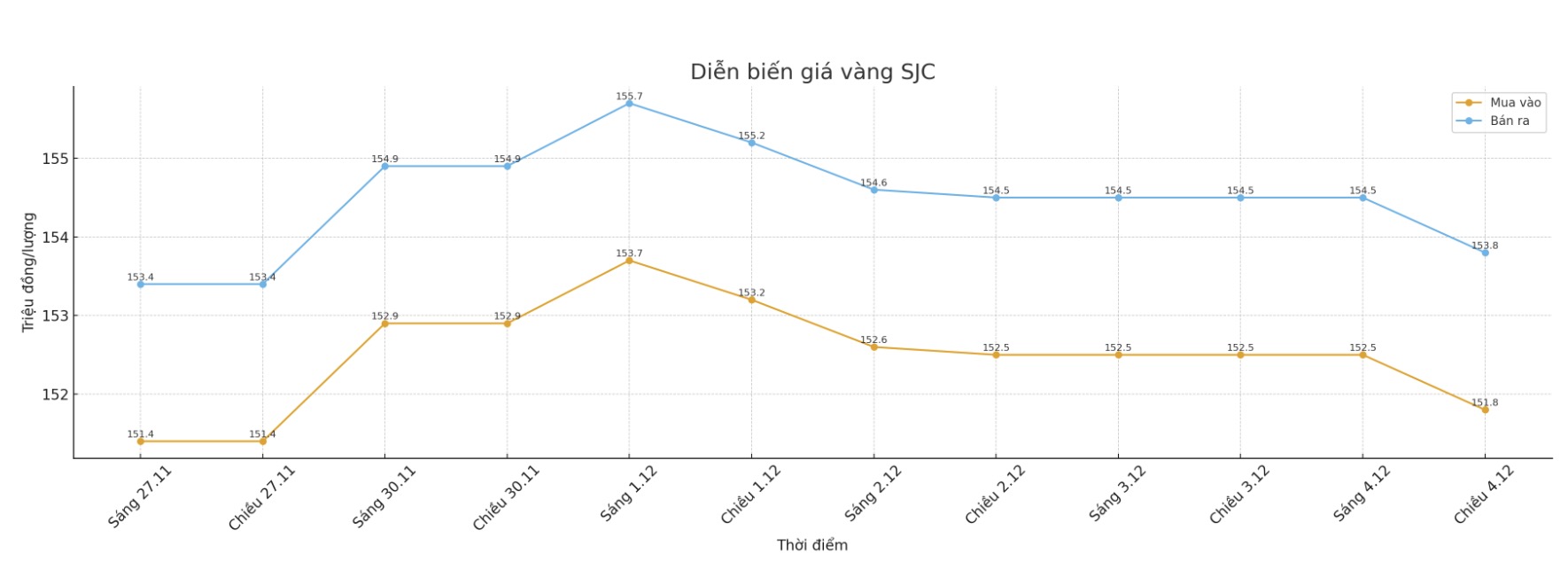

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 151.8 - 153.8 million VND/tael (buy - sell), down 700,000 in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.3- 153.8 million VND/tael (buy - sell), down 700,000 in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.8-153.8 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

