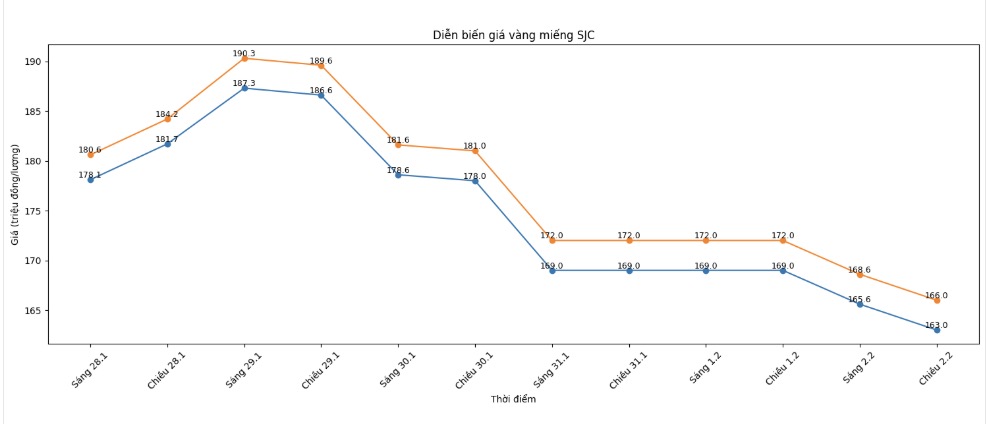

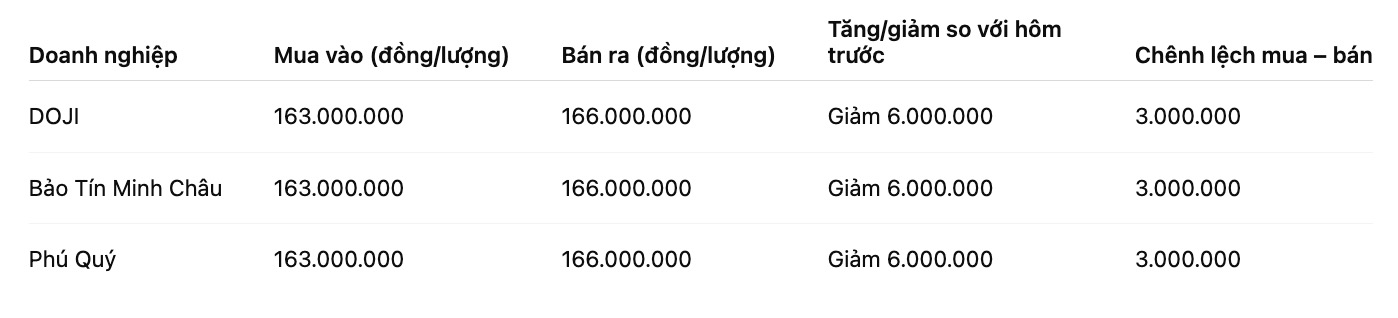

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar prices were listed by Bao Tin Minh Chau at the threshold of 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

