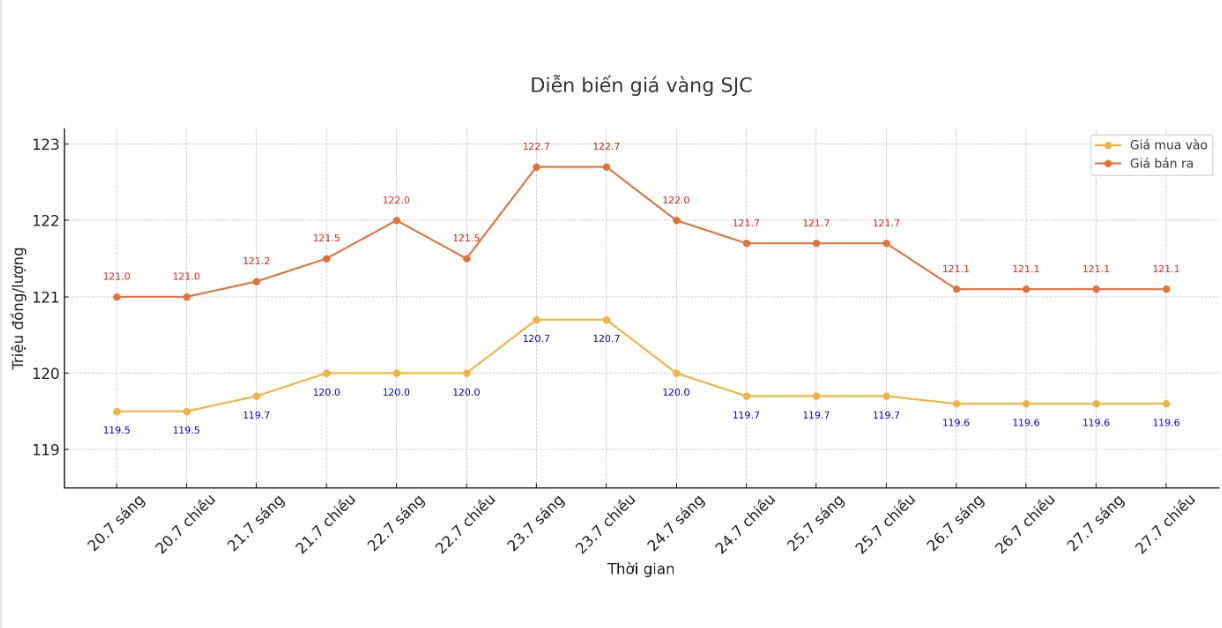

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.6-121.1 million/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.6-121.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.3 million VND/tael.

