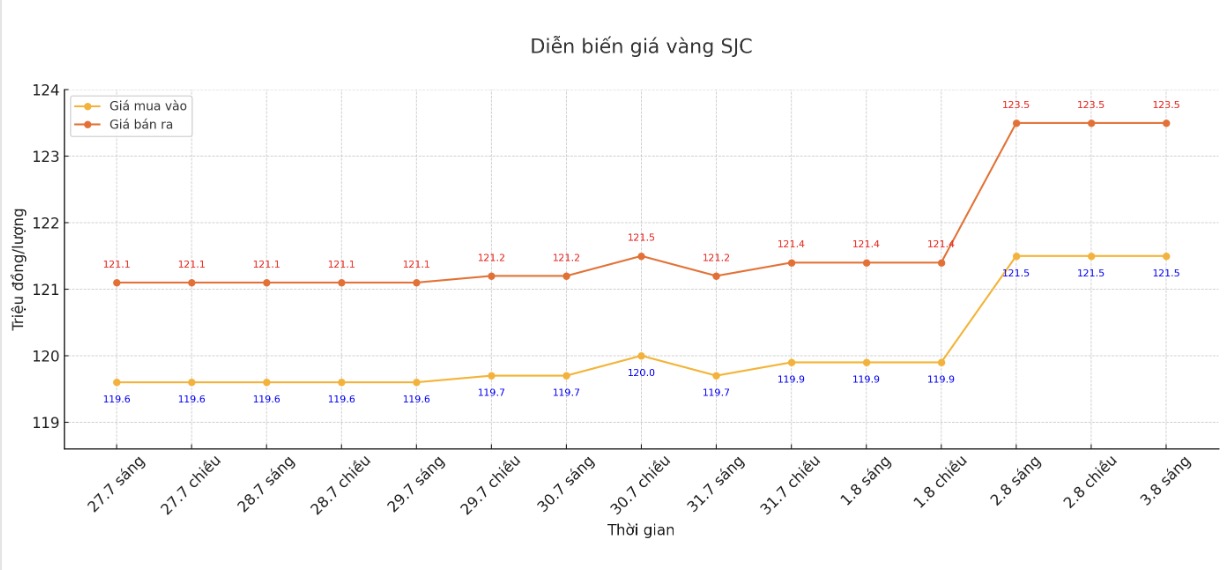

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 121.5-124.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 121.5-123.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 120.5-123.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

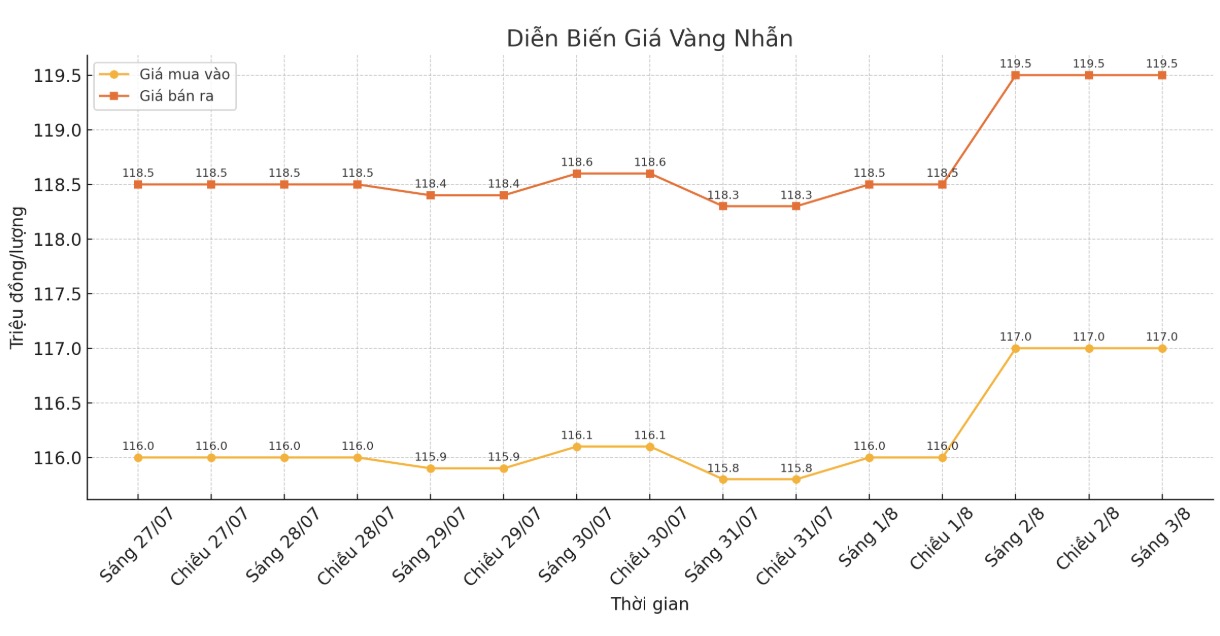

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out). The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

