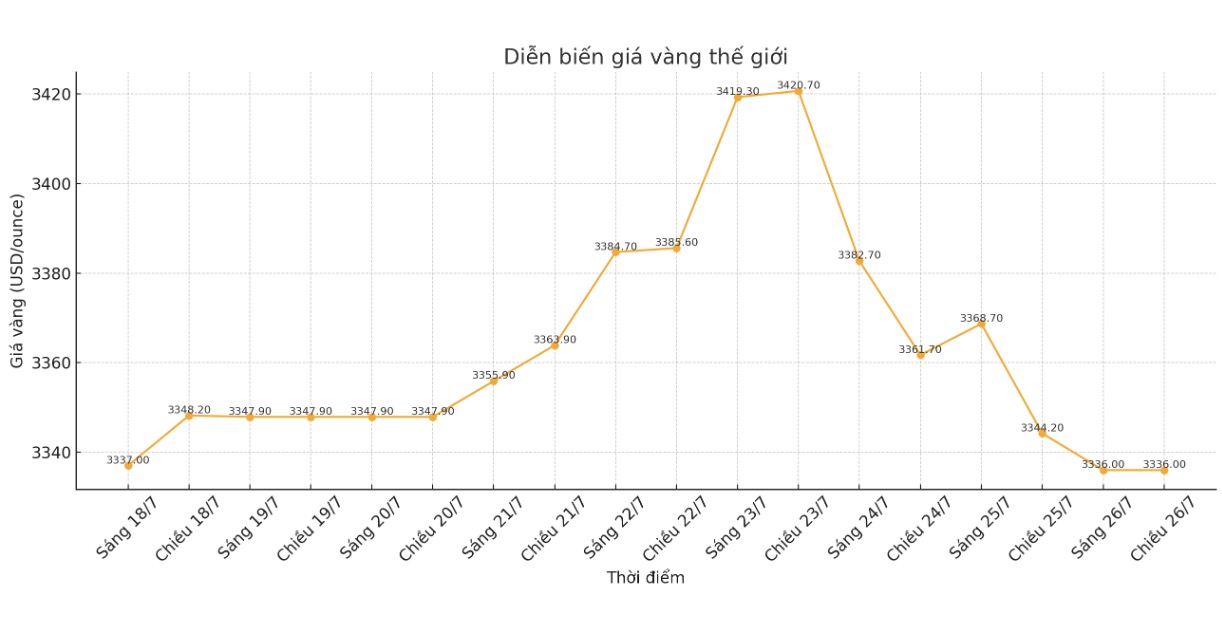

Gold and silver prices had a strong breakout until a rally fell right before the finish line. This is the fourth time gold has tried to squeeze to $3,400/ounce, but once again "thrown".

Meanwhile, silver also has the clearest chance in the past 14 years to reach the 40 USD/ounce mark, but the increase is not strong enough to reach the finish line.

This is definitely a familiar story for precious metals investors. Although market trading can discourage many people, this should not be surprising. Gold prices are largely driven by investment sentiment. And in this volatile market, sentiment can change in the blink of an eye.

Gold selling pressure began when there was news that the Donald Trump administration and the Japanese government were about to reach a trade deal, according to which imports from Japan could be taxed at 15%.

There is speculation that this negotiation could be a stepping stone to an agreement with the European Union. US President Donald Trump said on Friday that the possibility of the US reaching a deal with Europe is 50/50.

Uncertainty surrounding Mr Trump's prolonged trade war is the biggest driver of safe-haven demand like gold, so any clear signal will impact this demand.

At the same time, gold's rally is counterproductive as many analysts have commented: High prices will adjust themselves.

Just before the weekend, the China Gold Association (CGA) reported that gold consumption fell 3.54% in the first half of this year. High prices make consumers buy less physical gold, including jewelry. However, investment demand remained strong, with the total value of gold ETFs in China increasing by 8.8 billion USD in the first 6 months of the year, according to the World Gold Council report.

A trend is forming in the commodity analytics world: high prices will continue to reduce physical demand, but economic instability will continue to support investment demand, which is likely to pull gold prices back to record levels by the end of the year.

While the US government has continuously signed trade deals, the unanswered question is: Who will bear these taxes and how?

This week, General Motors reported that US tariff policies have caused their second-quarter profits to fall by 35%. Corporations will have to bear additional costs, affect profits or will transfer this cost to consumers.

The threat of inflation - slow growth but high inflation is a real risk for the US economy, and this is the ideal environment for gold.

Rising inflation and low interest rates will reduce real US yields before the end of the year, making US government bonds less attractive. Meanwhile, gold has shined in a low real yield environment and become a more attractive investment portfolio diversification tool due to reduced opportunity costs, because gold does not yield interest.

The failure of gold and silver to break out is disappointing, but don't ignore the big picture.

See more news related to gold prices HERE...