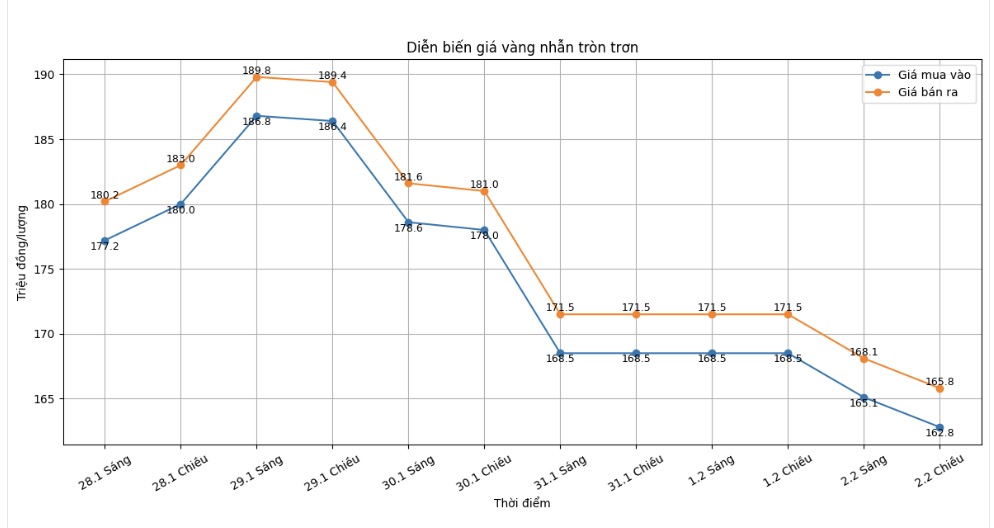

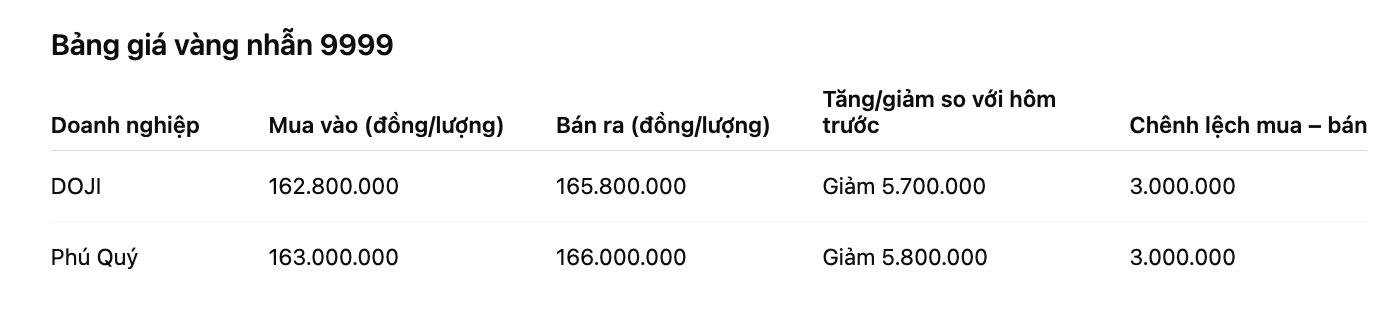

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 162.8-165.8 million VND/tael (buying - selling); down 5.7 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 164.5-167.5 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 163-166 million VND/tael (buying - selling), down 5.8 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

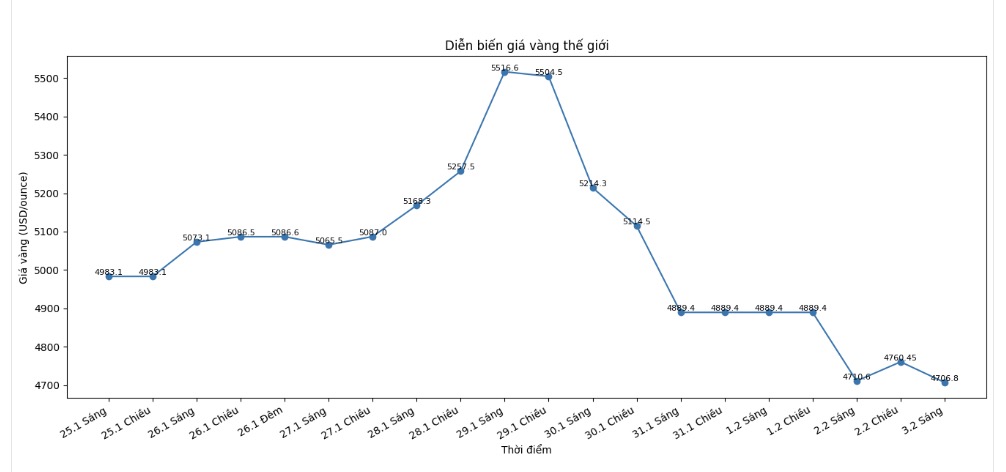

World gold price

At 0:15 AM, world gold prices were listed around the threshold of 4,706.8 USD/ounce; down 53.6 USD compared to the previous day.

Gold price forecast

After a strong correction in recent trading sessions, domestic and foreign gold markets are entering a sensitive phase, when investor sentiment is simultaneously affected by US monetary policy, USD developments and short-term technical factors.

On the international market, gold prices have fallen deeply compared to the historical peak previously set, in the context of the USD rebounding strongly and US bond yields maintaining at a high level. This move stems from concerns that the US Federal Reserve (Fed) may pursue a more drastic monetary tightening stance in the near future, after the US President announced new personnel for the position of Fed Chairman.

In addition, CME Group's raising margin requirements for precious metal futures contracts also increased selling pressure, forcing many investors to narrow their positions, thereby pulling gold prices down sharply in the short term. According to analysts, this is a technical factor that often causes strong corrections but does not necessarily reflect a long-term trend change.

Commenting on this development, Mr. Vivek Dhar, commodity strategist at Commonwealth Bank of Australia, said that gold being sold off along with US stocks shows that the market is reacting to the expectation of a more "hawkish" monetary policy. However, Mr. Dhar still maintains the view that this is mainly a correction, not a structural reversal of the precious metals market.

From a medium and long-term perspective, many major financial institutions still maintain positive ratings for gold. According to JP Morgan, gold buying demand from central banks along with the trend of global investors diversifying assets continues to play a role as a pillar supporting gold prices. The bank forecasts that central banks' gold purchases in the coming years will remain at a high level, creating a foundation for a sustainable upward trend.

For the domestic market, SJC gold and gold rings prices may continue to fluctuate strongly according to world prices in the short term. The buying-selling spread maintained at a high level shows that risks are still present, especially for short-term investors. Buyers need to be cautious, closely monitor international developments and carefully consider when participating in the market, especially in the context of still complex fluctuations.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...