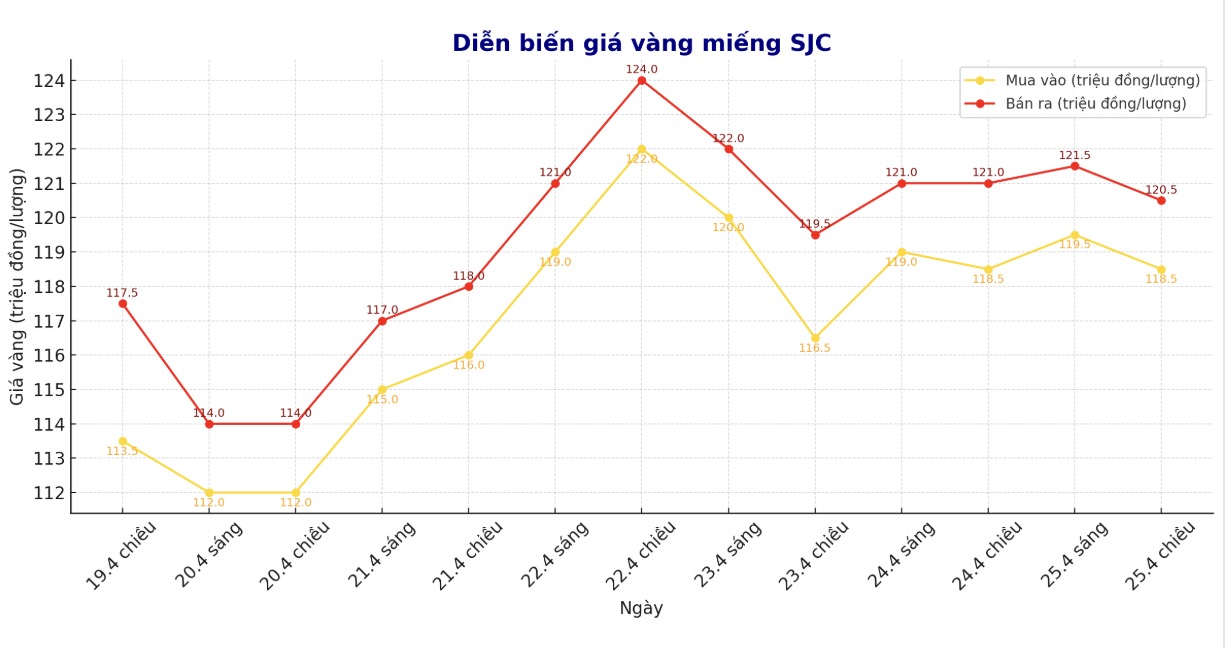

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out); kept the same for buying and decreased by VND 500,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy - sell); kept the same for buying and decreased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell); kept the same for buying and decreased 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.5-120 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

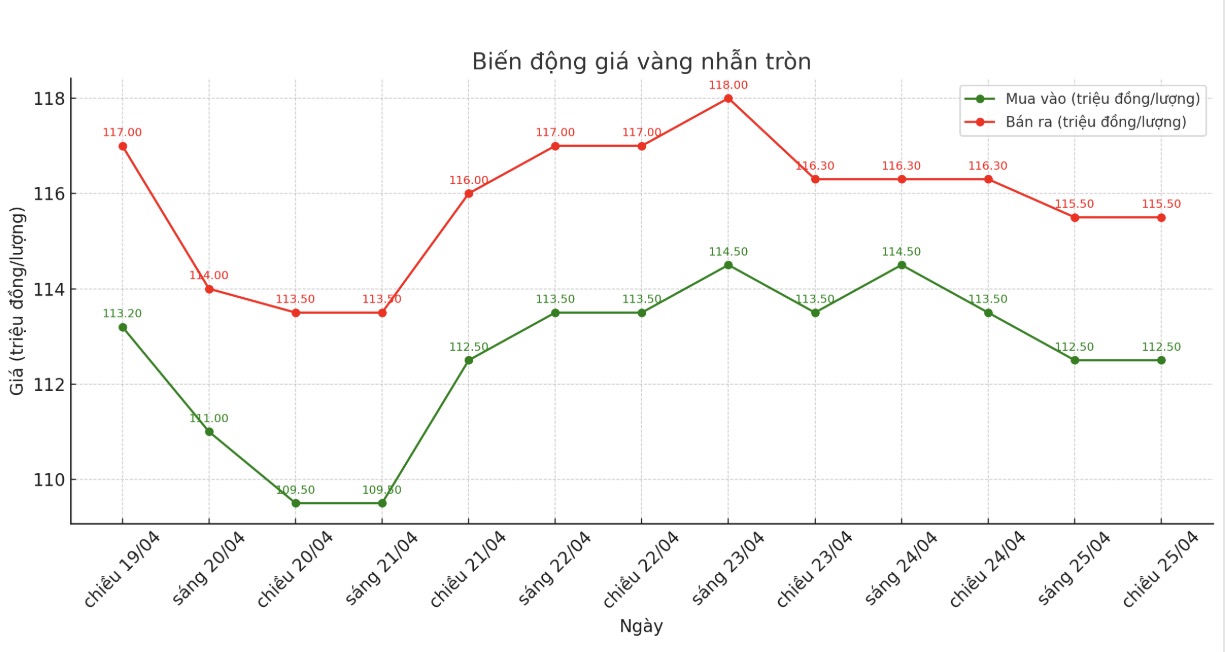

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-125.5 million VND/tael (buy - sell); down 1 million VND/tael for buying and down 800,000 VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-119 1.5 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-118 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

