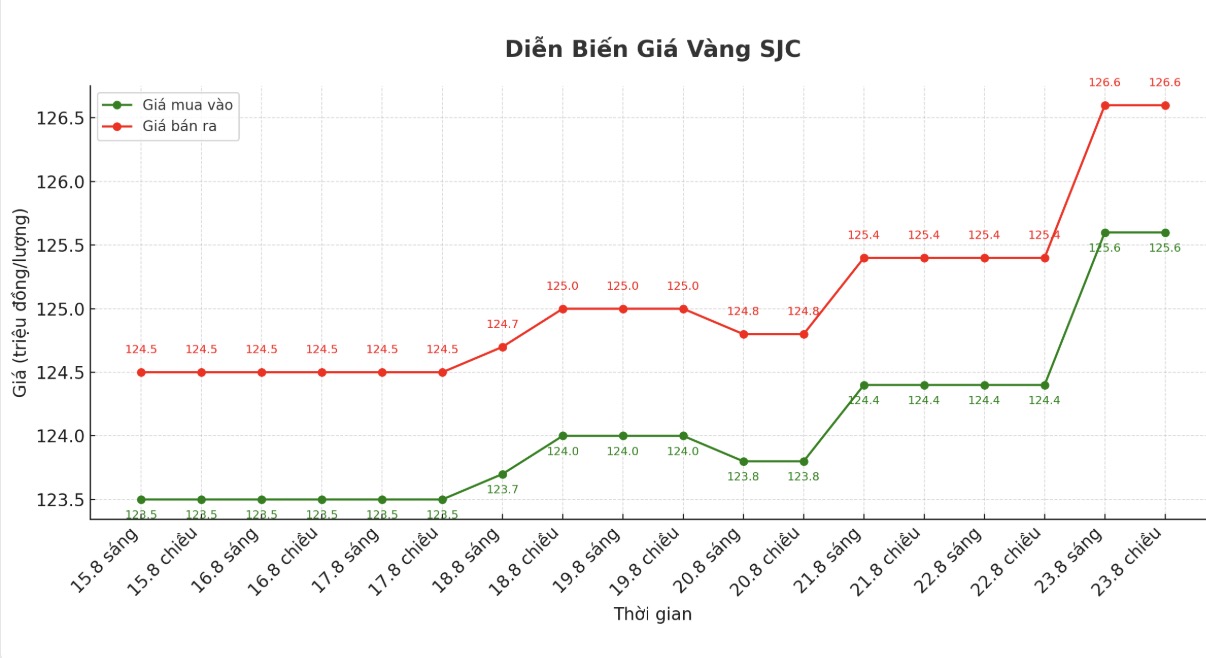

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND125.6-126.6 million/tael (buy in - sell out), a sharp increase of VND1.2 million/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-126.6 million VND/tael (buy - sell), a sharp increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 124.6-126.6 million VND/tael (buy - sell), a sharp increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

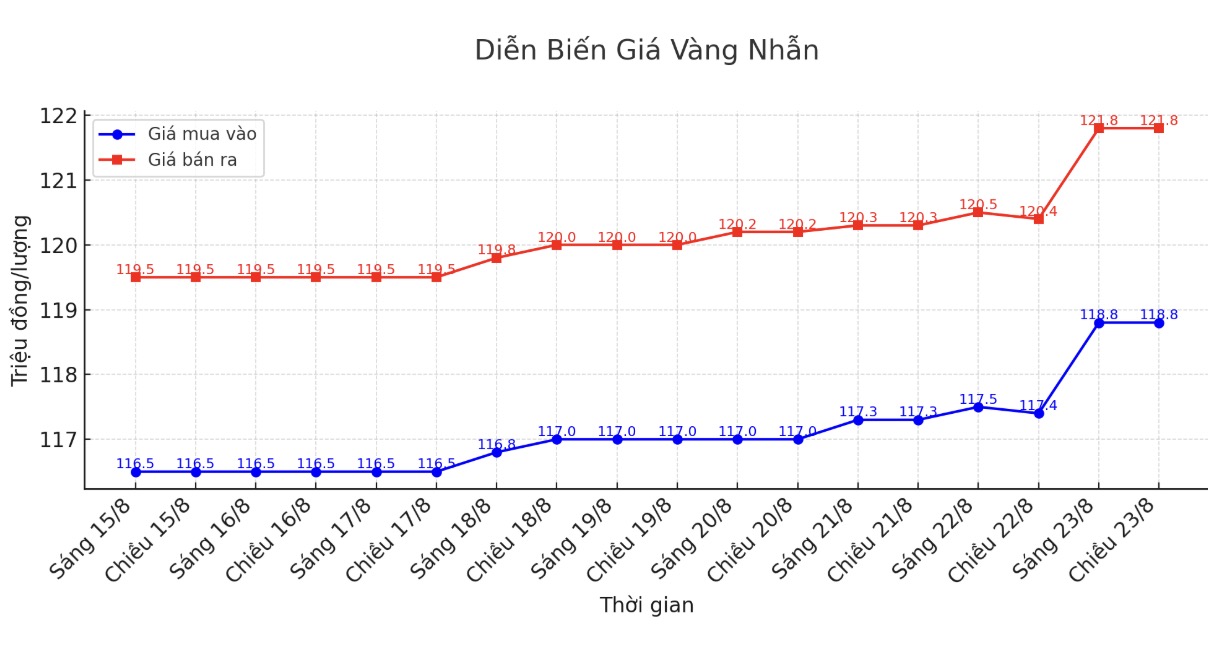

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 118.7-121.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 118.3-121.3 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

