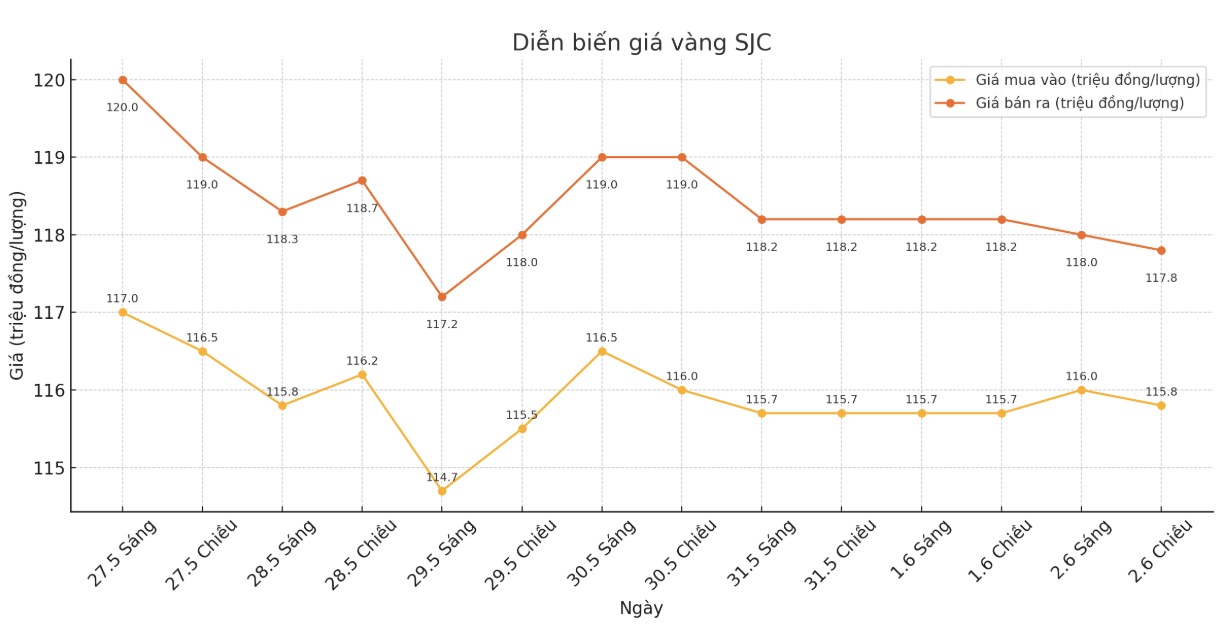

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.8-117.8 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.8-117.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.8-117.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND115.3-117.8 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

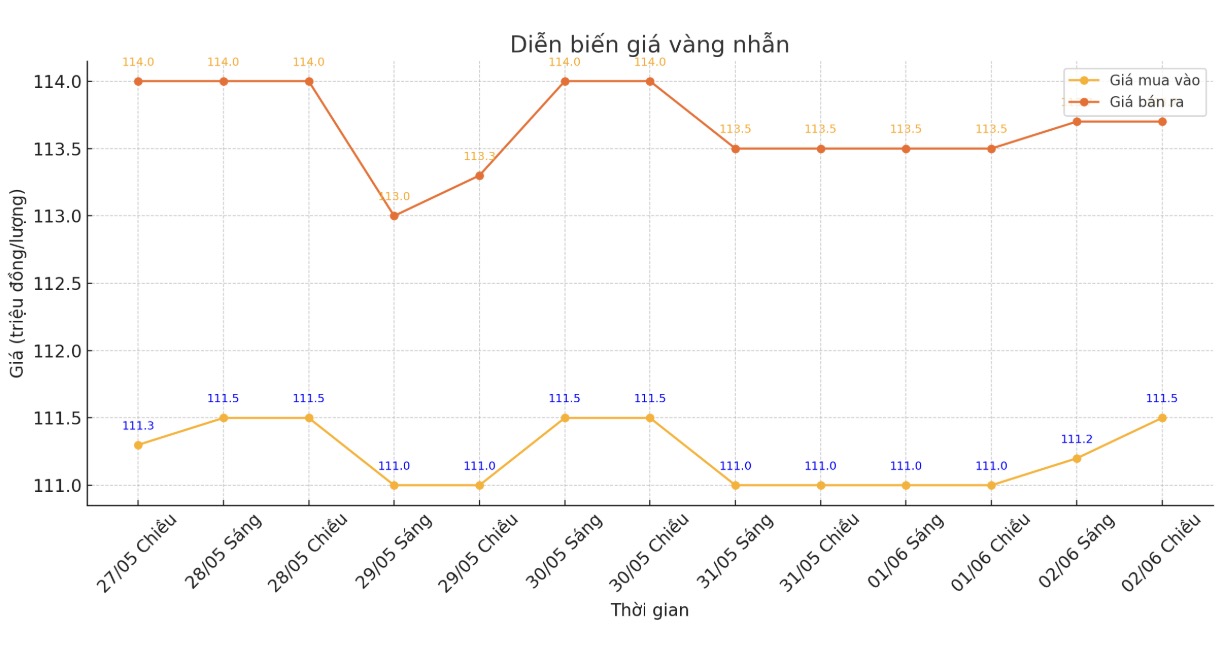

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-113.7 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.8-113.8 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