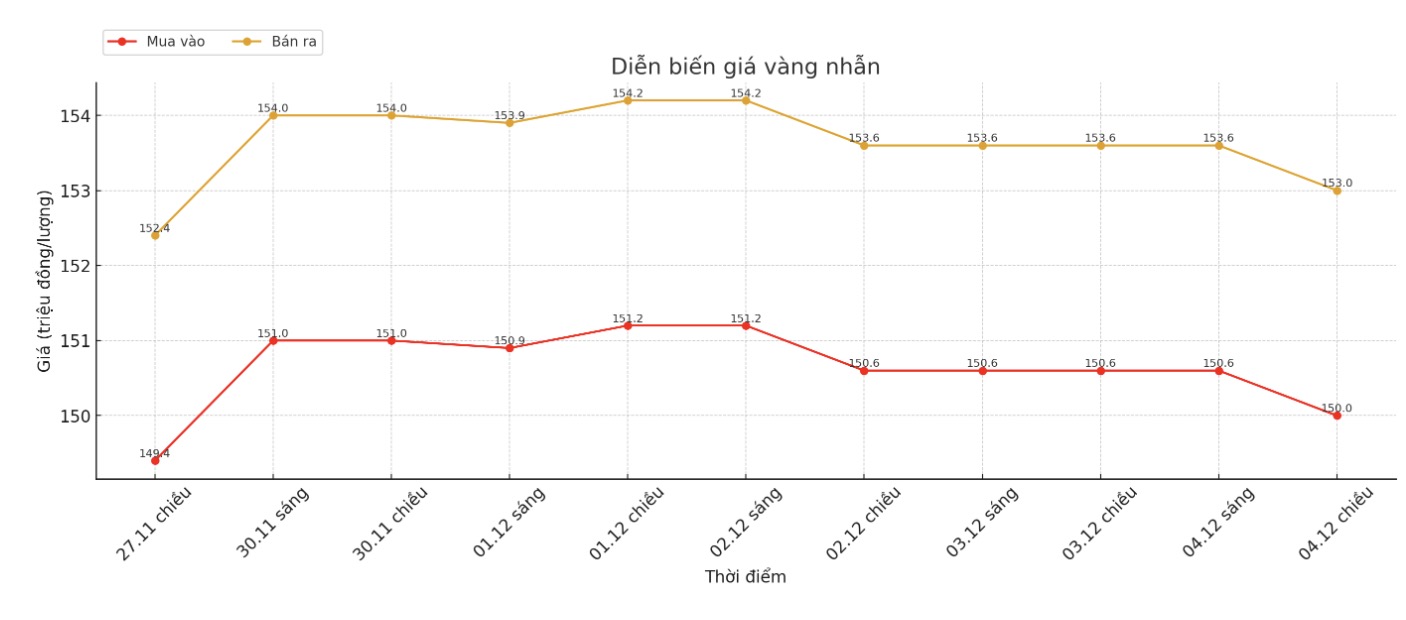

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), down 600,000 in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 0:30 at 4,211 USD/ounce, up 2.6 USD compared to a day ago.

Gold price forecast

Gold prices are under pressure as some conventional profit-taking moves from short-term futures traders appear. February gold contract decreased by 9.2 USD, to 4,223.5 USD. The price of silver for March delivery decreased by 0.685 USD, down to 57.93 USD.

The global stock market fluctuated overnight. US stock indexes are expected to open slightly as the trading session in New York begins.

In overnight news, Ukrainian negotiators will participate in a new round of talks in Florida, in the context of Russian President Vladimir Putin saying that some points in the US-backed peace plan are "un Acceptable", the latest sign that an agreement is still far away.

In another development, global freight rates have skyrocketed. Ship rental prices for energy-to-geological cargo on shipping routes are heading for a rare year-end rally, as conflict, sanctions and rising production disrupt global supply chains, according to Bloomberg.

Daily revenue from crude oil transportation on main routes recorded the largest increase of the year, up to 467%, while the fare for liquefied natural gas transportation and goods such as iron ore increased more than four times and twice respectively.

Usually, transportation costs decrease at the end of the year due to weak seasonal demand. However, ships have to travel longer to deliver goods, contributing to skyrocketing toll prices, and many leaders of transportation businesses expect this shortage to last until at least the beginning of next year, the bulletin said.

Technically, the next upside target for February gold buyers is a solid breakout close at a record high for the contract: $4,433/ounce. The near-term downside target for the bears is to push prices below the strong technical support level at $4,100/ounce.

The first resistance level was an overnight high of $4,246.9/ounce, followed by a high of $4,273.3/ounce on Wednesday. First support was at $4,200 an ounce, followed by a low on Tuesday: $4,194 an ounce.

The main outside markets today showed the US dollar index moving sideways. Crude oil prices increased slightly, trading around 69.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.09%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...