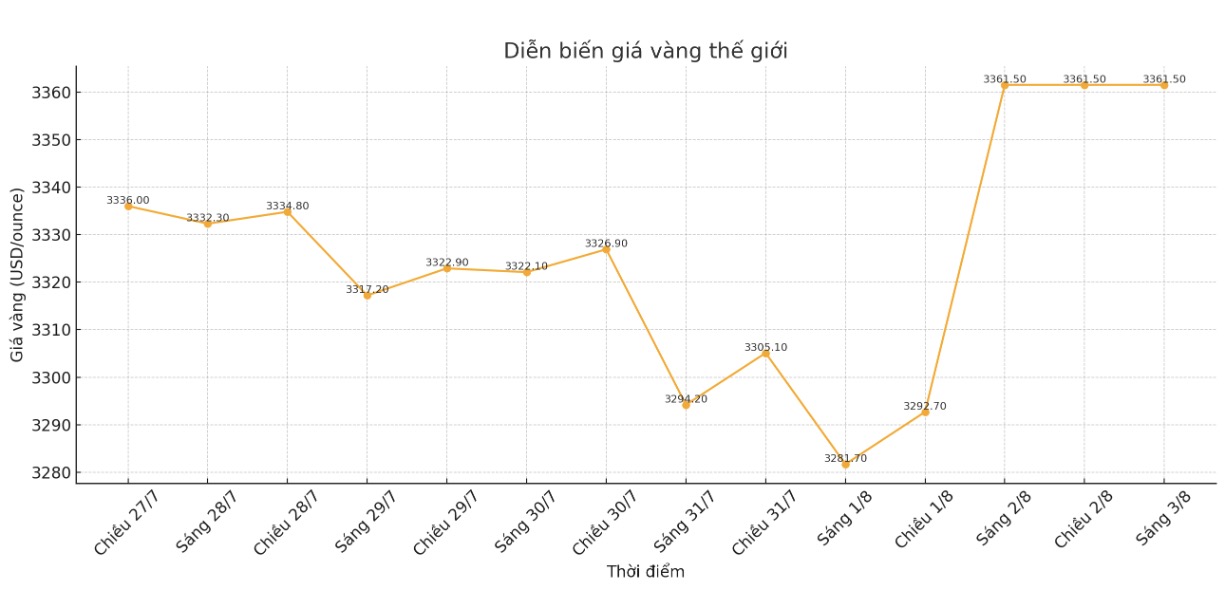

World gold price

The world gold price was listed at 6:00 a.m. on August 3 at 3,361.5 USD/ounce.

Gold price forecast

On Friday, the disappointing US employment data released completely reversed the downward trend in gold prices. Within just two minutes of the reports release, gold prices surged $30.

According to CME's FedWatch tool, the market now has a 90% probability that the US Federal Reserve (FED) will cut interest rates in September. In addition, there is a 50% chance that interest rates will decrease by a total of 1 percentage point before the end of 2025.

The weaker-than-expected jobs report weakens confidence in the US economy, putting pressure on the USD as the market expects the Fed to ease policy to stimulate growth, said Aaron Hill, senior market analyst at FP Markets. With gold, poor labor data further strengthens the role of safe-haven assets, boosting prices as investors seek stability.

Michael Brown Market strategist at Pepperstone maintains an optimistic view on gold, believing that global trade instability is the main driving force for gold's value as a currency asset.

The trend of diversifying reserves away from the US dollar and moving towards gold, especially in emerging markets, will continue in the near future. Demand for shelter amid concerns about the US economy will continue to strengthen the upward trend.

The prices to watch are $3,400/ounce, then the peak around $3,445/ounce, and the possibility of breaking a new record at $3,500/ounce. I absolutely do not rule out the possibility of gold prices reaching a new peak before the end of 2025" - Michael Brown said.

According to the latest gold demand trend report from the World Gold Council, in the first half of 2025, investment demand for gold-backed ETFs reached its highest level since early 2020.

However, total ETF holdings are still significantly lower than last year. This shows that there is still room for growth, even when prices are approaching record highs.

Notable economic data next week

Tuesday: ISM Service PMI (USA).

Wednesday: The US auctions a 10-year Treasury note.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...