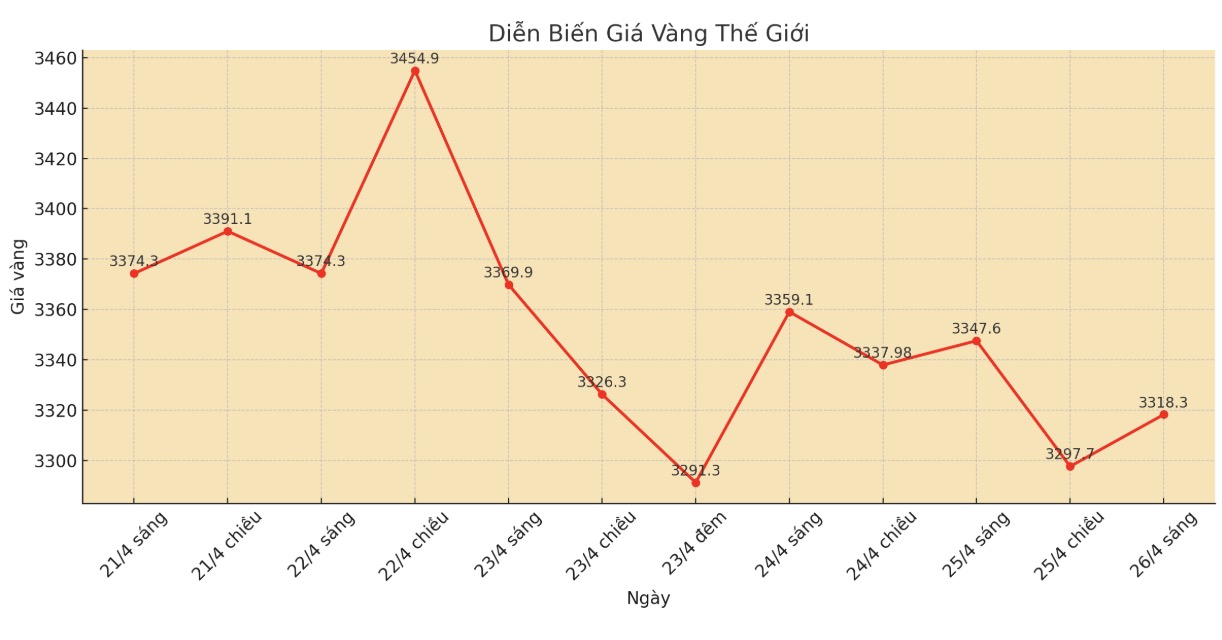

World gold price

As of 6:10 a.m., the world gold price was listed at 3,318.3 USD/ounce, down 18 USD.

Gold price forecast

According to Kitco, gold prices fell sharply as investor sentiment increasing risk appetite increased, putting pressure on safe-haven metals such as gold and silver.

Gold prices for June delivery are currently down 41.6 USD to 3,307 USD/ounce. The price of silver delivered in May decreased by 0.228 USD to 33.275 USD/ounce.

The Asian and European stock markets mostly increased points in the last session. US stock indexes are expected to open slightly down.

Jim Wyckoff - senior analyst at Kitco commented that it seems that the tension in US-China relations is showing signs of cooling down, as both sides have shown a desire to negotiate trade and have had low-level meetings. This contributes to improving investment sentiment in the market.

In addition, there are other geopolitical factors that are being noted. Some sources said that senior official of Donald Trump's administration, Steve Witkoff, is about to meet Russian President Putin. At the same time, there is information that the US and Israel could destroy Iran's nuclear capabilities if the country does not agree to the deal.

According to Jim Wyckoff, although gold prices are under quite strong selling pressure this week, the above geopolitical factors may help gold prices soon find a bottom.

Technically, June gold prices still have a short-term technical advantage. The target for buyers is to close above the strong resistance level of 3,509.90 USD/ounce. The downside target for the bears is to bring prices below the support level of $3,200/ounce.

The first resistance was at $3,350/ounce, followed by $3,384.1/ounce. First support was $3,296 an ounce and then $3,270.8 an ounce.

Overseas markets are currently showing a slight increase in the USD index. Nymex crude oil prices weakened, trading around $62/barrel. The yield on the 10-year US Treasury note is currently at 4.288%.

Note: Compare the article data with the same previous trading session.

See more news related to gold prices HERE...