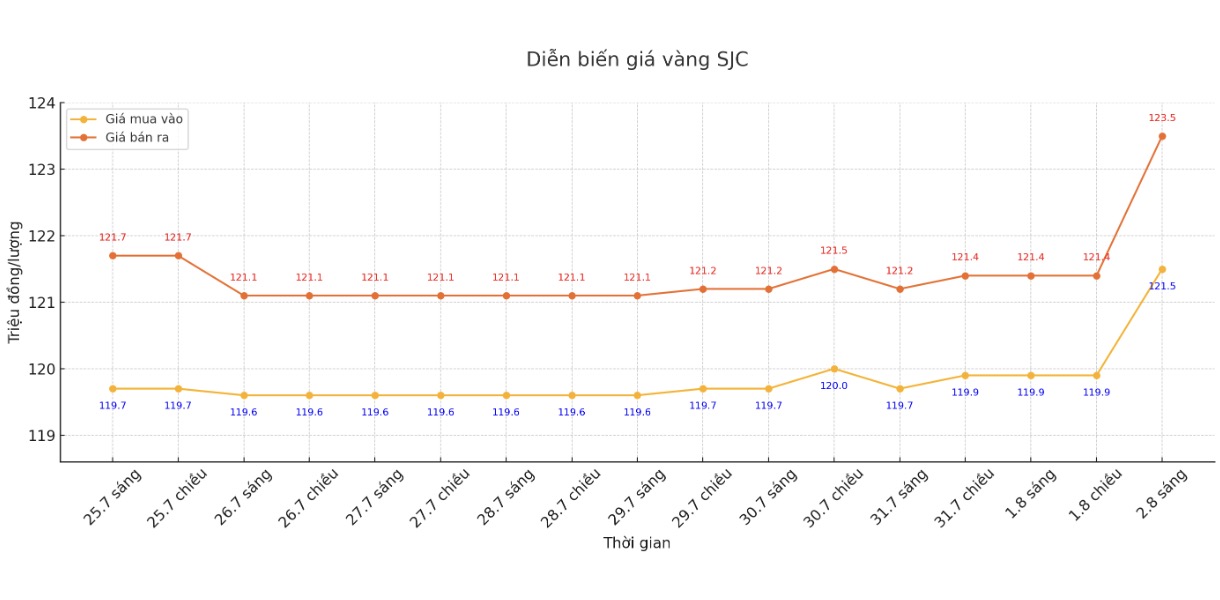

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying and an increase of 2.1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying and an increase of 2.1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 120.5-123.5 million/tael (buy - sell), an increase of VND 600,000/tael for buying and an increase of VND 2.1 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

