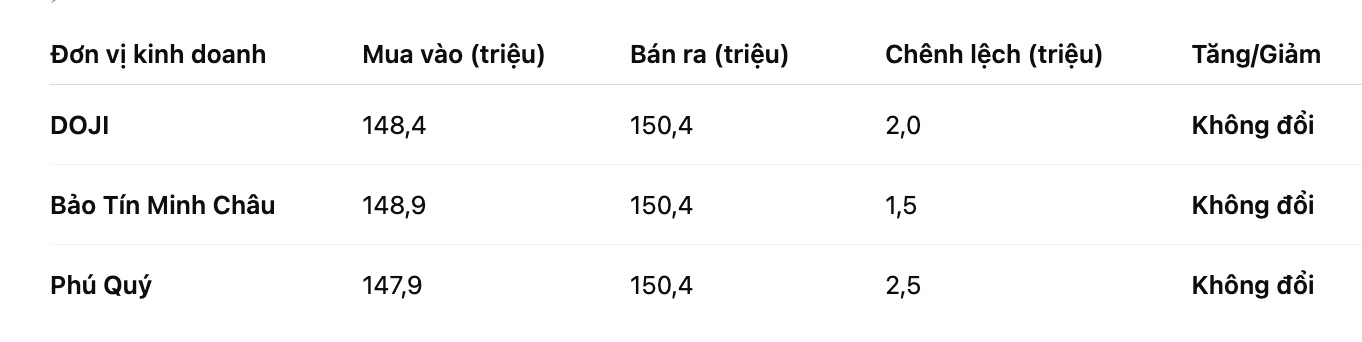

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 148.4-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.9-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.9-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.8-149.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

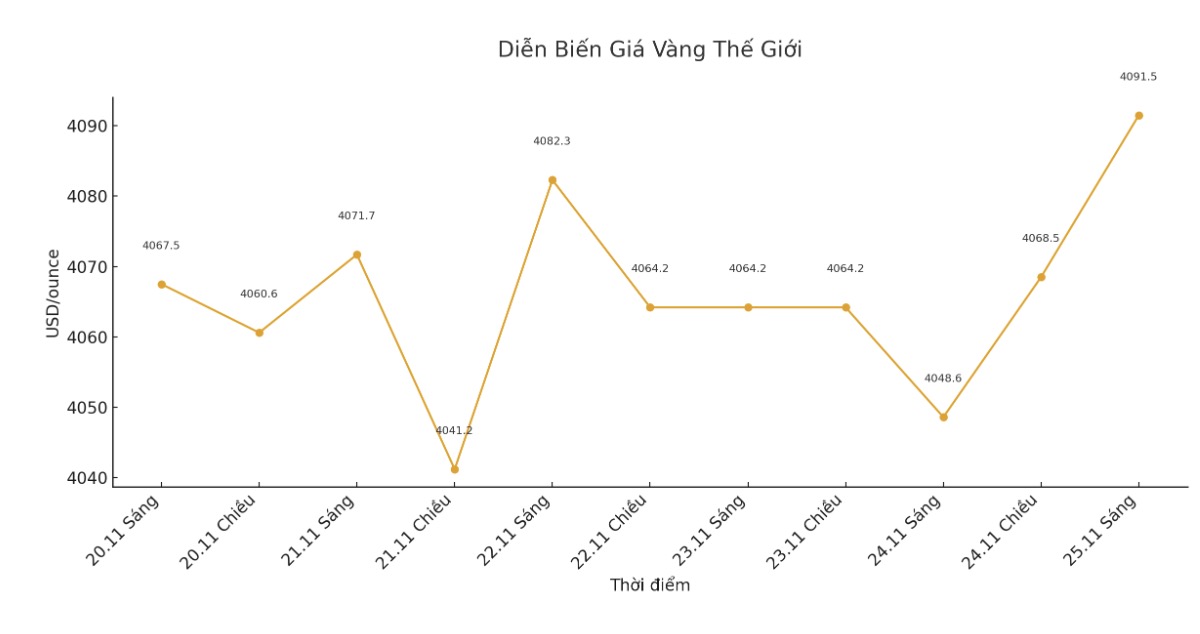

World gold price

The world gold price was listed at 1:44 am at 4,091.5 USD/ounce, up 27.3 USD/ounce.

Gold price forecast

Gold prices surged, starting a quiet trading week due to shortened trading time during the US holiday. Traders and investors are waiting for a series of dense US economic data to be released on Tuesday and Wednesday.

December gold contract increased by 16.6 USD, to 4,096.2 USD/ounce. December delivery silver price increased by 0.342 USD, to 50.245 USD/ounce.

US economic data will be released on Tuesday, including September retail sales, September manufacturing price index (PPI), pending home sales, Richmond FED's business survey, monthly home price index, consumer confidence index, trade and manufacturing inventories, and the Ministry of Finance's monthly budget report.

On Wednesday, there will be a weekly jobless claims report, a long-term goods order, a second Q3 GDP estimate, a preliminary economic index report, an ISM Chicago survey, personal income and spending (including important inflation measures), new housing sales, DOE's weekly liquidity inventory report and the Federal Reserve's Be Book.

Technically, the next upside target for December gold delivery contracts is to close above the strong resistance level at the November peak of 4,250 USD/ounce. The short-term downside target for the bears is to pull the price down below the strong technical support zone at $4,000/ounce.

The first resistance level was at 4,100 USD/ounce, followed by the previous week's peak of 4,134.3 USD/ounce. First support was last night's low of $4,036.4 an ounce, followed by Friday's low of $4,018.1 an ounce.

In the outside market, the USD index increased slightly. Crude oil prices are more stable and trading around 58.5 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.06%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...