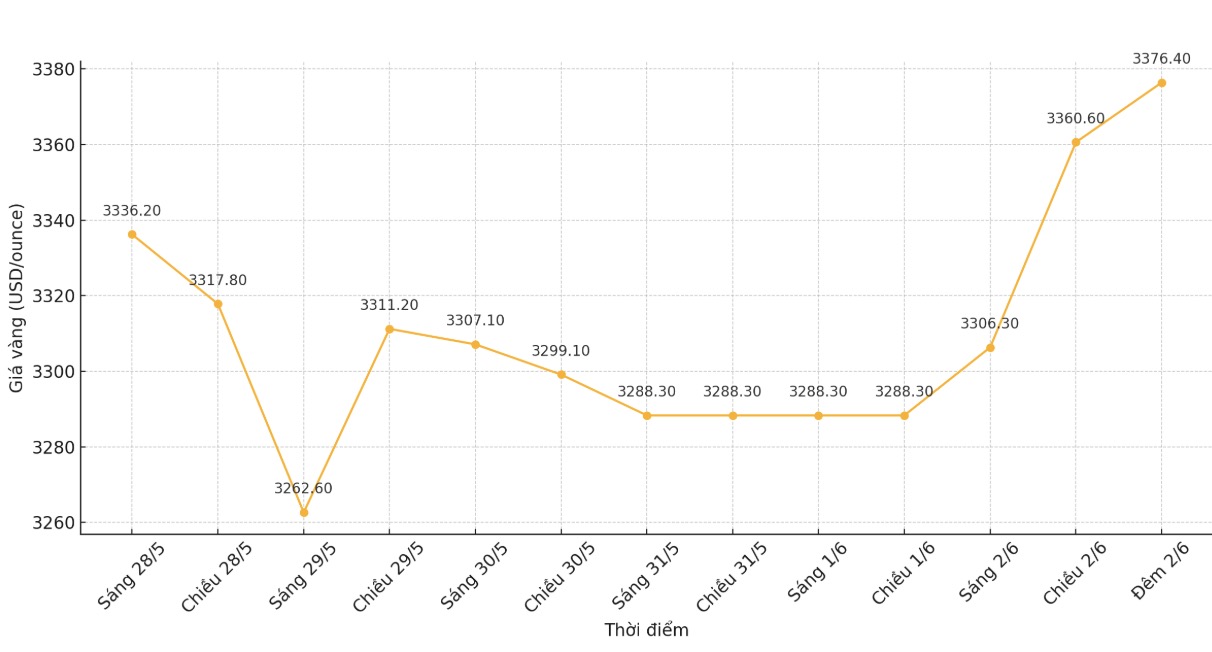

World gold price

At 22:00 on June 2, the world gold price was listed at 3,376.4 USD/ounce, up 88.1 USD.

Gold price forecast

World gold prices increased sharply as safe-haven demand amid US President Donald Trump's threat to re-impose tariffs and escalating tensions between Russia and Ukraine, raising concerns about global trade and geopolitical instability.

The $0.00 (.DXY) index fell 0.6% against the basket of major currencies, after Donald Trump said on Friday that he planned to double import tariffs on steel and aluminum to 50%, while China responded by dismissing allegations of violating the strategic mineral export deal. The weak USD makes gold more attractive to holders of other currencies.

On Sunday, US Treasury Secretary Scott Bessent said that Mr. Donald Trump will soon have a phone call with Chinese President Xi Jinping to resolve the dispute over important minerals.

UBS analyst Giovanni Staunovo commented: Rising risk sentiment, combined with Asian stocks falling, is a factor; in addition, rising geopolitical tensions including the escalation between Ukraine and Russia are boosting demand for safe-haven assets such as gold. The continued US-China trade tensions are also an additional supporting factor for gold prices.

In terms of geopolitics, Russia and Ukraine have increased their attacks as tensions continue to escalate, despite diplomatic efforts, including a large-scale attack by Ukraine and an overnight airstrike by Russian drones.

In the US, Federal Reserve Chairman Jerome Powell is scheduled to speak today, and the market is also waiting for comments from many Fed officials this week to grasp the monetary policy direction.

Golds rally is unlikely to surpass $3,500 an ounce unless trade tensions escalate further, said Zain Vawda, an analyst at MarketPulse at OANDA.

In another development, JP Morgan CEO Jamie Dimon warned at an economic forum that the bond market will be in crisis if the US does not take increasingly serious measures to control public debt. He stressed: "It will happen."

Key outside markets today showed a sharp decline in the USD index. following crude oil prices on Nymex increased sharply, currently trading around 63.5 USD/barrel. The yield on the 10-year US government bond is currently at 4.52%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...