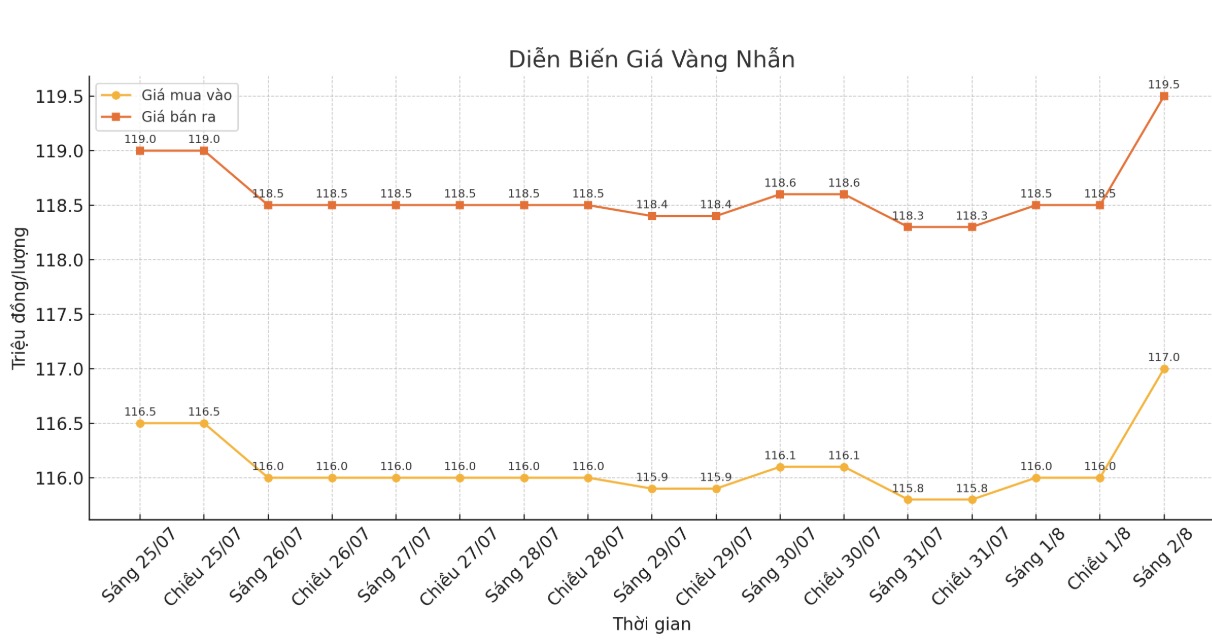

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

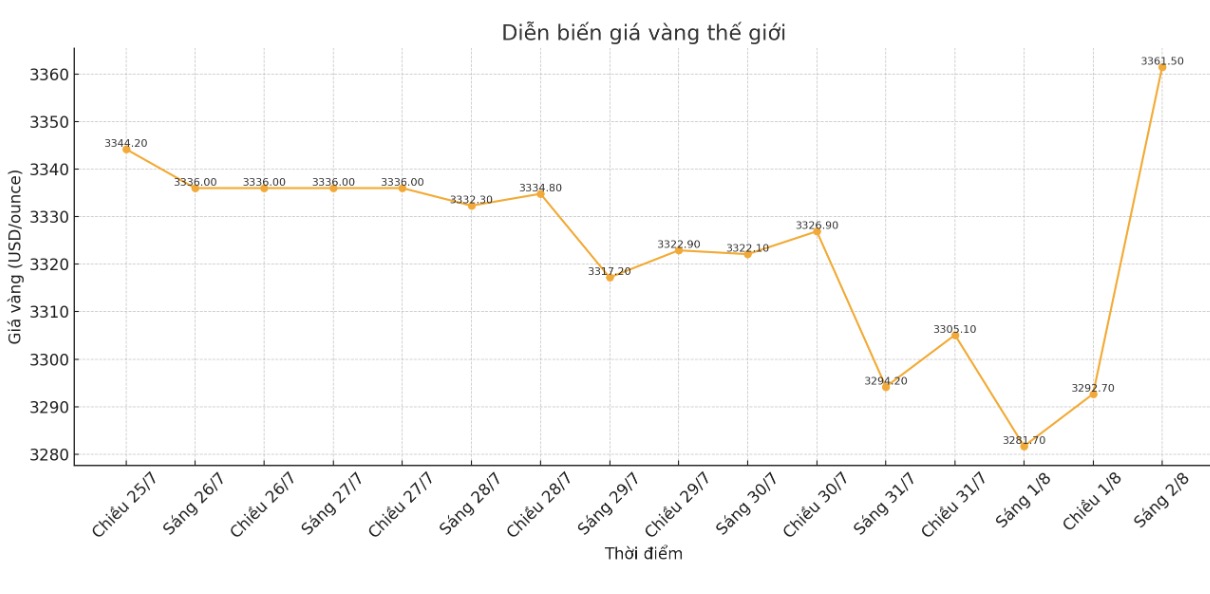

World gold price

At 8:41 a.m., the world gold price was listed around 3,361.5 USD/ounce, up to 79.8 USD/ounce.

Gold price forecast

Gold prices increased sharply in the first trading session of Friday in the US, after the US Department of Labor released a gloomy economic report, leaning towards those who support loose monetary policy. December gold contract increased by 48.6 USD to 3,397.2 USD/ounce.

The US July employment report is considered the most important indicator of the month, showing that the number of non-farm jobs increased by only 73,000,000, much lower than the forecast of about 100,000 jobs.

The unemployment rate increased slightly from 4.1% to 4.2%. Notably, revised figures for May and June showed up to 258,000 jobs were cut compared to the initial report, making the 73,000 figure for July even weakest. The market is now predicting a 75% chance that the Federal Reserve will cut interest rates at its September meeting.

Todays report is important, but more than the employment data, I think we need to focus on the unemployment rate, Priya Misra, portfolio manager at JP Morgan, said.

The market is now expecting the Fed to cut interest rates twice at the end of this year, starting in September. Earlier this week, the FED announced to keep the reference interest rate unchanged at 4.25-4.5%. Fed Chairman Jerome Powell said "there is no decision for September yet".

Another reason for the increase in gold prices is a series of new announcements by US President Donald Trump on import taxes, causing investors to buy gold as a safe haven. The new US counterpart tax rate on trading partners will take effect from August 7.

"We have inflationary pressure from import taxes and salary increases, but the new jobs are disappointing. In this situation, if the FED cuts interest rates, the impact on gold will be very positive" - Melek said.

Ms. Louise Street - Senior Market Analyst at the World Gold Council - assessed that the global market has had a volatile start in 2025, when trade tensions, unpredictable changes in US policies and geopolitical hot spots continuously appeared.

Since the beginning of the year, gold prices have increased by 26% in USD, an increase that is outstanding compared to many other major assets. This impressive increase has attracted investment flows from all over the world, as investors seek safety against global economic and political uncertainties.

She predicted that in the second half of the year, gold prices may fluctuate within a narrower range after a period of strong increases, but there are still many potential factors that can support the upward trend. "If there are more major economic or geopolitical shocks, demand for gold will increase, thereby creating more momentum for gold prices to continue to increase" - Ms. Street commented.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...