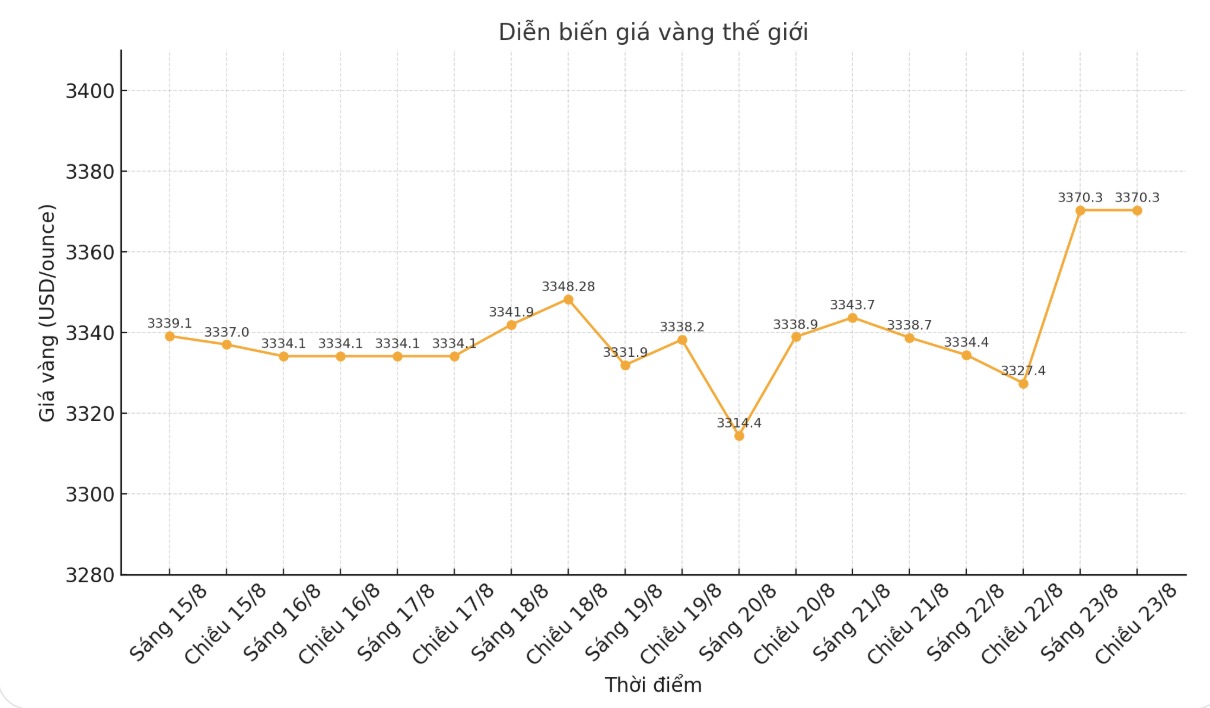

World gold price

The world gold price was listed at 6:00 a.m. at 3,370.3 USD/ounce.

Gold price forecast

On Friday, in a much-anticipated speech at the annual meeting of the US Federal Reserve (FED), Mr. Powell - Chairman of the FED paved the way for the possibility of interest rate cuts from next month. He highlighted the risks of rising inflation and slowing economic growth. However, he also said that while risks are balanced, US monetary policy may need to be adjusted.

Mr. Powells speech really surprised many people. This statement is clearly understood by the market as dovish, bringing gold prices back to an upward trajectory this week. We believe that the recent weakening period is a good opportunity, because from now on, the precious metal is likely to continue to move up, said Naeem Aslam - Investment Strategy Director at Zaye Capital Markets.

Ole Hansen - Head of Commodity Strategy at Saxo Bank, said that although the gold market was still quite quiet in the summer, the FED opened the door for interest rate cuts until the end of the year.

In this context, the yield curve will be steeper and the USD will weaken, which is a positive environment for gold. Although the summer market is still quiet, it is difficult to think that prices will not be higher next week or in the long term, he said.

Michael Brown, senior market analyst at Pepperstone, said that while Mr. Powell's comments could trigger a strong rally in gold prices, there are still some unanswered questions regarding Powell's future policy direction.

Powell has clearly supported the idea of a rate cut in September, but I think the focus will quickly shift to whether it will be a series of cuts, or just a one-time cut and stop, he said.

This week, 13 market analysts participated in a gold survey, and none predicted a decrease in prices. Eight analysts (62%) see gold rising next week. Meanwhile, five analysts (38%) are neutral on the precious metal.

Meanwhile, Kitco's online poll recorded 194 votes, showing that retail investors on Main Street are also less optimistic than before, but still maintain confidence in gold's prospects.

115 retail traders (59%) expect gold prices to rise next week, 35 (18%) see gold falling, and the remaining 44 (23%) see gold prices moving sideways in the short term.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...