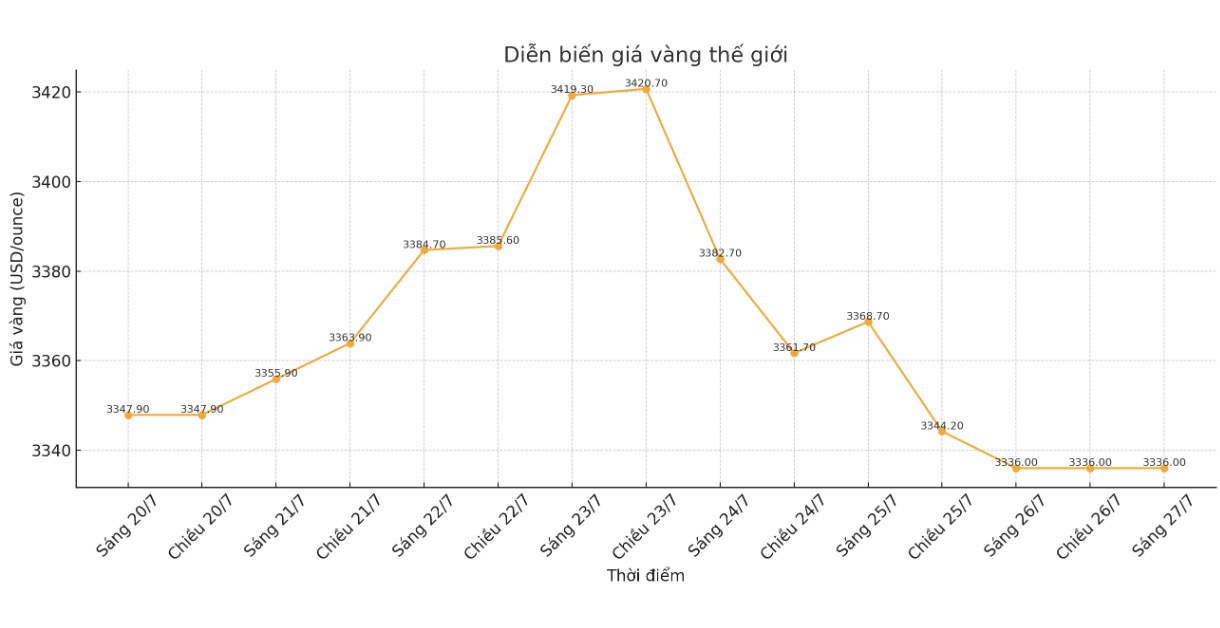

Gold prices opened the week with a strong increase above the 3,400 USD/ounce mark, but changing market sentiment caused many investors to take profits, pushing prices down to the support zone of nearly 3,300 USD/ounce. Meanwhile, silver hit a 14-year high of $29.527 on Tuesday, but is currently testing the $38/ounce support zone.

The latest spot gold price was at 3,328.4 USD/ounce, down more than 1% for the day and 0.62% for the week. Spot silver was at 38.05 USD/ounce, down 2% on the day and almost flat for the week.

Mr. Phillip Streible - chief strategist at Blue Line Futures said gold is struggling as investors shift their attention to the stock market at record valuations.

He added that gold is also under pressure as the US and Japan announced the possibility of signing a trade agreement, imposing a 15% tax on Japanese imports to the US. The deal could also be the basis for negotiations with the European Union. President Donald Trump believes the possibility of reaching an agreement with the EU is 50/50.

Trade wars tend to ease, so demand for safe havens like gold has also decreased. Instead of seeking risk hedging tools, investors are drawn to positive profit reports and trade expectations, Streible said.

Mr. Streible said that gold prices may continue to decline next week, as the US Federal Reserve (FED) is expected to keep interest rates unchanged after the monetary policy meeting. The Fed's neutral policy could support the USD in the short term.

However, he added that gold could be supported if US labor market data is weaker than expected by the end of next week.

any signs of weakness in the labor market, which could prompt the Fed to consider cutting interest rates, will be a positive signal for gold, he said.

Sharing the same view, Ms. Barbara Lambrecht - commodity analyst at Commerzbank said that the investment trend in gold has reached its peak in the short term, especially when the FED has no plans to cut interest rates at the upcoming meeting.

Mr. Alex Kuptsikevich - chief analyst at FxPro, commented that this is the fourth time gold prices have failed to surpass the 3,400 USD/ounce mark, and technical risks are increasing. Currently, gold prices are trading near the 50-day average.

If prices fall sharply below this average line next week, it will be a signal that the trend has shifted from accumulation to adjustment. In the adjustment scenario, gold prices could fall sharply to the 3,150 or even 3,050 USD/ounce zone. The above target is near the peak before " released" day (a metaphor for April 2, 2025 - when US President Donald Trump announced the "Liberation Day" tariff package), corresponding to a withdrawal of 61.8% since the increase at the end of last year. The target below is a 50% retreat area, near the 200-day average" - he commented.

Although gold may continue to fall, some experts see this as a buying opportunity.

Meanwhile, Mr. Aakash doshi, head of global gold strategy at State Street Global Advisors, said that gold still has a solid foundation as an important monetary asset. Although risk-off sentiment has caused stocks to hit a new peak, gold prices are still less than 5% below the April peak.

There are many structural reasons why spikes like this are still a buying opportunity, he said.

Looking ahead at next week's Fed meeting, doshi remains optimistic that gold will regain its upward momentum in August, as the Fed may abandon a neutral stance at the annual Jackson Hole meeting in Wyoming.

While gold is struggling, experts are not giving up hope for silver. Mr. Christian Magoon, CEO of Amplify ETFs - the manager of Junior Silver Miners ETF (SILJ), said that successful US trade deals could bring stability to the manufacturing sector, thereby boosting industrial demand for silver.

Economic data to watch next week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.