The Institute for Supply Management (ISM) released its manufacturing purchasing managers' index (PMI) in July on Tuesday, down to 48 from 49 in June. The figure was lower than expected, as the consensus had previously forecast a slight increase to 49.5.

Ms. Susan Spence - Chairwoman of the Production Business Survey Committee of ISM - said that this disappointing result shows that overall economic activity is weakening.

When looking at the manufacturing economy, 79% of the sectors GDP contracted in July, up sharply from 46% in June.

Notably, 31% of GDP is falling sharply (with a composite PMI of 45% or less), up from 25% in June. The rate of manufacturing GDP with a PMI of equal to or below 45% is a good indicator to assess the general level of weakness.

Of the six largest manufacturing sectors, none recorded growth in July, compared to four in June, said Spence.

The gold market bounced immediately after the production data. Many opinions say that gold is an attractive safe haven asset in the context of continued loss of momentum in production.

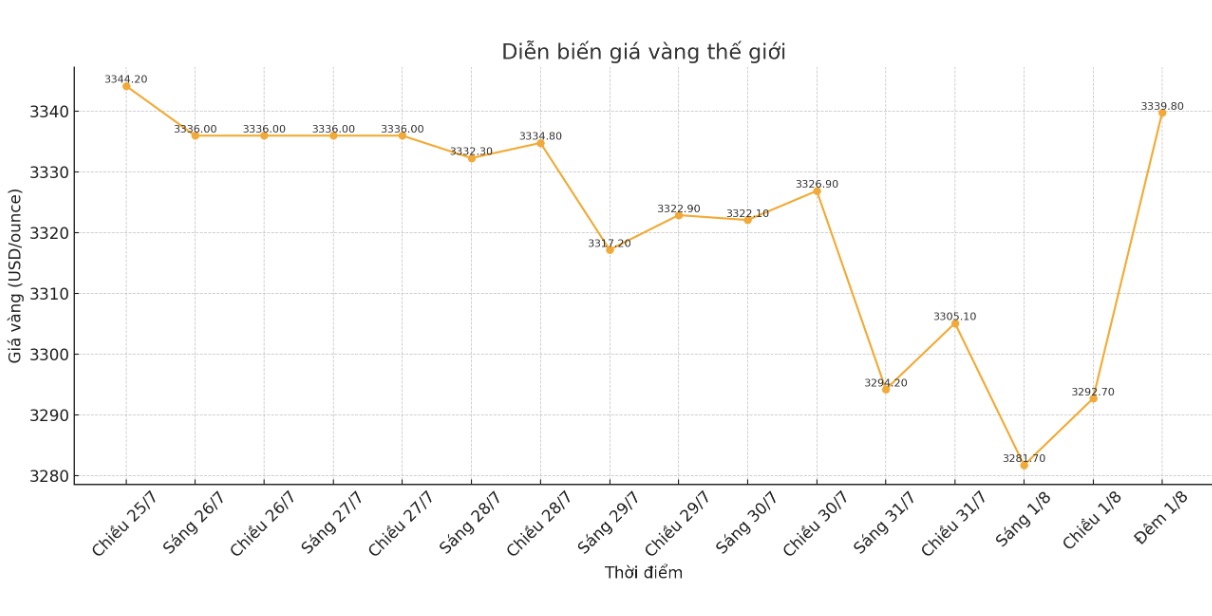

The world gold price was listed at 11:30 p.m. on August 1 at 3,339.8 USD/ounce, up 46.2 USD compared to 1 day before.

Weaker PMI index has further raised concerns about economic recession, putting pressure on the USD as it shows persistent weakness in an important pillar of the economy.

For gold, a low PMI increases attractiveness, likely boosting demand as investors seek safe-haven assets amid increased uncertainty, said Aaron Hill, senior market analyst at FP Markets.

In terms of the components in the report, the new order index increased to 47.1, from 46.4 in month 6; at the same time, the production index increased to 51.4, compared to 50.3 months before.

The report also showed a decline in the labor market, as the US employment index fell to 43.4 from 45 in June.

However, weak operations are also contributing to reducing production costs. The price index fell to 64.8 from 69.7 last month.

Technically, December gold futures are holding a short-term technical advantage. The next target for buyers is to close above the strong resistance level of 3,509 USD/ounce (peak in July). The bears will try to push prices below the strong support level of $3,300/ounce.

The initial resistance level was at 3,400 USD/ounce, then 3,450 USD/ounce. The immediate support level is at the weekly bottom of $3,350 and then $3,331.4/ounce.

See more news related to gold prices HERE...