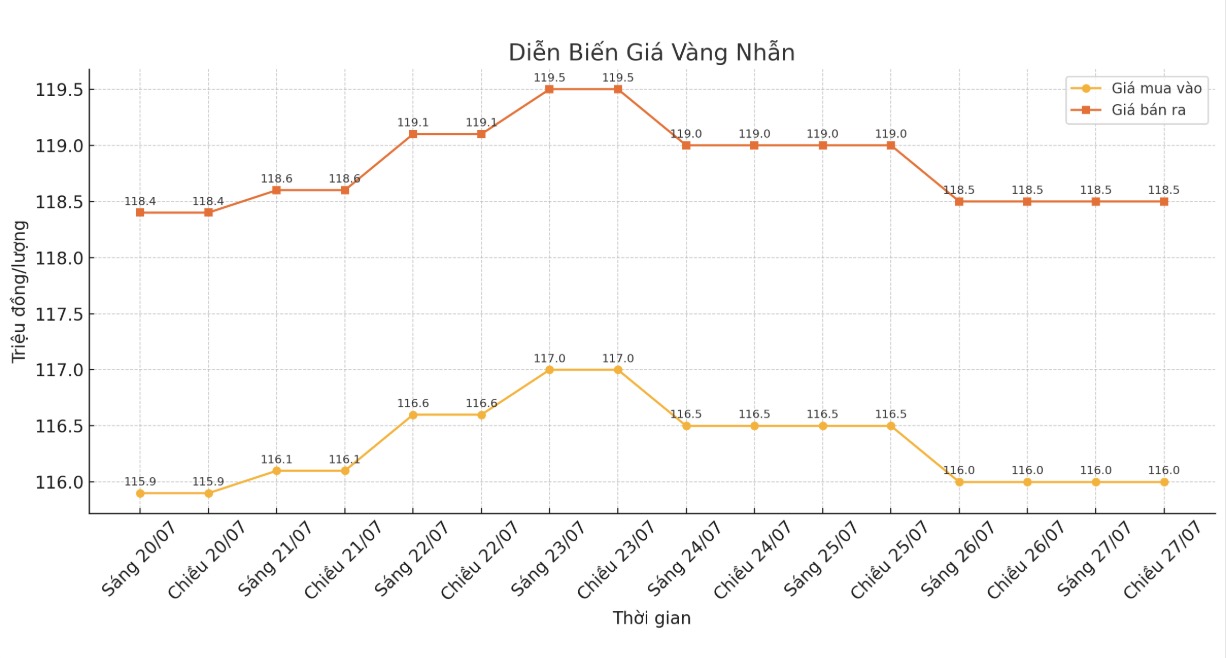

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out). The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

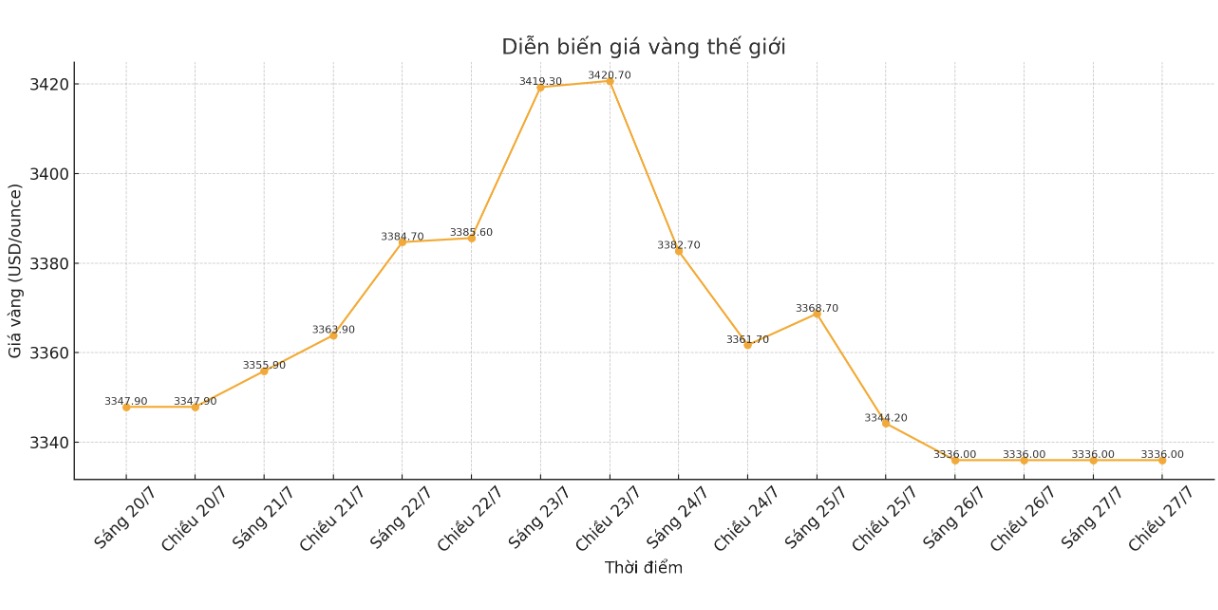

World gold price

The world gold price was listed at 6:00 a.m. at 3,336 USD/ounce.

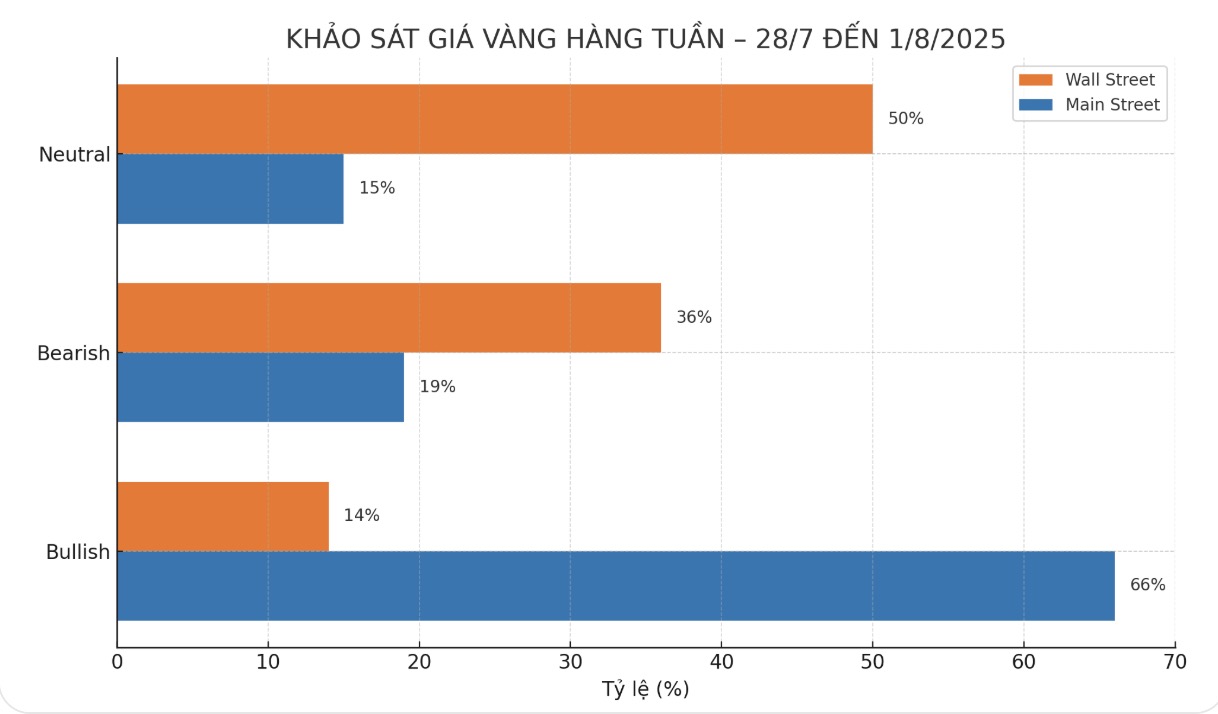

Gold price forecast

FxPro senior analyst Alex Kuptsikevich said gold is facing the risk of a deep correction if it continues to fail to maintain above $3,450/ounce a price that has been denied four times since April. According to him, if the trend is broken down for the average of 50 days, prices could quickly fall to the 3,150 or even 3,050 USD/ounce zone.

For his part, Mr. Daniel Pavilonis - senior commodity broker at RJO Futures commented that gold prices may weaken in the context of inflation not exploding as expected and bond yields continuing to decrease. He also noted the possibility of real estate reallocation by investors, causing cash flow to temporarily withdraw from gold.

Meanwhile, Adrian Day - Chairman of Adrian Day Asset Management - predicted that gold will continue to fluctuate within a narrow range as from mid-April until now. He emphasized that only when there are strong enough puts such as economic crises, surprise policies or major changes from the Fed, can gold make a clear breakthrough.

According to James Stanley, senior market strategist at Forex.com, what the market is seeing is just a temporary correction. If the Fed continues to maintain expectations of a rate cut this year without being too dovish, gold will continue to benefit - as it has for the past year and a half, he said.

Mr. Kevin Grady - Chairman of Phoenix Futures and Options - said that the slight adjustment of the gold market due to positive news from trade agreements is normal. However, he emphasized that gold can still increase in parallel with stocks, especially when central banks continue to buy strongly and the trend of separating from the USD is becoming increasingly clear.

Economic data to watch this week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...